Is US Inflation Really Falling?

Record levels of estimated CPI data are raising concerns about the accuracy of US inflation readings and the reliability of economic signals.

Concerns over the reliability of US inflation data are intensifying after new analysis revealed that a record share of Consumer Price Index (CPI) components is now based on estimates rather than direct price observations.

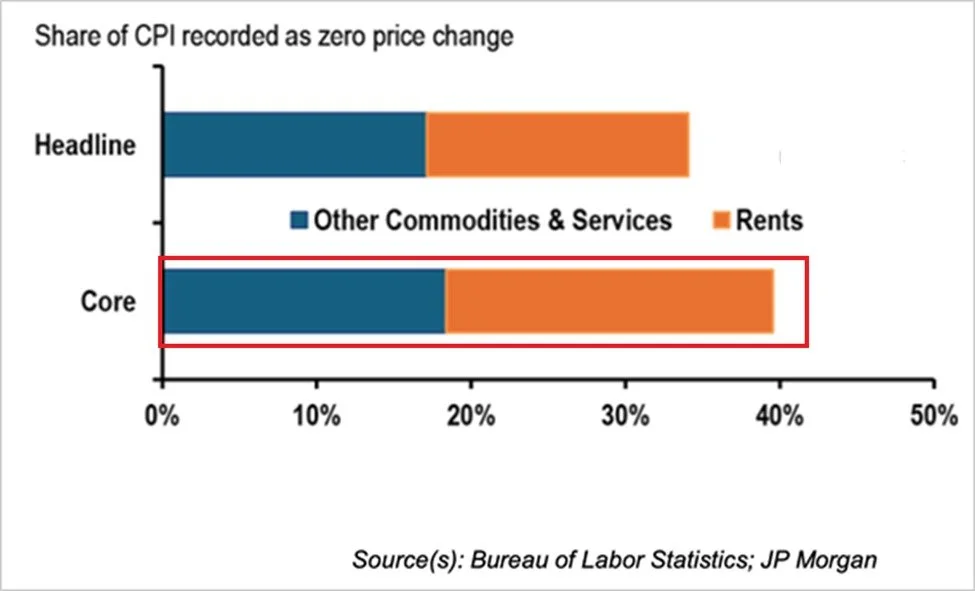

According to recent data highlighted by market analysts, 40% of core CPI components in October were estimated rather than measured. Of that figure, approximately 22 percentage points came from rents, while 18 points were attributed to other commodities and services.

How CPI Is Normally Measured

Under standard conditions, the Bureau of Labor Statistics (BLS) collects roughly 90,000 monthly price observations across more than 200 product and service categories. These observations form the backbone of CPI calculations and are designed to reflect real-time price changes faced by consumers.

When price data is unavailable — due to non-response, sampling gaps, or operational constraints — the BLS fills those gaps using statistical estimation methods. Historically, such estimates accounted for roughly 10% of CPI components.

A Structural Shift in Data Quality

That balance has shifted sharply. In the latest release, an estimated 34% of all CPI components were derived using prices from other items or alternative geographic areas. This marks the fifth consecutive CPI reading above 30% — more than triple the average observed between 2022 and 2024.

From an editorial perspective, the significance lies not in a single data point, but in the persistence of this trend. Inflation data is increasingly reliant on inference rather than direct measurement — a subtle but meaningful change in how economic reality is recorded.

Market Reaction and Growing Skepticism

The rise in estimated data has fueled broader scepticism across financial markets and social platforms. Critics argue that when a substantial portion of inflation measurement relies on modelling, CPI risks shifting from a tracking tool to a perception management mechanism.

“When a third of your measurement is guesswork dressed as precision, you’re not tracking inflation anymore. You’re managing perception.”

Others point to staffing reductions at the BLS as a contributing factor, arguing that fewer field resources naturally lead to greater reliance on estimation. While the BLS has not framed the issue in such terms, the optics have intensified debate around the credibility of headline inflation figures.

Why It Matters for Policy and Markets

Inflation data plays a central role in shaping Federal Reserve policy, influencing interest rates, bond markets, and fiscal planning. If inflation signals are increasingly blurred, policymakers may find themselves navigating with reduced visibility — particularly at a time when monetary decisions carry outsized consequences.

Confidence in economic data is a fragile asset. Once questioned, it is difficult to restore — and markets are beginning to reflect that unease.

Olivia Carter

Olivia Carter