Danish Pension Fund Signals Exit From U.S. Treasuries as Debt Concerns Mount

U.S. Treasury prices fell as Denmark’s Akademikerpension announced plans to exit U.S. government bonds, citing concerns over America’s fiscal outlook.

U.S. government bonds came under renewed pressure as Denmark’s pension fund Akademikerpension announced plans to divest from U.S. Treasuries, citing concerns over the country’s deteriorating fiscal position.

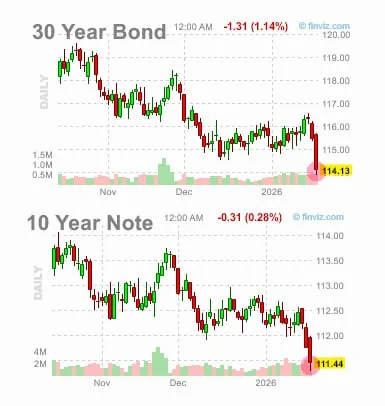

The move coincides with an acceleration in the selloff across long-dated U.S. debt. Prices of 30-year Treasuries have declined sharply, while 10-year notes continue to trend lower, reflecting persistent upward pressure on yields.

Why Akademikerpension Is Exiting

Akademikerpension stated that its decision is driven primarily by concerns about the long-term sustainability of U.S. public finances, rather than by current political tensions between the United States and Europe.

According to the fund, rising debt levels and fiscal slippage have materially altered the risk profile of U.S. government bonds — traditionally viewed as the world’s safest assets.

Debt Dynamics Add to Market Anxiety

The announcement follows reports that U.S. federal debt expanded by a record $2.25 trillion during Donald Trump’s first year back in office, despite campaign promises to curb government borrowing.

For bond investors, the combination of expanding deficits, higher interest costs and political uncertainty has begun to undermine confidence in long-duration U.S. debt.

Markets Debate Motives — Signal or Strategy?

Some analysts argue that Akademikerpension’s announcement may be part of broader diplomatic pressure, particularly amid ongoing tensions between Denmark and the United States related to Greenland.

Under this view, the statement could represent a negotiating tactic rather than a definitive portfolio shift.

Others remain less dismissive. A public signal from a large European pension fund — even if symbolic — challenges the long-standing perception of U.S. Treasuries as a universally uncontested safe haven.

The “First Domino” Question

Market participants are now watching closely to see whether other institutional investors follow suit.

While some believe U.S. political leadership will ultimately step back from policies that unsettle global capital — a dynamic often referred to as “Trump Always Chickens Out” (TACO) — the current environment offers little room for complacency.

This is 2026. Fiscal stress is structural, not cyclical. And global investors appear increasingly unwilling to ignore that distinction.

Technical Snapshot

From a technical perspective, U.S. Treasuries remain under sustained downside pressure, with recent price action suggesting limited near-term support unless policy expectations shift meaningfully.

The broader message is clear: confidence in U.S. fiscal dominance is no longer taken for granted — and the bond market is beginning to price that reality in.

Olivia Carter

Olivia Carter