Why Emotions Are the Fastest Way to Lose Money in Markets

Emotional decisions during market downturns often lead investors to sell at the worst possible time. History shows discipline and systems outperform fear.

Emotions are one of the most expensive liabilities an investor can carry. Time and again, market history shows that fear and excitement — not lack of information — are the primary reasons people lose money.

The Panic of March 2020

In March 2020, global markets collapsed by more than 30% in just three weeks. The world was entering lockdowns, headlines were relentless, and uncertainty dominated every conversation.

For many investors, selling felt rational. Cash appeared to be the only safe option.

Yet those who sold during the panic missed a powerful rebound. Over the following six months, markets recovered by more than 60%, leaving fear-driven sellers locked out of one of the fastest recoveries in history.

Why Market Timing Rarely Works

Trying to time the market is a losing game because it requires being right twice:

- Selling near the top

- Buying back near the bottom

Research consistently shows that most investors get the first step wrong by panicking — and the second step even worse by waiting too long to re-enter.

The result is predictable: selling low and buying back higher after confidence returns.

The Same Lesson in 2022

The pattern repeated itself in 2022. Inflation surged to 9%, interest rates rose sharply, and geopolitical tensions escalated.

The S&P 500 fell roughly 25%. Predictions of a “lost decade” became common.

Less than two years later, markets reached new all-time highs.

The lesson remained unchanged: volatility is not a flaw of markets — it is the price paid for long-term returns.

Why Feelings Are So Costly

When investment decisions are driven by fear, excitement or anxiety, outcomes tend to be poor. Emotions amplify short-term noise and push investors to act precisely when patience is required.

By the time investing feels “safe” again, the recovery is often already over.

Systems Beat Emotions

Successful investing is not about predicting the future or reacting to headlines. It is about following a system:

- Clear rules

- Defined risk management

- Long-term discipline

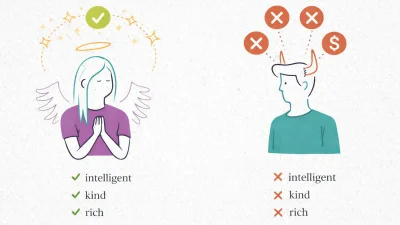

Emotions make investors poor. Systems make investors wealthy.

The difference is not intelligence or access to information — it is the ability to stay rational when markets test your resolve.

Emily Turner

Emily Turner