Strong Momentum in Chinese Stocks Meets Growing Policy Constraints

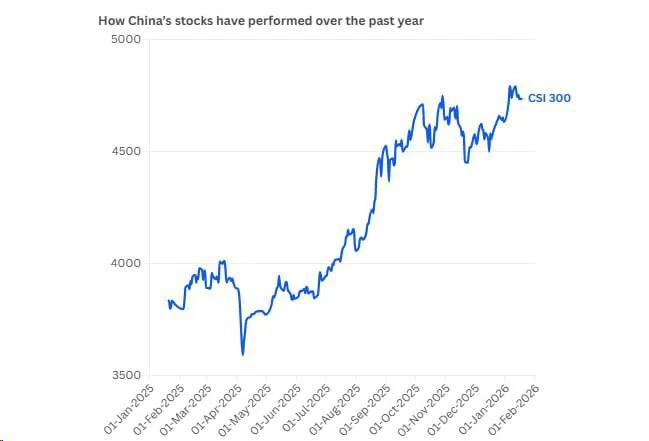

China’s stock market has posted strong gains alongside record trading activity, prompting regulators to tighten margin rules. Historical data highlights both opportunity and elevated volatility risks.

China’s equity market has entered a phase of heightened momentum, marked by rising prices, record trading volumes, and increased regulatory attention. Recent measures aimed at limiting margin trading have underscored official concerns about overheating, even as many investors remain optimistic about the continuation of the rally.

Such dynamics are not unfamiliar to observers of China’s financial markets. Periods of rapid price appreciation have historically been accompanied by elevated volatility, abrupt policy responses, and sharp reversals. Understanding these structural characteristics is essential when interpreting the current move.

Long-Term Returns: Competitive, but Uneven

Over the past two decades, China’s stock market has delivered average annual returns of roughly 6–8% in U.S. dollar terms, accounting for currency fluctuations. By comparison, the S&P 500 has generated approximately 9–10% annualized returns over the same period.

The difference, however, lies less in headline performance and more in consistency. China’s market history has been shaped by pronounced boom-and-bust cycles:

- In 2007, the Shanghai Composite surged nearly 100%, followed by a decline of about 65% in 2008.

- During 2015, equities rose more than 60%, only to fall over 40% in the following year.

- Extended periods of stagnation have also occurred, with limited net progress across multiple years.

This pattern reflects a market where timing, policy shifts, and liquidity conditions often play a larger role than steady earnings growth.

Structural Features That Shape Market Behavior

State involvement remains a defining factor. Authorities retain broad discretion to influence trading conditions, including restrictions on IPOs, limits on large shareholder sales, and adjustments to short-selling or margin rules. Market mechanisms typically function within boundaries set by policymakers.

Retail investor dominance is another distinguishing trait. Individual investors account for a substantial share of daily turnover, contributing to rapid sentiment shifts and amplified price movements compared with institutionally driven markets.

Market segmentation further complicates valuation. Domestic A-shares, offshore listings in Hong Kong, and U.S.-traded ADRs can trade at materially different prices despite representing the same underlying companies.

Leverage sensitivity is particularly relevant in the current context. Restrictions on margin financing have historically preceded periods of consolidation or correction, as leveraged positions unwind.

Geopolitical factors also remain embedded in risk assessments, ranging from cross-border regulatory disputes to broader regional tensions.

What the Current Environment Signals

The recent advance in Chinese equities may continue in the near term, supported by momentum and investor participation. At the same time, policy actions suggest that regulators are increasingly focused on containing speculative excess rather than encouraging unchecked price acceleration.

Historical experience indicates that rallies in China can persist longer than expected, but can also reverse quickly once conditions change. As a result, market performance often depends less on macro narratives and more on liquidity trends and regulatory signals.

In past cycles, periods of peak optimism have frequently coincided with rising volatility rather than sustained stability.

The Chinese equity market has repeatedly demonstrated its ability to deliver strong short-term gains, while remaining structurally prone to sharp adjustments when policy priorities shift.

Daniel Brooks

Daniel Brooks