Retail Traders Are All In — Again

Retail investors have pushed equity buying to record levels in early 2026, fueling risk appetite while options data suggests enthusiasm remains more controlled than in 2021.

Retail investors have kicked off 2026 with an unprecedented surge in equity buying, pushing activity to record levels and reshaping short-term market dynamics.

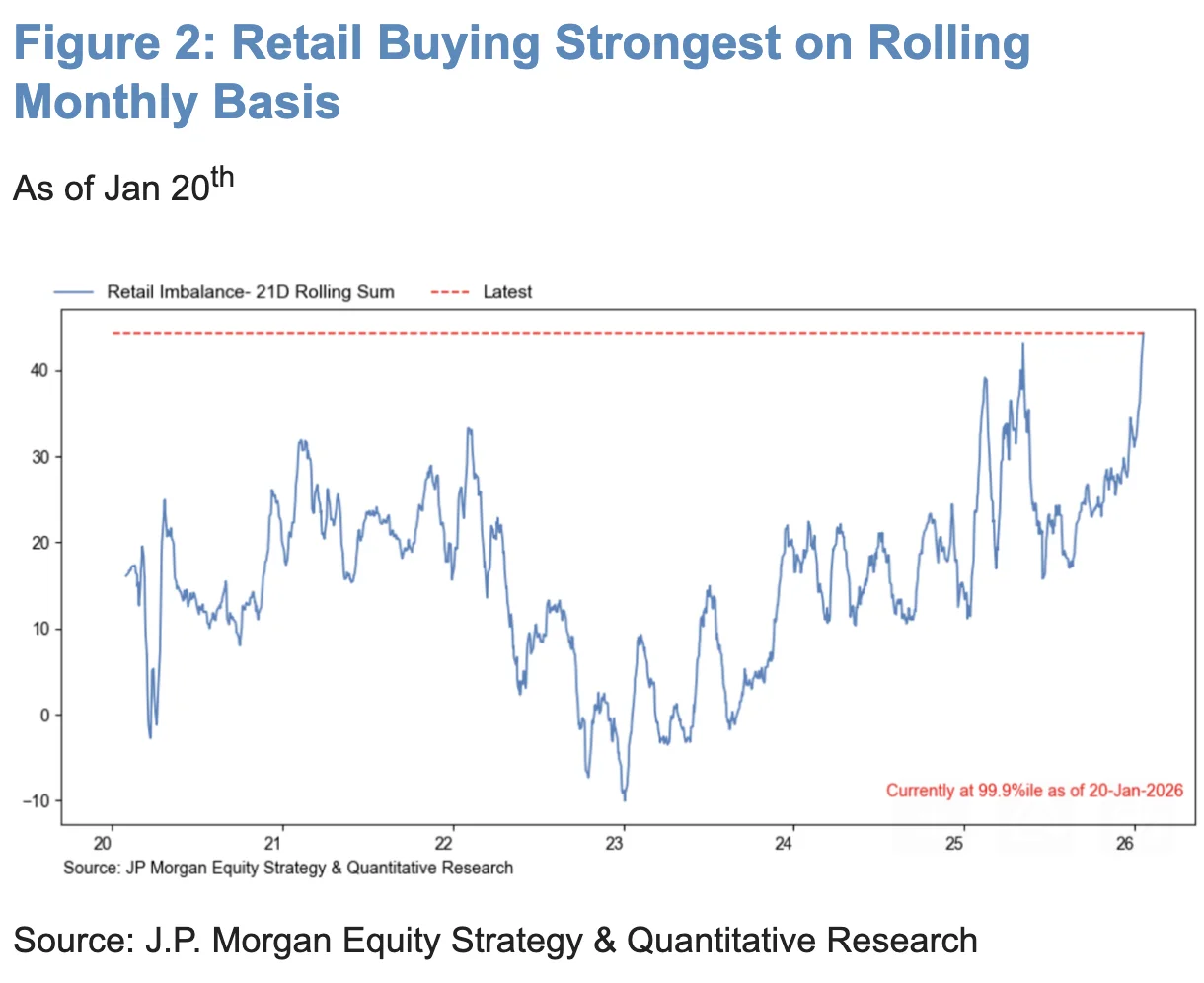

According to recent data, retail traders poured roughly $12.9 billion into stocks over the past week alone, marking one of the strongest bursts of individual investor demand on record. On a rolling monthly basis, retail buying has now reached an all-time high.

What makes this episode stand out is its persistence. Previous spikes in retail demand — such as last year’s buy-the-dip phases and short-lived momentum trades — tended to fade quickly. This time, participation has remained elevated, even through episodes of market volatility.

Tuesday’s session, when equities sold off amid tariff headlines and geopolitical tension, became the third-largest retail trading day of the past year. Rather than stepping aside, individual investors leaned into the pullback.

Risk Appetite Returns to Volatile Corners

The renewed retail presence has coincided with a strong start to the year for higher-beta and volatility-sensitive parts of the market.

Improving macro conditions, firmer growth expectations, and a shift toward more cyclical outcomes have encouraged investors to take on additional risk. As confidence has improved, market leadership has broadened beyond mega-cap growth and into more speculative areas.

Several momentum-driven stocks tied to elevated trading activity and strong retail engagement have emerged as clear beneficiaries of this trend.

Not 2021 — At Least Not Yet

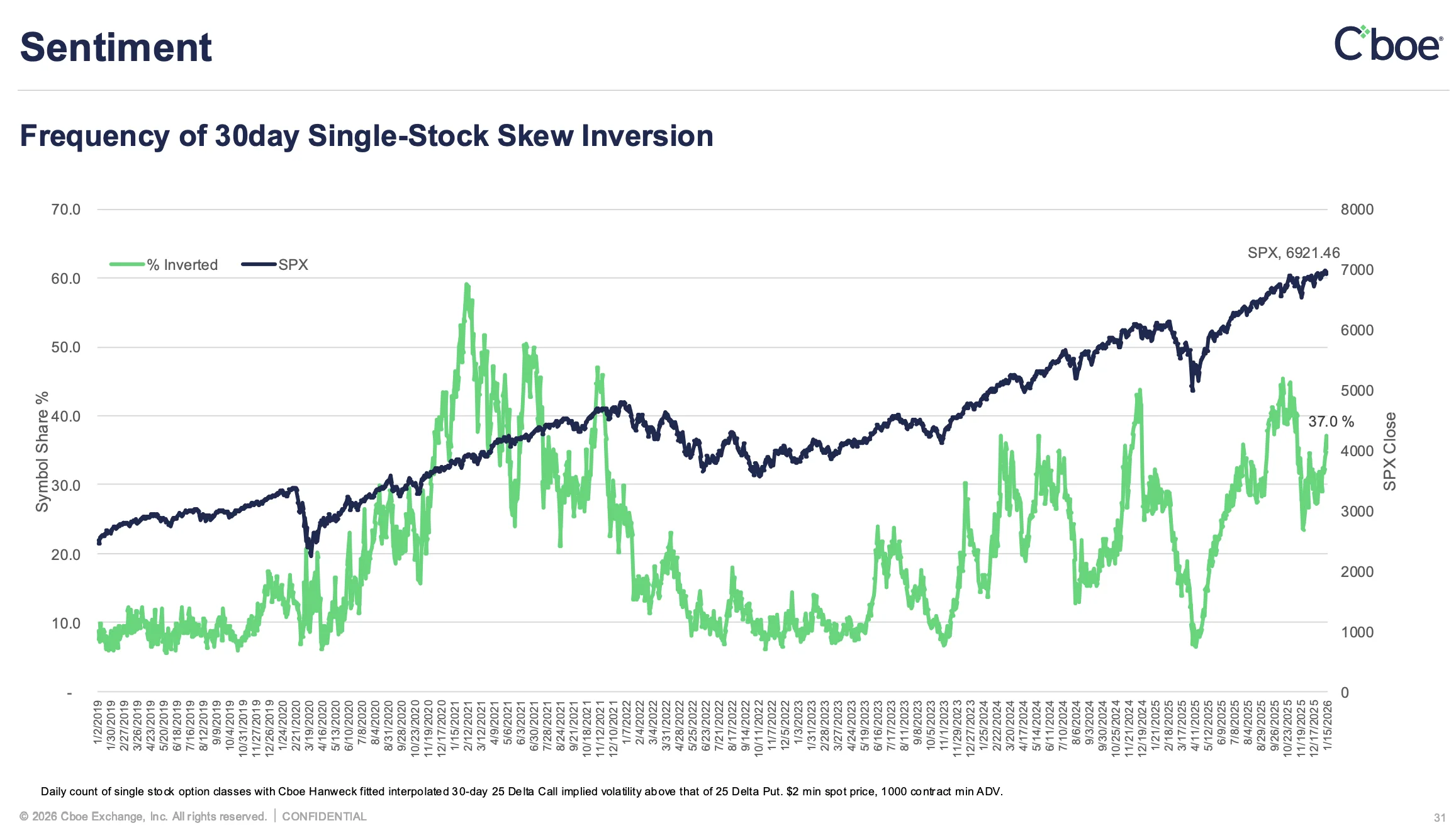

The scale of retail participation has inevitably drawn comparisons to the 2021 trading frenzy. However, options market data suggests today’s environment remains more restrained.

While activity in single-stock options has increased, the share of stocks where call options trade at higher implied volatility than puts remains well below the extremes seen during the peak of 2021 exuberance. This points to strong engagement, but not outright euphoria.

Retail investors are once again a major force in the market. Their buying has helped sustain momentum and push risk appetite higher — but so far, the options market suggests enthusiasm remains more controlled than during past speculative peaks.

Daniel Brooks

Daniel Brooks