Something Strange Is Happening to How Investors View Oracle’s Future

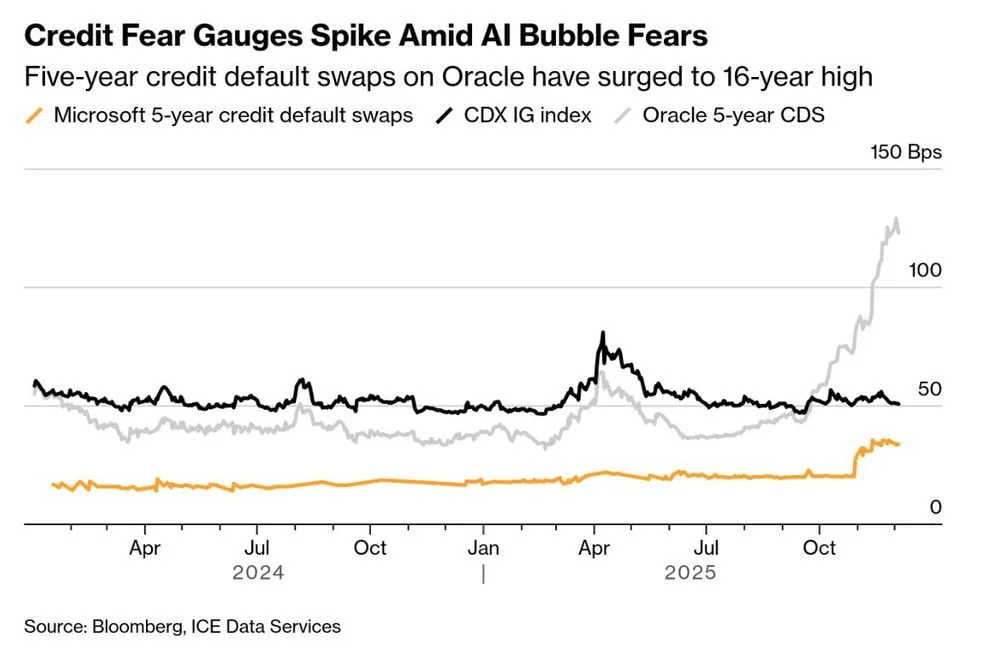

Oracle’s 5-year credit default swaps have surged to a 16-year high as investors grow uneasy with the company’s rapid AI spending and rising debt load.

Oracle’s credit-risk gauges have surged to their highest level in more than a decade, reflecting growing investor unease with the company’s aggressive AI expansion and rapidly rising leverage. Five-year credit default swaps (CDS) on Oracle have climbed to a 16-year high, far outpacing similar measures for Microsoft and the broader CDX IG index, according to Bloomberg data.

The move stands out: while credit markets across the tech sector have remained broadly stable, Oracle’s CDS curve has steepened sharply in recent months. The company is taking on substantial new debt to fund AI infrastructure and cloud expansion, and investors are beginning to question whether the pace is sustainable.

Credit Markets Flash a Warning

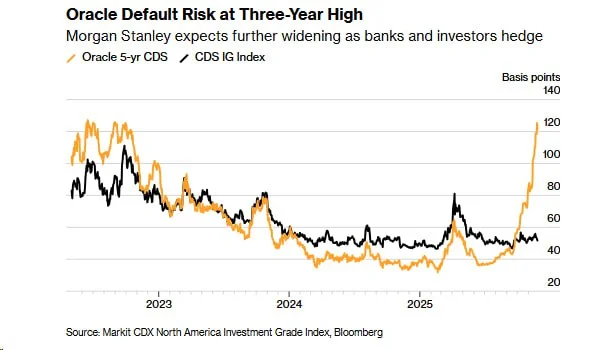

Analysts at Morgan Stanley recently warned that Oracle’s CDS had already risen to a three-year high — a sign that bondholders were demanding greater protection against potential credit deterioration. Now, that stress has accelerated even further. The firm noted that Oracle is “borrowing and spending on AI at an extraordinary pace,” pushing leverage higher and leaving markets looking for reassurance from management.

Microsoft’s and the CDX IG index’s CDS levels have remained comparatively calm, underscoring how specific the pressure on Oracle has become.

AI Spending Echoes Dot-Com Era Risk Appetite

The surge in credit fear indicators comes as concerns over an “AI bubble” intensify across markets. High-profile investors — including Michael Burry — have drawn parallels between today’s AI-driven capital expenditure boom and the exuberance seen during the dot-com era. Then, as now, companies were rewarded for bold promises rather than near-term profitability.

“As seen in historical cycles, investors are again assuming exponential growth will eventually justify massive spending,” Burry cautioned recently, noting that his fund is shorting what he calls the “AI bubble.”

Oracle’s aggressive positioning in the AI infrastructure race has elevated expectations, but has also amplified credit-market sensitivity. Rising CDS levels indicate that bond investors are pricing in more risk even as equity markets continue to emphasize long-term upside scenarios.

The key question for investors is whether Oracle can demonstrate that its heavy AI capitalisation will deliver sustainable returns — or whether the market will continue treating its rising debt load as a growing vulnerability. For now, credit markets are signalling caution.

Michael Reed

Michael Reed