The “Sick Economy” of Asia Is No Longer Japan — It’s China

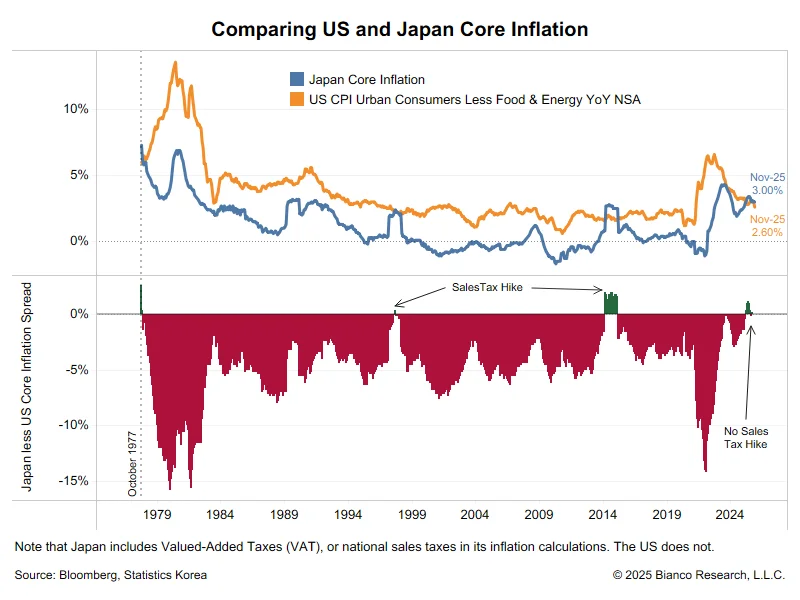

Japan’s core inflation has surpassed the U.S. for the first time since 1977, strengthening expectations of aggressive Bank of Japan rate hikes.

Japan’s inflation rate has overtaken that of the United States for the first time in nearly five decades, marking a major turning point for global macro markets and reinforcing expectations of tighter monetary policy from the Bank of Japan.

According to data released today, Japan’s November core CPI rose 3.0% year-over-year, matching expectations. Meanwhile, U.S. core CPI increased by 2.6%, below market forecasts.

This is the first time since 1977 that Japan has recorded a higher inflation rate than the U.S., according to analysis from Jim Bianco.

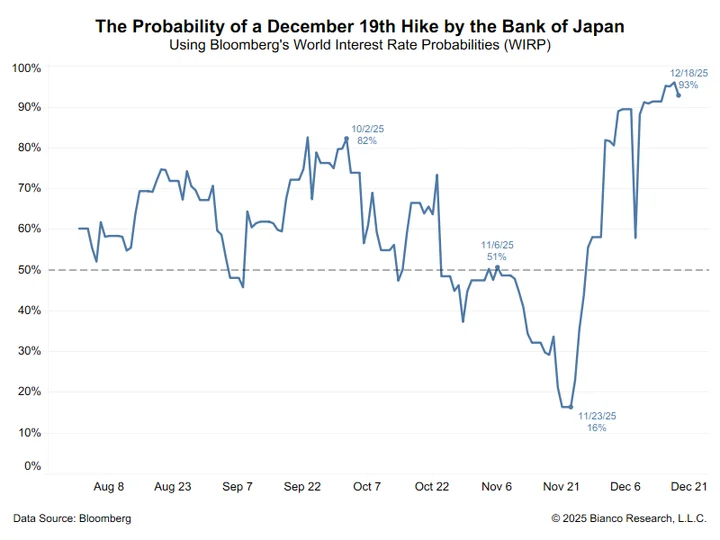

BoJ Rate Hike All But Priced In

The inflation data comes just hours ahead of the Bank of Japan’s monetary policy decision. Market pricing suggests a rate hike is now highly likely.

As shown in the chart above, markets are assigning a greater than 90% probability to a BoJ rate hike at today’s meeting. Expectations for tightening have surged sharply in recent weeks.

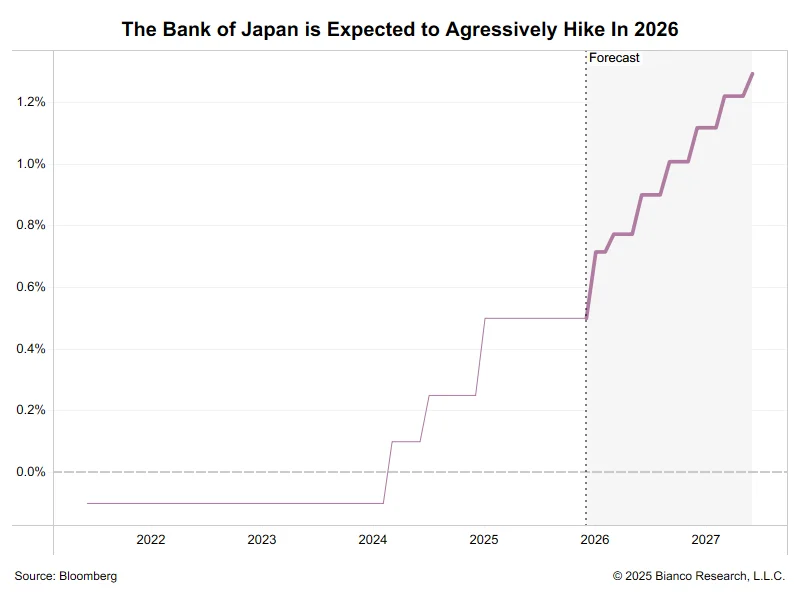

Aggressive Tightening Expected in 2026

Beyond the near-term decision, investors are increasingly pricing a much more aggressive tightening cycle over the next two years.

Forecasts indicate that the Bank of Japan may continue raising rates throughout 2026, marking a decisive break from decades of ultra-loose monetary policy.

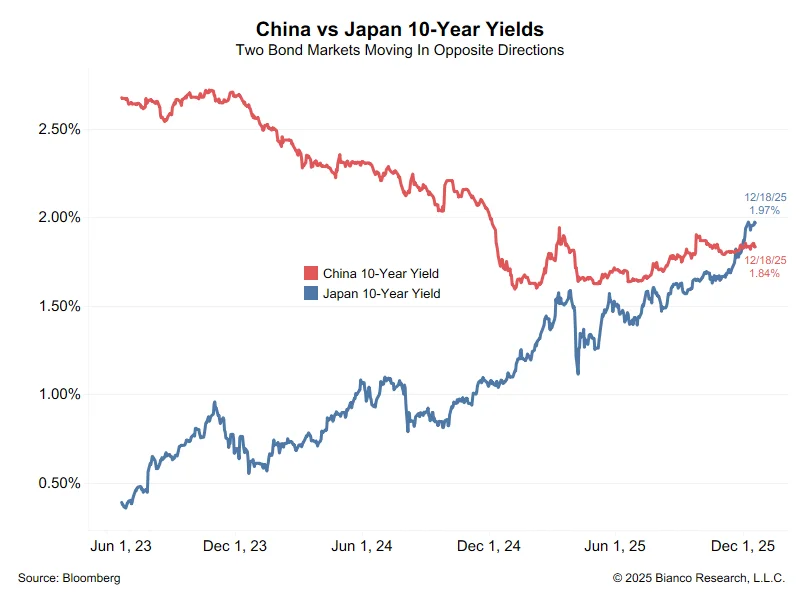

Japan’s Bond Yields Surge

Japan’s shift toward higher inflation and tighter policy has already had a significant impact on government bond markets.

Japan’s 10-year government bond yield has surged, overtaking China’s for the first time in more than 30 years. This marks a historic reversal in Asia’s bond market hierarchy.

“For the first time in 30 years, Japan is no longer the lowest 10-year yield in Asia,” Bianco noted.

China Replaces Japan as Asia’s Weak Link

While Japan’s yields are rising amid inflation pressure, China’s 10-year yields continue to trend lower, reflecting economic weakness and deflationary forces.

“The ‘sick economy’ of Asia is no longer Japan,” Bianco said. “It’s China.”

Inflation Gap Tells the Story

As the chart illustrates, Japan’s inflation dynamics have shifted materially relative to the U.S. It is worth noting that Japan includes consumption taxes in its inflation calculations, while the U.S. does not. Even accounting for this difference, the trend represents a significant regime change.

As the chart illustrates, Japan’s inflation dynamics have shifted materially relative to the U.S. It is worth noting that Japan includes consumption taxes in its inflation calculations, while the U.S. does not. Even accounting for this difference, the trend represents a significant regime change.

Japan’s transition from chronic deflation to persistent inflation has wide-reaching implications for:

- global bond yields,

- currency markets, particularly the yen,

- and capital flows across Asia.

After decades of being a source of cheap capital for the world, Japan may now become a source of tightening financial conditions instead.

Olivia Carter

Olivia Carter