U.S. Mortgage Applications Hit Two-Year High as Buyers Return to the Market

U.S. mortgage applications surged to their highest level in nearly two years as easing borrowing costs encouraged more homebuyers to return to the market.

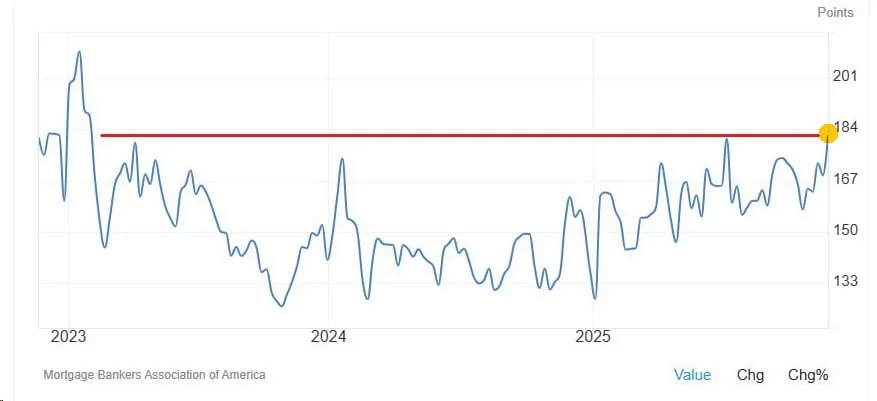

U.S. mortgage applications surged last week to their highest level since early 2023, signaling that lower borrowing costs are beginning to stir demand in a housing market that has been sluggish for most of the year.

The Mortgage Bankers Association (MBA) said its index of home-purchase applications rose 7.6% to 181.6 in the week ending November 21. The move came even as the average contract rate for a 30-year fixed mortgage edged up to just above 6.4%, a one-month high.

While the reading may be influenced by typical holiday-season volatility, the sharp increase suggests improving sentiment among buyers who have been waiting for relief from elevated financing costs. The MBA survey, which has been published weekly since 1990, covers more than 75% of U.S. retail residential mortgage applications.

Pending Home Sales Also Show Strength

The improvement in mortgage demand aligns with stronger data from the National Association of Realtors (NAR). Pending sales of previously owned homes rose 1.9% in October — far above economists’ expectations — marking the highest level in nearly a year.

The gain was supported by a drop in mortgage rates earlier in the month, when the 30-year fixed rate briefly slipped to a one-year low of 6.3%. Rising inventory levels this year have also helped draw more buyers back into the market.

Regionally, contract signings increased in three out of four U.S. regions, led by a 5.3% jump in the Midwest. The South — the largest housing market — posted a modest 1.4% increase, while the West declined.

Improvement Likely, But Challenges Remain

Economists caution that meaningful recovery for the housing market still hinges on a more pronounced decline in mortgage rates. Home prices remain elevated, and the vast majority of U.S. homeowners continue to hold mortgages with rates below 5%, limiting the incentive to move.

“There is scope for improvement in the months ahead,” said Charlie Dougherty, senior economist at Wells Fargo. “But we do not anticipate a strong rebound as elevated homeownership costs remain a constraint.”

Still, analysts note that even a modest rise in applications for home purchases is a positive sign for sales heading into early 2026.

Olivia Carter

Olivia Carter