Yuan Moves Closer to 7 per Dollar, Analysts Flag Short-Lived Break

The Chinese yuan is approaching the key 7-per-dollar level, but analysts warn any move below the threshold is likely to be short-lived due to economic pressures.

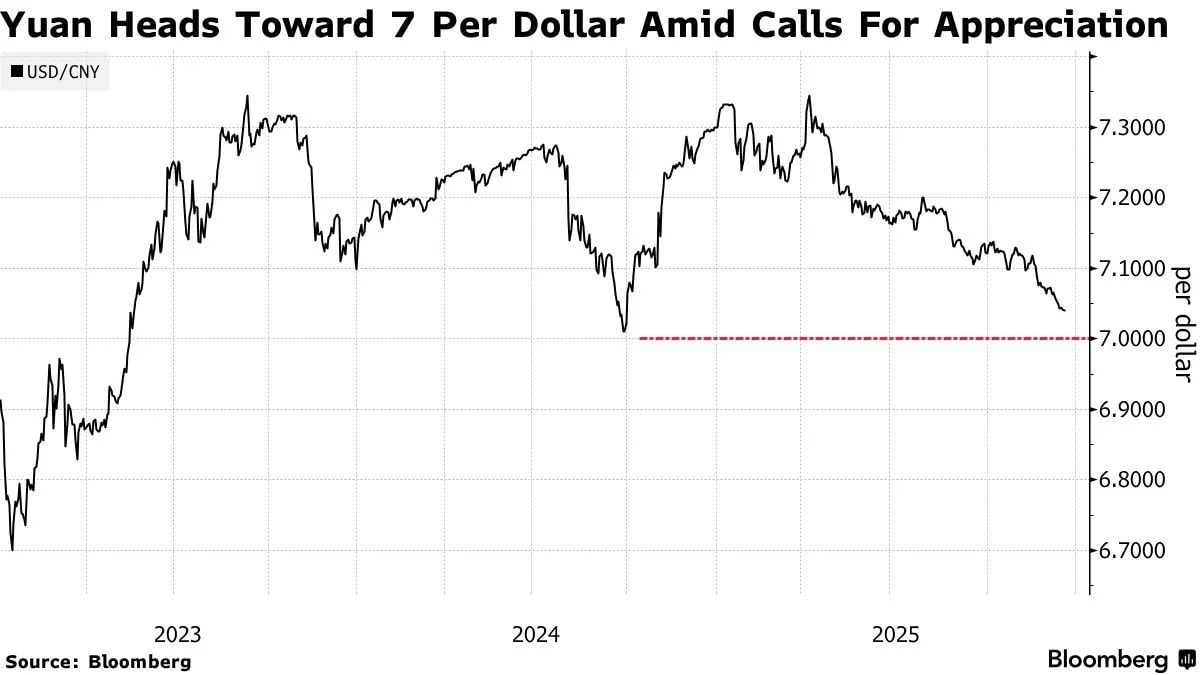

The Chinese yuan is moving closer to the closely watched 7-per-dollar level against the U.S. dollar, a threshold that has long served as a psychological marker for currency markets.

According to market observers, any appreciation beyond that point is likely to be temporary. Pressure on Chinese manufacturers and weak foreign investment inflows are expected to limit the durability of yuan strength.

Analysts Flag Short-Lived Break Below 7

Jason Schenker, president of Prestige Economics, said it is possible for China’s currency to move below the 7-per-dollar level within the next six months. However, he expects the yuan to later give back gains and end 2026 at around 7.03 per dollar.

Schenker ranked first in Bloomberg’s survey of analysts forecasting the onshore dollar-yuan exchange rate during the third quarter, lending additional weight to his outlook.

Policy Signals From Beijing

The move comes as Chinese authorities continue to signal support for a stronger currency. Officials have called for further yuan appreciation against the U.S. dollar, reinforcing expectations that policymakers are comfortable with a firmer exchange rate in the near term.

Still, analysts caution that structural factors — including export competitiveness and subdued foreign capital inflows — may prevent the yuan from sustaining levels meaningfully below 7.

Market Focus Remains on the 7 Level

For now, the 7-per-dollar mark remains the central reference point for investors tracking China’s currency. While a breach is increasingly plausible, market participants broadly expect such a move to be short-lived rather than the start of a lasting appreciation cycle.

Amelia Hayes

Amelia Hayes