Why China Is “Selling” U.S. Treasuries While the U.K. Is “Buying” Them

China’s reported holdings of U.S. Treasuries are falling while the U.K.’s are rising, but much of the move reflects custody shifts and reserve restructuring—not a wholesale exit from the dollar.

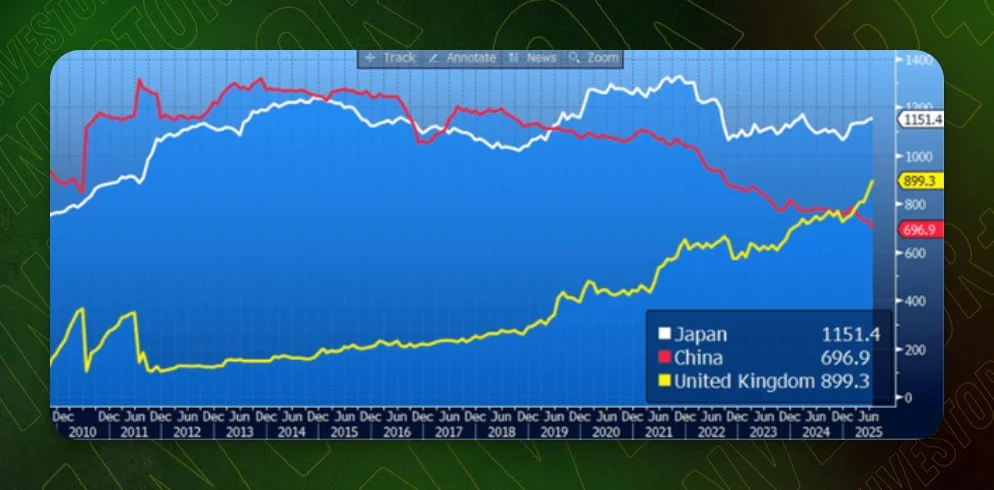

Recent U.S. Treasury data show China steadily reducing its reported holdings of U.S. government bonds, while the United Kingdom’s holdings climb and have now overtaken China’s — prompting headlines about Beijing “dumping” Treasuries and London “picking them up.” The underlying story is more nuanced.

From an editorial perspective, the significance lies in the mechanics of how global reserves are managed. What looks like a dramatic rotation out of U.S. debt is, to a large extent, a reshuffling of where those securities are held and how China structures its reserves, rather than a simple dollar exit.

What China Is Really Doing With Its U.S. Bonds

China’s central bank and the State Administration of Foreign Exchange (SAFE) have indeed been reducing their directly reported holdings of U.S. Treasuries in U.S. custody. But there are three key drivers behind this trend:

1. Supporting the yuan

To avoid excessive weakness in the yuan, Chinese authorities periodically intervene in FX markets. One tool is to sell part of their dollar assets, including Treasuries, and use the proceeds to buy yuan.

This is a standard currency-stabilisation mechanism: reserves are used as a buffer, not as a static stockpile. In such episodes, the data can briefly show lower Treasury holdings, even if the overall dollar footprint remains large.

2. Diversifying reserves beyond Treasuries

China has also been gradually diversifying its reserves. A larger share is being allocated to:

- Gold and other real assets;

- Commodity-linked exposures and long-term supply contracts;

- Settlements in national currencies, including within the BRICS universe.

The dollar share of reserves therefore declines at the margin, but it does not disappear. U.S. assets remain a core part of the portfolio, even as alternative stores of value are built up.

3. Changing the jurisdiction of custody

Perhaps the most misunderstood element is where those Treasuries are held. China does not always “sell” Treasuries in the economic sense; it often moves them out of direct U.S. custody into European and U.K. custodial centres such as London or Brussels.

When securities are transferred from a U.S. custodian to, for example, Euroclear or a London-based institution, the U.S. Treasury’s TIC statistics record this as:

- a decline in China’s holdings, and

- a rise in the holdings attributed to the United Kingdom or Belgium.

Economically, the owner may still be a Chinese public institution, but statistically the bonds now “belong” to the U.K. or Belgium because that is where they are booked.

Why the U.K. Suddenly Looks Like a Big Buyer

London is one of the world’s largest custodial hubs, alongside Brussels, thanks to infrastructure such as Euroclear and the Bank of England. Many sovereigns, not just China, park their dollar assets there.

The rise in U.K.-attributed Treasury holdings likely reflects:

- China and other reserve managers shifting custody to London-based accounts;

- Hedge funds and sovereign wealth funds using London as a base for dollar operations;

- European demand for longer-dated Treasuries as investors position for lower Federal Reserve rates;

- Middle Eastern reserves being channelled through U.K. banks and custodians.

In other words, the U.K. figure is as much about its role as a global transit hub for dollar liquidity as it is about domestic British demand.

What the Aggregate Data Tell Us

When you combine the numbers, a clearer picture emerges:

- China’s reported share is declining;

- Holdings attributed to the U.K. and Belgium are rising;

- Total foreign holdings of Treasuries are broadly stable over time.

This suggests that the global appetite for U.S. government debt remains intact. Much of what looks like a “Chinese sell-off” is actually a change in where the securities sit on global balance sheets, not a full-scale retreat from the dollar system.

So, Is China Dumping Treasuries?

China is restructuring its reserves — supporting the yuan when needed, gradually increasing gold and non-dollar exposures, and shifting some bond custody out of U.S. jurisdiction. At the same time, London’s role as a custodial centre makes the U.K. appear to be an aggressive buyer, even when it is simply holding assets on behalf of others.

From an editorial perspective, the takeaway is straightforward: the optics of “China selling, Britain buying” are far more dramatic than the underlying reality. The U.S. Treasury market remains a central pillar of the global financial system, and recent data point more to a re-routing of holdings than to a collapse in foreign demand.

Olivia Carter

Olivia Carter