Stablecoins Are Quietly Rewiring Global Payments — Coinbase

Coinbase Institutional says stablecoins are now the dominant real-world use case for crypto, reshaping payments, cross-border transfers, and the future of digital finance.

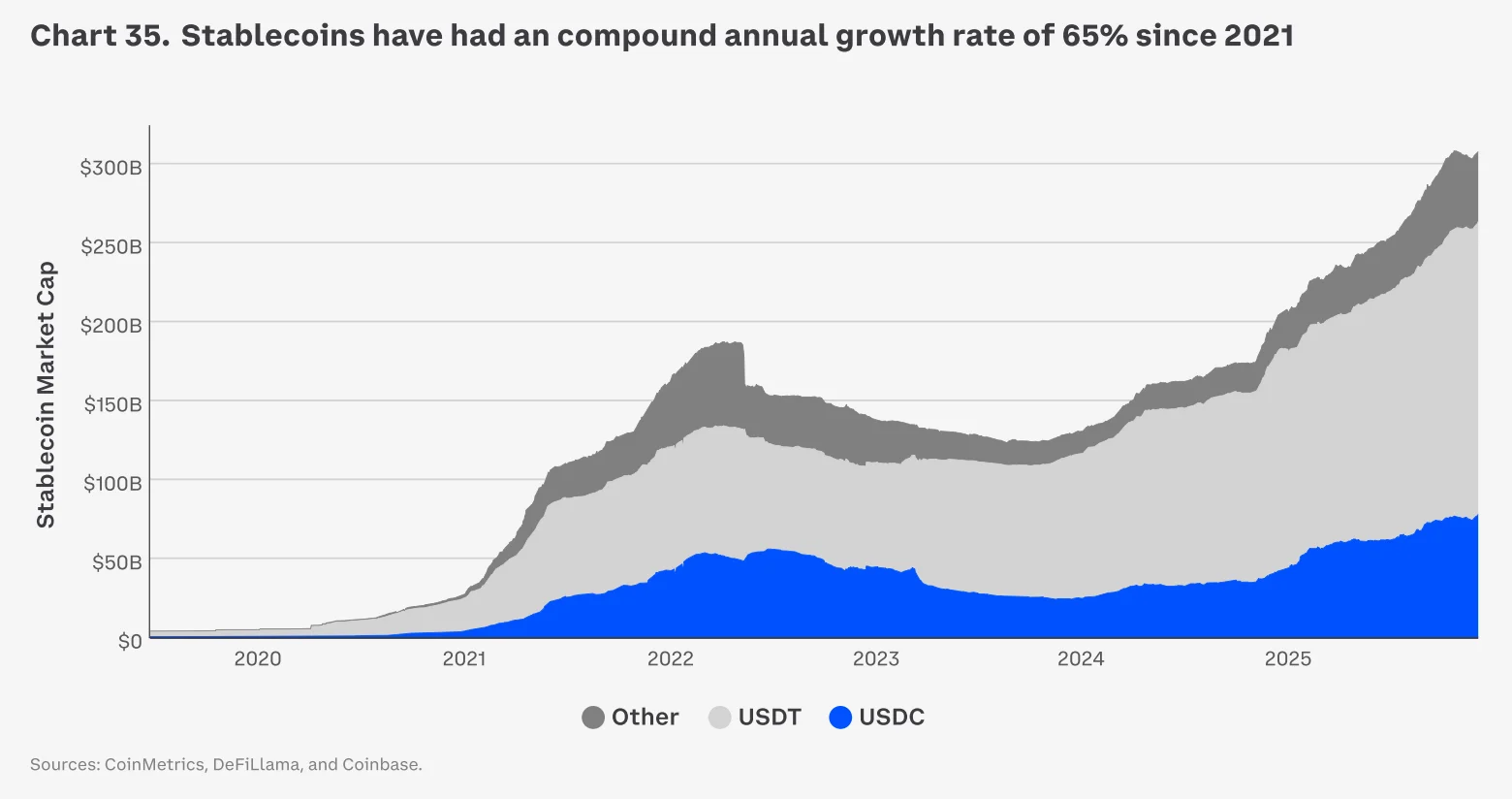

Stablecoins have moved from theory to infrastructure. In its Crypto Market Outlook 2026, Coinbase Institutional argues that stablecoins are no longer an experimental corner of the crypto market, but its most widely adopted and economically meaningful application today.

From speculative promise to everyday utility

For years, analysts described stablecoins as crypto’s potential “killer app” — a way to combine blockchain rails with price stability. Coinbase now says that phase is over. Stablecoins, particularly those pegged to the U.S. dollar, have cemented themselves as the primary mechanism for value transfer across the crypto ecosystem.

Rather than serving mainly as trading collateral, stablecoins are increasingly used for real economic activity: cross-border payments, on-chain settlement, treasury management, and commercial transactions that benefit from speed and programmability.

Why velocity matters more than supply

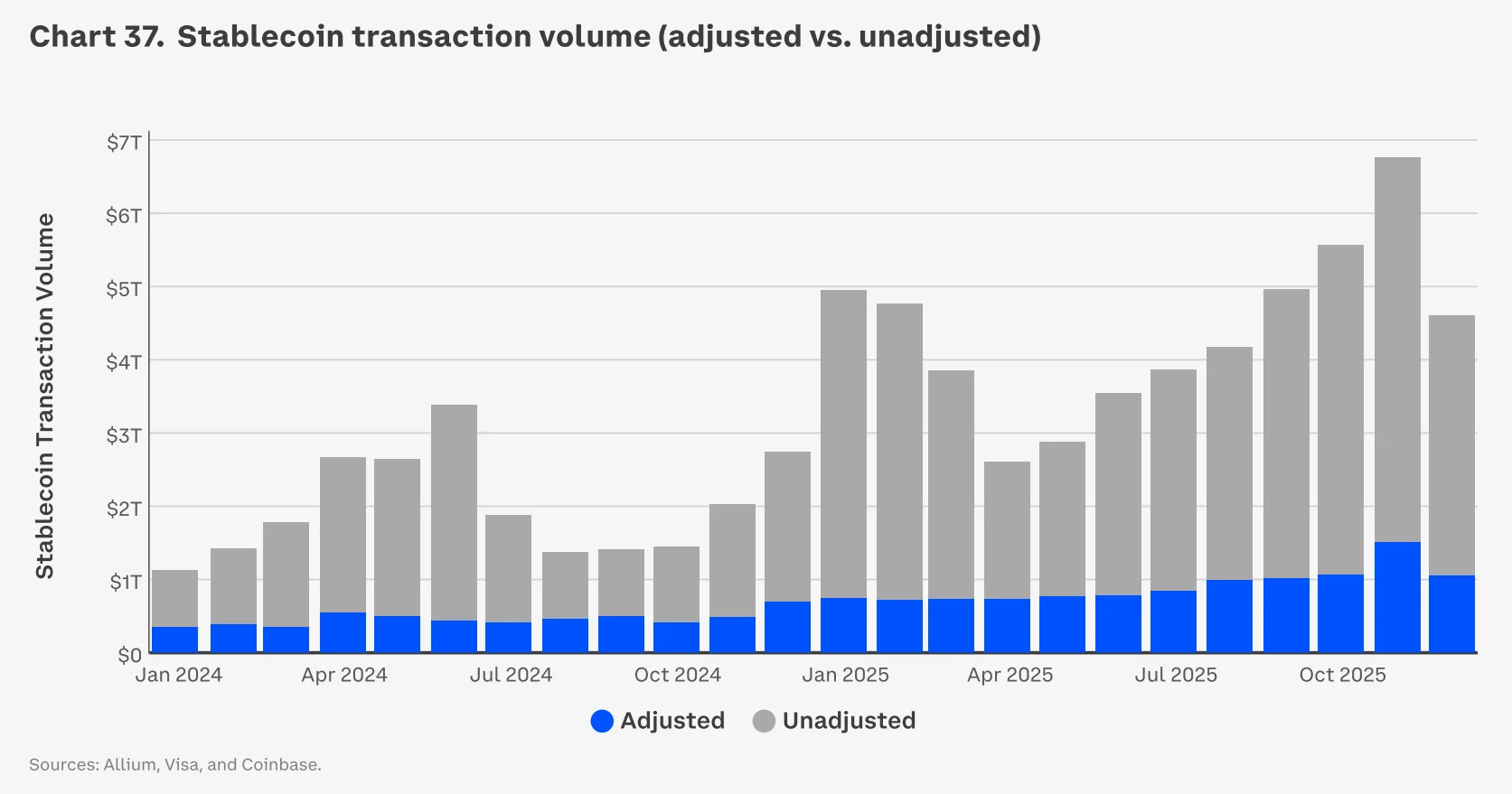

Coinbase places particular emphasis on velocity — how frequently stablecoins change hands — rather than just total supply. Rising velocity signals that stablecoins are being actively used, not simply parked in wallets or exchanges.

This shift suggests that blockchain-based payment rails are starting to compete with traditional systems, especially in regions where legacy banking infrastructure is slow, expensive, or fragmented.

Regulation is no longer a blocker

Another key theme in the report is regulatory clarity. As frameworks for stablecoins become more defined, traditional financial institutions are increasingly willing to engage. Coinbase notes that stablecoins are now being recognised not just as crypto instruments, but as legitimate digital representations of fiat currency for settlement and payments.

That recognition lowers adoption barriers for enterprises, payment providers, and fintech platforms exploring on-chain money movement.

Stablecoins and the dollar paradox

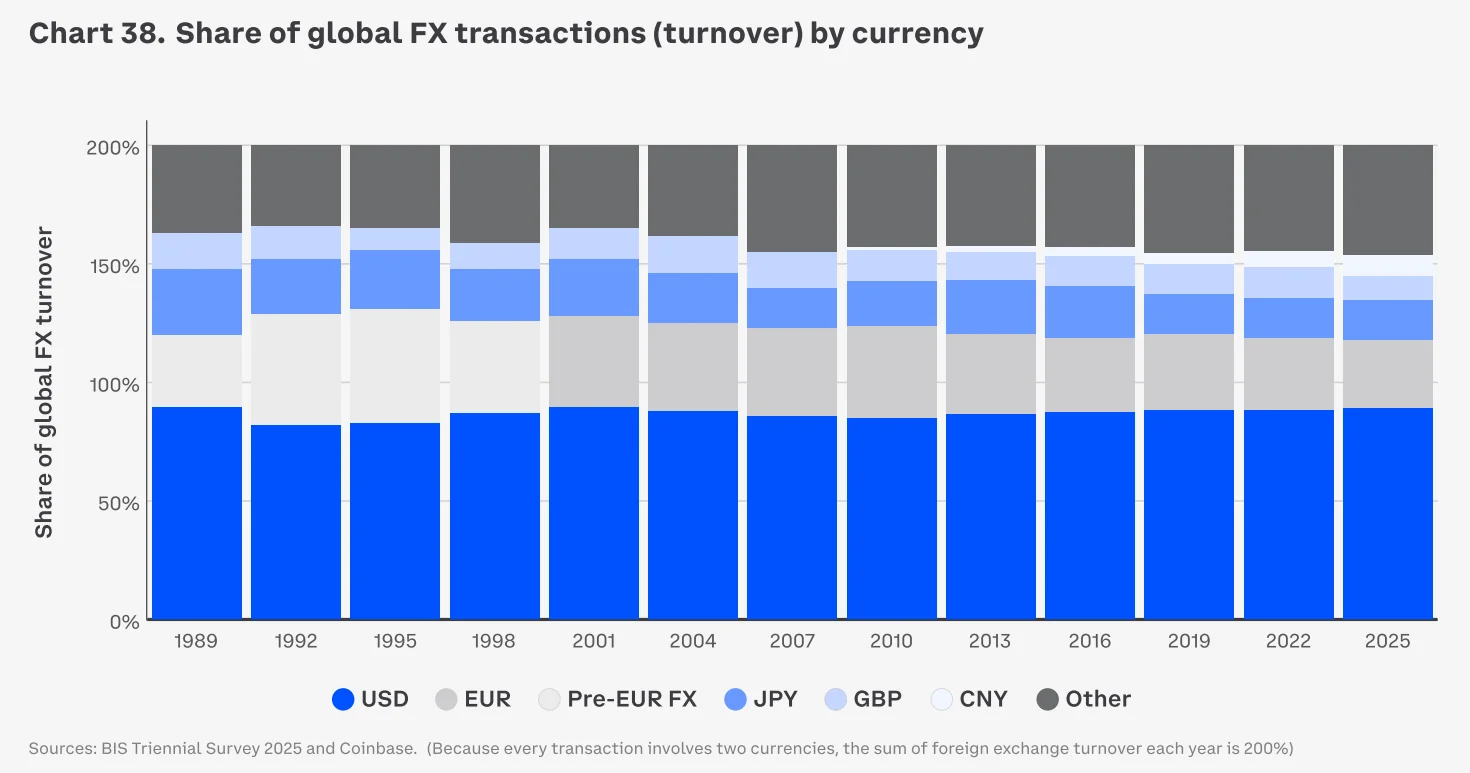

Coinbase also highlights a structural paradox. While stablecoins are often discussed in the context of de-dollarisation, dollar-pegged stablecoins may, in practice, reinforce the U.S. dollar’s dominance by extending its reach through faster, cheaper, and more accessible global payment channels.

In effect, blockchain rails could make the dollar more portable — even as global financial systems diversify.

What this means heading into 2026

- Payments over speculation: Crypto adoption is increasingly driven by utility, not trading hype.

- Infrastructure narrative: Stablecoins are evolving into financial plumbing rather than consumer-facing products.

- Institutional entry: Clearer rules make stablecoins easier to integrate into regulated financial workflows.

Key takeaways

| Theme | Coinbase’s view |

|---|---|

| Primary use case | Stablecoins are now the most widely used crypto application. |

| Market signal | Rising velocity shows real economic activity, not passive holding. |

| Macro impact | Stablecoins may both challenge and reinforce USD dominance. |

Source: Coinbase Institutional, Crypto Market Outlook 2026.

Sophia Bennett

Sophia Bennett