DOJ Subpoenas Raise Questions Over Federal Reserve Independence

Legal scrutiny of the Federal Reserve has unsettled markets, raising concerns over central bank independence and driving volatility in bonds, FX and gold.

Federal Reserve Chair Jerome Powell confirmed that grand jury subpoenas have been issued as part of a Justice Department probe, a development that immediately reverberated across global markets.

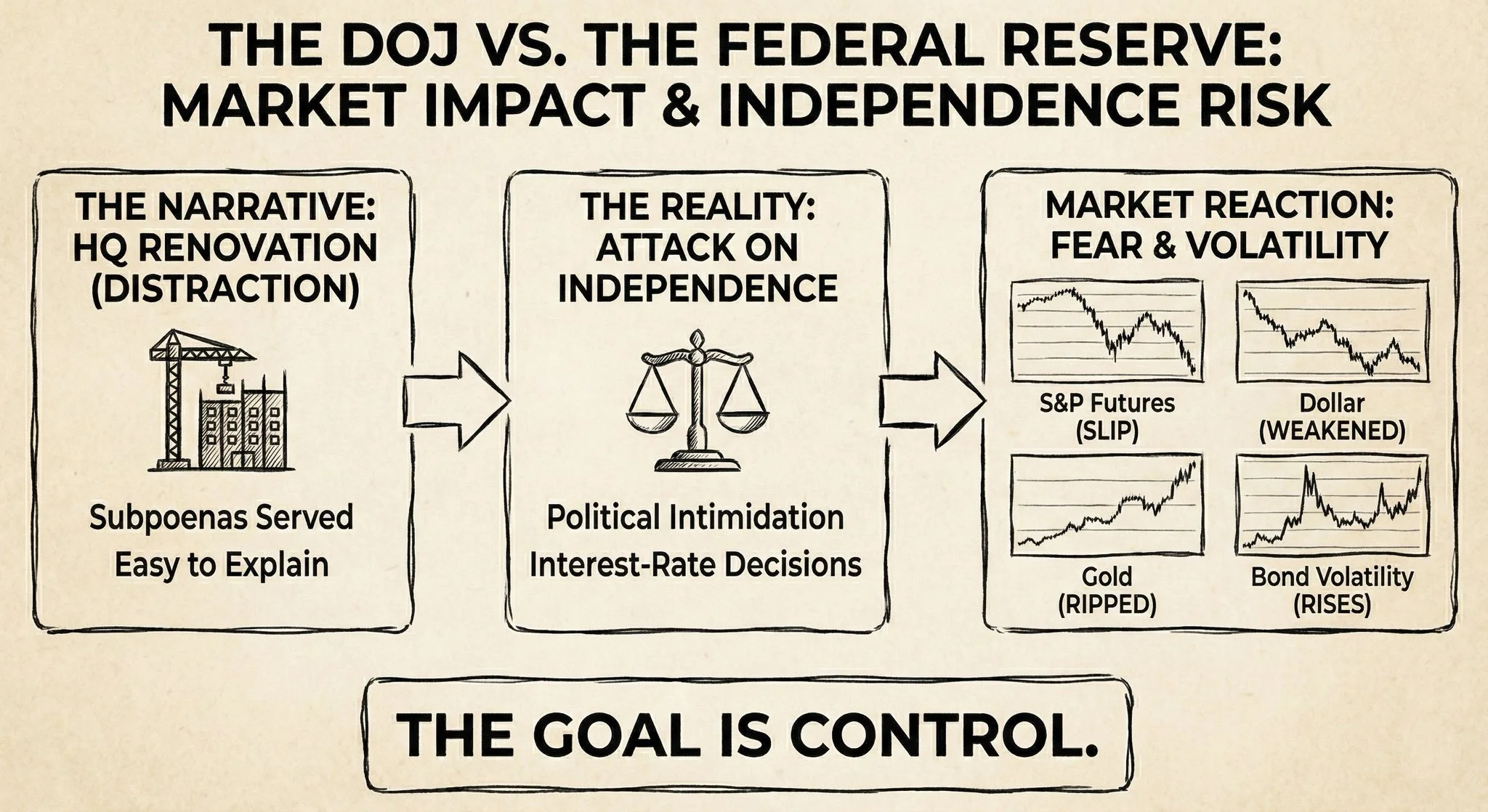

While the inquiry has been framed publicly around administrative matters, including a renovation project at the Fed’s headquarters, investors have focused on a more consequential issue: the perception of pressure on central bank independence.

The independence question

Central bank credibility rests on the assumption that interest-rate decisions are driven by economic data, not political or legal influence. Any challenge to that perception can have outsized market consequences.

Powell’s comments, while measured, acknowledged the existence of legal action at a time when monetary policy remains highly sensitive. That alone was enough to prompt investors to reassess risk.

In macro terms, the concern is not the investigation itself, but the precedent it may imply. If markets begin to price in the possibility of politically influenced rates, term premiums rise and volatility follows.

Market reaction

The initial response was swift:

- S&P futures edged lower as risk appetite softened.

- The U.S. dollar weakened modestly against major peers.

- Gold climbed to fresh record highs, reflecting demand for hard assets.

- Bond market volatility increased, particularly at the long end of the curve.

Such moves are consistent with a market hedging against uncertainty rather than reacting to immediate economic deterioration.

Why bonds matter most

The most important signal may come from the Treasury market. Longer-dated yields embed expectations not just for growth and inflation, but also for policy credibility.

Any sustained increase in term premiums would tighten financial conditions broadly, spilling into equities, credit and global funding markets.

As historical cycles often show, challenges to institutional credibility tend to surface first in rates before spreading elsewhere.

In the near term, risk assets may attempt to look through the noise. However, the issue is unlikely to fade quickly if volatility in cash Treasuries accelerates once full market liquidity returns.

For investors, the key question remains simple: can the Federal Reserve maintain unquestioned independence at a time of heightened political sensitivity?

The answer will matter not just for U.S. markets, but for global capital flows as a whole.

Olivia Carter

Olivia Carter