How Many Stocks Should You Hold in a Portfolio?

Diversification reduces portfolio risk — but only up to a point. Here’s how many stocks investors actually need to balance risk reduction and manageability.

One of the most common questions investors ask is simple: how many stocks should I hold in a well-diversified portfolio?

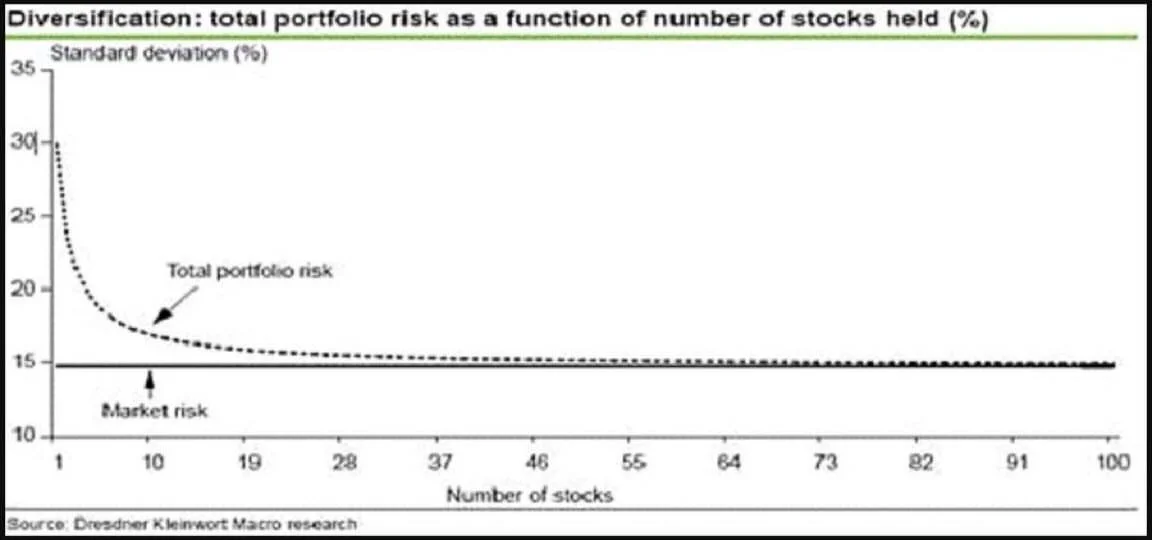

The chart below provides a clear, intuitive answer by showing how total portfolio risk changes as the number of stocks increases.

What the Chart Shows

The vertical axis represents portfolio volatility (standard deviation), while the horizontal axis shows the number of stocks held. The dotted curve illustrates total portfolio risk, while the flat lower line represents market (systematic) risk.

Key Insights

- One stock = very high risk.

With a single stock, portfolio risk is close to 30%. Volatility is driven entirely by company-specific events. - Early diversification matters most.

Adding just a few stocks dramatically reduces risk. At around 10–15 stocks, volatility falls to roughly 17–18%. - Diminishing returns after 20–30 stocks.

Beyond 20–30 holdings, the curve flattens near 15%. Additional stocks provide minimal extra risk reduction.

Why Risk Never Falls to Zero

Even with 100 stocks, portfolio risk does not disappear. The remaining volatility reflects market (systematic) risk — factors such as economic cycles, interest rates, geopolitical events, and overall market sentiment.

This type of risk affects all companies simultaneously and cannot be eliminated through diversification.

What diversification does eliminate is unsystematic risk: the risk tied to individual companies, such as poor earnings, management mistakes, or bankruptcy.

Practical Takeaway for Investors

For most long-term investors, the data points to a clear sweet spot:

- 15–30 stocks provide meaningful diversification

- Portfolio risk is reduced close to market levels

- The portfolio remains manageable and easier to monitor

Holding significantly more than 30 stocks often leads to over-diversification, where complexity increases but risk reduction does not.

Diversification is powerful — especially at the beginning. But it is not infinite.

An optimal portfolio doesn’t aim for zero risk. It aims for a balance between risk reduction, clarity, and control. For most investors, that balance is achieved with roughly 15 to 30 carefully selected stocks.

Emily Turner

Emily Turner