Why Some High Earners Struggle in Retirement

High income doesn’t guarantee long-term wealth. This article explains why discipline, capital allocation and compounding matter more than earnings alone.

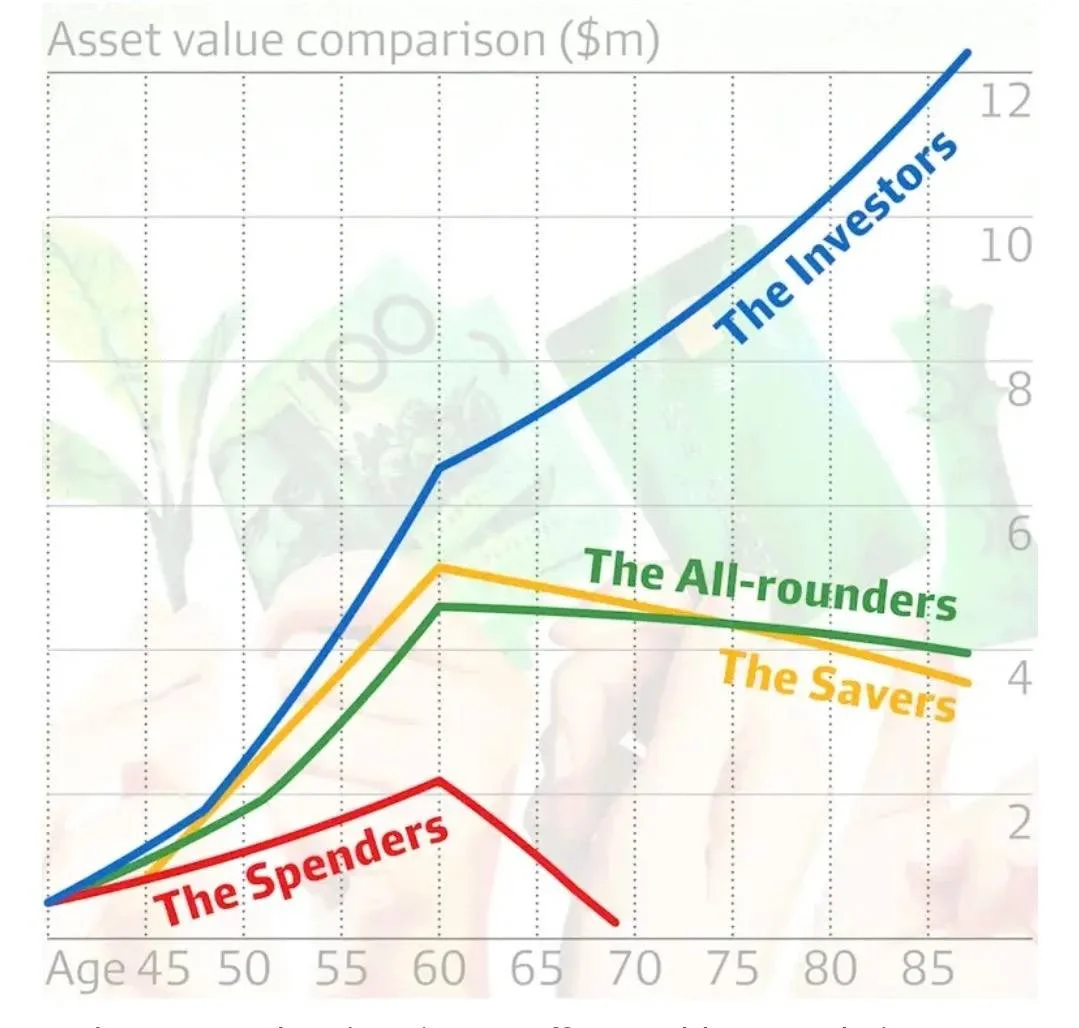

This chart reveals a common trap facing high-income households. Even with $1 million or more in net worth and annual family income exceeding $600,000, financial outcomes can diverge sharply over time.

The difference is not income. It’s behaviour, structure and discipline.

The Spenders: Early Success, Then a Sharp Drop

High earners who focus primarily on lifestyle often reach their peak net worth relatively early — typically between ages 50 and 55. Rising income creates a strong sense of financial success.

But without a system, spending grows faster than assets. Habits remain unchanged as income plateaus. When earnings decline, capital begins to erode.

Retirement, instead of becoming a new phase of life, turns into a financial stress point.

Core mistake: Living at peak income rather than building sustainable capital.

The Savers: Safe, Disciplined — and Slowly Falling Behind

Savers display discipline and caution. Capital is preserved, losses are avoided, and volatility is kept low.

Yet over time, inflation and missed opportunities quietly erode real purchasing power. Wealth does not collapse — but it stagnates.

You don’t lose money outright. You lose potential.

Core mistake: Confusing safety with progress.

The All-Rounders: Balance Without Acceleration

This group appears rational: some saving, some investing, some spending. On paper, it looks reasonable.

In reality, the lack of focus prevents meaningful compounding. Without scale or conviction, growth remains linear.

No acceleration. No exponential effect.

Core mistake: Diversification of effort instead of strategy.

The Investors: Capital That Keeps Working

Investors follow a different trajectory. Their curve continues to rise long after income peaks.

They rely on systems, compounding and behavioural discipline. Income matters — but only as fuel. The engine is capital working independently of labour.

This is the only path where time becomes an ally rather than a threat.

Key principle: Capital works even when you don’t.

The Real Lesson

High income does not eliminate the need for discipline. Saving alone is insufficient. Investing without expense control is fragile.

The next level is not about earning more.

The next level is a system:

- Expense control

- Capital accumulation

- Systematic investing

- Compounding-driven growth

Income opens the door. Structure determines what happens next.

Emily Turner

Emily Turner