Retirement Savings Goals by Age — And What to Do If You’re Behind

How much should you save for retirement? A clear, age-based framework explains the 10x income rule, savings milestones, and how lifestyle and retirement age change the numbers.

Few financial questions generate as much uncertainty as retirement planning. When will you retire? How long will retirement last? And how much will you actually spend once you stop working?

From an editorial perspective, the significance lies in creating structure where uncertainty dominates. That is exactly what age-based retirement savings factors aim to provide — not precise predictions, but practical guideposts.

Based on extensive modelling, a simple framework emerges: aim to accumulate roughly 10 times your pre-retirement income by age 67 to maintain your current lifestyle in retirement.

The Core Assumptions Behind the 10x Rule

This framework is not arbitrary. It rests on several long-term assumptions:

- Saving approximately 15% of income annually, starting at age 25 (including employer contributions)

- Maintaining a diversified portfolio with more than 50% allocated to equities over a lifetime

- Retiring at age 67

- Planning to maintain pre-retirement living standards

Under these conditions, reaching 10x income by retirement — combined with Social Security or other pension income — should provide sufficient income stability.

Ambitious? Perhaps. But spread across four decades, the goal becomes far more achievable than it initially appears.

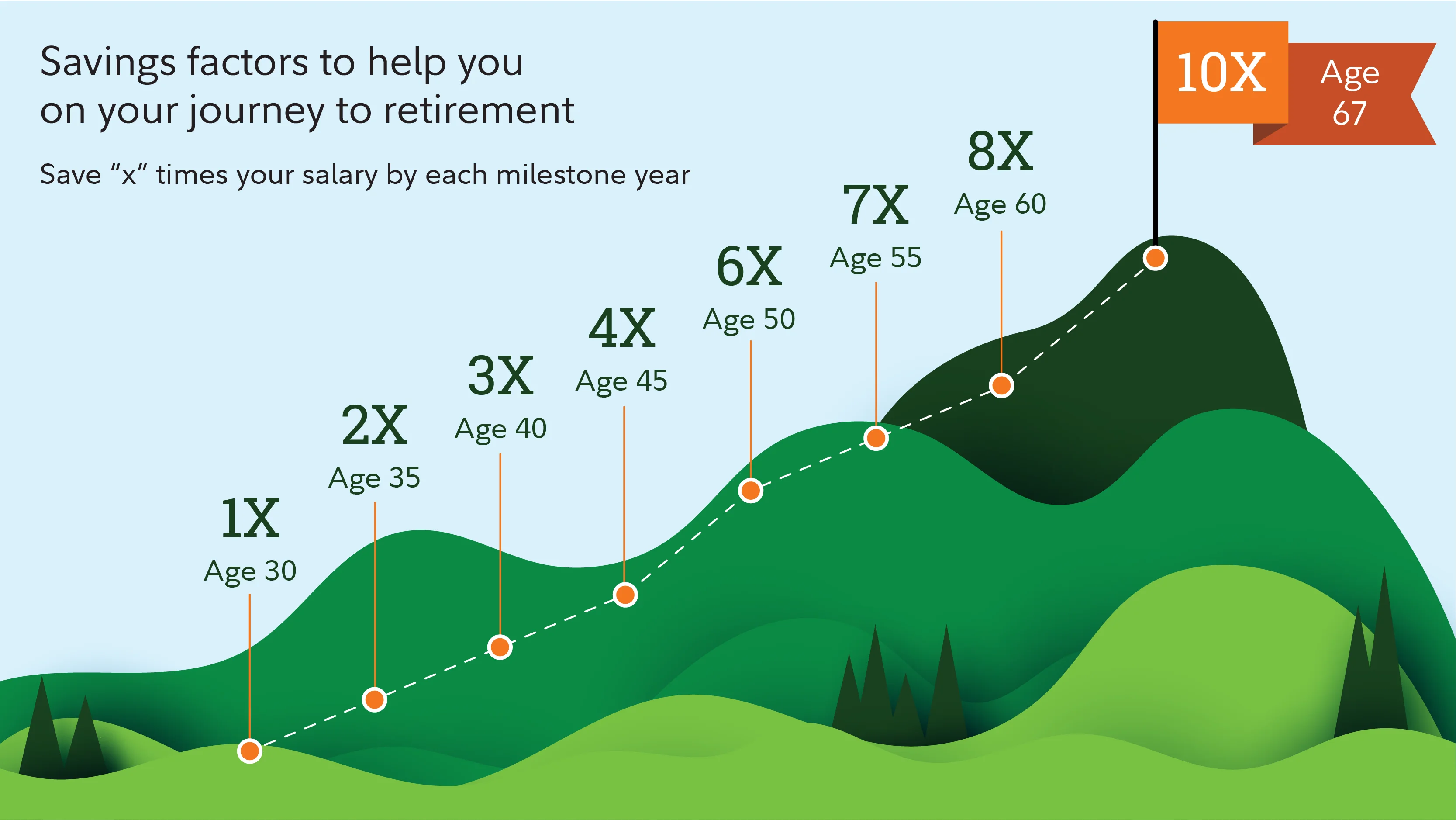

Age-Based Retirement Savings Milestones

To help investors track progress, the framework breaks the long journey into interim milestones:

| Age | Target Savings |

|---|---|

| 30 | 1× annual income |

| 40 | 3× annual income |

| 50 | 6× annual income |

| 60 | 8× annual income |

| 67 | 10× annual income |

These milestones are aspirational. Few investors hit every one precisely. Their value lies in signalling whether adjustments are needed — early enough to matter.

Two Factors That Can Change Your Target

1. When You Retire

Retirement age has a powerful mathematical effect. Working longer means:

- More years of portfolio growth

- Fewer years drawing income

- Higher Social Security benefits

Illustrative examples highlight the difference:

- Retire at 70: ~8× income may be sufficient

- Retire at 67: ~10× income

- Retire at 65: ~12× income

Health and labour-market realities are not always controllable. Still, postponing retirement — even modestly — materially reduces the savings burden.

2. Your Retirement Lifestyle

Spending expectations matter just as much as timing:

- Below-average lifestyle (downsizing, lower expenses): closer to 8×

- Maintained lifestyle: around 10×

- Above-average lifestyle (travel, higher consumption): 12× or more

Retirement is not a single experience — it reflects personal priorities.

What If You’re Behind?

Falling short of a milestone is common — and not fatal.

- Under 40: Increasing savings rates and maintaining growth-oriented portfolios typically has the highest payoff.

- Over 40: A mix of higher contributions, controlled spending, and extended working years may be required.

Markets fluctuate. Careers evolve. What matters most is forward action rather than perfect adherence to past benchmarks.

Retirement planning will always involve uncertainty. But structured frameworks help convert vague anxiety into concrete decisions.

The 10x income guideline is not a guarantee — nor a rigid rule. It is a starting point. One that helps investors measure progress, adjust early, and approach retirement with greater confidence.

And as historical cycles often show, time — when combined with disciplined saving — remains the most powerful variable of all.

Emily Turner

Emily Turner