BlackRock Sees AI as the Biggest Driver of U.S. Stocks Next Year

BlackRock’s 2026 Global Outlook highlights AI as the dominant megatrend driving global markets, investment flows and economic growth, marking what the firm calls a historic transformation of the world economy.

From an editorial perspective, the significance lies in how sharply BlackRock positions artificial intelligence as the defining force of the global economy in 2026.

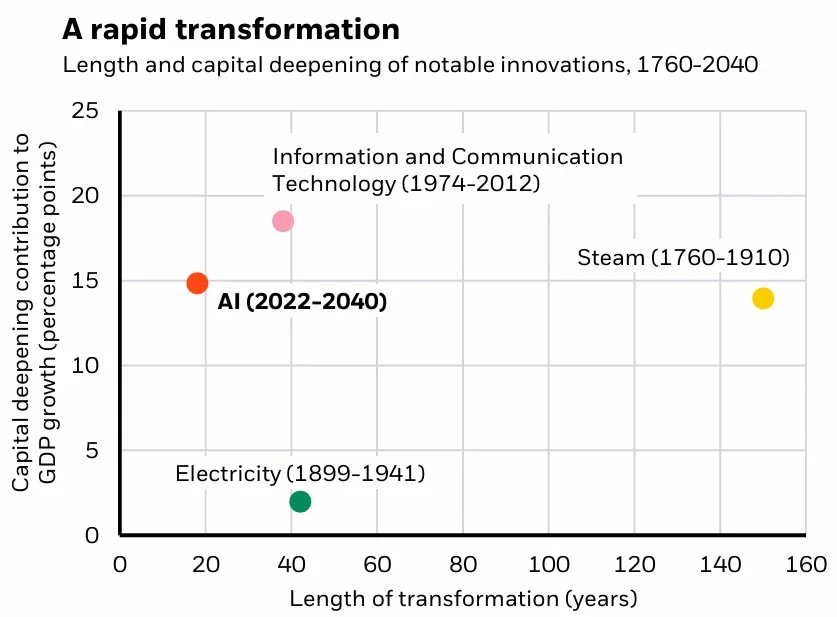

Artificial intelligence has moved from a technological theme to the central driver of macroeconomic and market dynamics, according to the newly released BlackRock 2026 Global Outlook. The world’s largest asset manager argues that AI is now a “mega force” reshaping economic growth, capital allocation and market structure on a scale comparable to the industrial revolutions of the past.

AI spending could reach $5–8 trillion through 2030

BlackRock’s analysts estimate that global corporate investment into AI infrastructure — including compute, data centers and energy systems — may total between $5 trillion and $8 trillion by 2030. This level of capital deployment would make AI the fastest and most capital-intensive technological buildout in modern history.

“A few big macro drivers imply a few big market drivers,” the report notes. As AI becomes the dominant force behind earnings and productivity, broad equity indexes can no longer be viewed as neutral allocations. Investors, BlackRock argues, are being pushed into making deliberate, directional calls on AI exposure.

Chart takeaway: Getting inflation all the way back down to target – the dotted green line – would require the Fed to deal a significant blow to the economy.

AI turns micro into macro

The Outlook emphasises that AI spending is so large and so concentrated among a handful of technology giants that it effectively shapes macroeconomic conditions. Capital expenditure by hyperscalers is already influencing U.S. GDP growth, corporate leverage patterns and energy demand.

BlackRock expects AI-linked revenues to expand beyond the tech sector and eventually permeate the broader economy — but the timing mismatch between front-loaded investment and delayed revenue remains one of the major uncertainties.

U.S. equities remain the biggest beneficiary

As AI earnings continue to beat expectations, BlackRock remains overweight U.S. stocks, describing AI as the primary engine behind record-high valuations in 2025 and into 2026. The firm sees this trend persisting, although it acknowledges growing concerns about market concentration.

The report also warns that traditional diversification has become a “mirage,” as markets are increasingly driven by a single underlying factor — AI. According to BlackRock, even shifting into equal-weighted indexes now constitutes a major active call rather than a neutral allocation.

A historic economic shift

BlackRock argues that AI could potentially lift U.S. economic growth above its long-term trend of 2% for the first time in 150 years. Such an outcome is not guaranteed, but the firm says it is “conceivable for the first time,” as AI accelerates innovation and productivity across multiple industries.

“The transformation is unfolding at unprecedented speed and scale,” the Outlook concludes, noting that the investment environment of 2026 will be defined by higher capital intensity, rising leverage, and a widening divide between future AI winners and losers.

BlackRock’s full 2026 Global Outlook, including methodology and complete data tables, is available at the link below.

Olivia Carter

Olivia Carter