AI Boom Lifts Market Margins While Non-Tech Lags

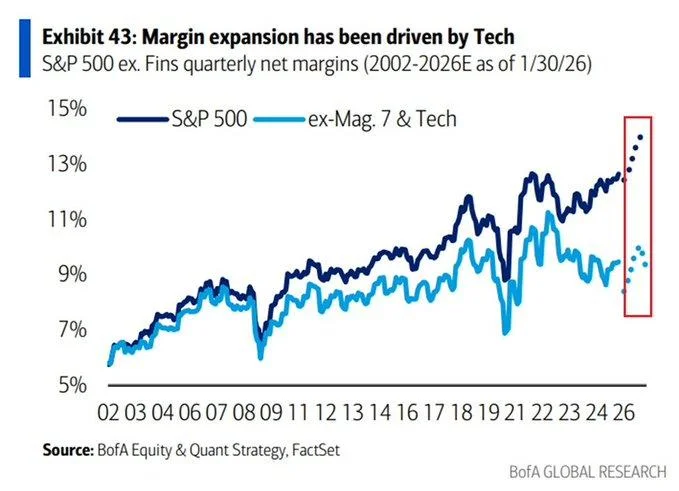

Net profit margins in the S&P 500 have climbed to a record 13%, driven largely by technology and AI-related companies. Outside tech and the Magnificent Seven, profitability continues to lag.

Artificial intelligence is reshaping corporate profitability across U.S. equities. The latest data show that net margins within the S&P 500 have reached historic highs — but the strength is increasingly concentrated in technology and AI-driven firms.

Record Margins — With a Catch

According to recent market research, net profit margins for companies in the S&P 500 excluding financials have climbed to approximately 13%, marking the highest level on record.

However, once the so-called “Magnificent Seven” and the broader technology sector are excluded, margins fall sharply to around 9%.

This creates a profitability gap of roughly 4 percentage points — the widest divergence ever observed between technology-heavy firms and the rest of the index.

Profitability Outside Tech Is Under Pressure

Over the past four years, companies outside the technology and financial sectors have seen net margins decline by nearly 2 percentage points. This suggests that margin expansion at the index level is not broad-based but rather increasingly concentrated.

In other words, headline profitability numbers may be masking underlying weakness across large parts of the market.

AI as the Structural Driver

The expansion in margins has coincided with accelerated investment in artificial intelligence, automation, and scalable digital infrastructure. AI-related efficiency gains, cost optimization, and revenue leverage appear to be disproportionately benefiting mega-cap technology firms.

As AI adoption spreads, market leadership has become more concentrated — reinforcing the performance gap between capital-light, high-margin tech platforms and more traditional sectors.

Chart: Margin Expansion Driven by Tech

The visual illustrates how aggregate margins have continued to trend higher, while margins excluding major technology players have flattened and recently declined.

What It Means for Investors

The data highlight an important structural shift:

- Index-level profitability remains historically strong.

- Margin expansion is increasingly concentrated in AI-driven companies.

- Broader corporate America is experiencing margin compression.

If current trends persist, market performance may remain heavily dependent on a relatively small group of technology leaders. That concentration dynamic could amplify both upside momentum and downside risk in the event of earnings disappointment.

Artificial intelligence is not just a thematic narrative — it is now measurably altering the profit structure of the U.S. equity market.

Daniel Brooks

Daniel Brooks