Institutional Adoption May Drive Ethereum TVL 10Х Higher

Ethereum’s total value locked could grow tenfold by 2026, driven by tokenization, stablecoins, and rising institutional adoption, according to Sharplink Gaming CEO.

Ethereum’s total value locked (TVL) could increase tenfold by 2026 as institutional adoption accelerates and tokenization expands across financial markets, according to Joseph Chalom, co-CEO of Sharplink Gaming and a former BlackRock executive.

Chalom argues that Ethereum’s next growth phase will not be driven by speculation alone, but by real-world use cases — particularly stablecoins, tokenized assets, and growing exposure from large investors.

Why Ethereum TVL Could Grow Sharply

According to Chalom, several structural trends are converging:

- Stablecoin expansion: the stablecoin market could grow from $308B to $500B by next year.

- Ethereum dominance: around 54% of all stablecoin activity already runs on Ethereum.

- Tokenization: real-world assets (RWA) such as funds, stocks and bonds could reach $300B by 2026.

As more assets move on-chain, Ethereum remains the primary settlement layer — which directly feeds into higher TVL.

Institutions Are Increasing Exposure

Chalom expects ETH holdings and tokenization activity by sovereign wealth funds to grow five- to tenfold over the next year. He notes that major financial players including BlackRock, JPMorgan, and Franklin Templeton have already increased on-chain activity.

Sharplink Gaming itself ranks as the second-largest public Ethereum treasury company, holding nearly 798,000 ETH, worth about $2.3B.

Not Everyone Is Fully Bullish

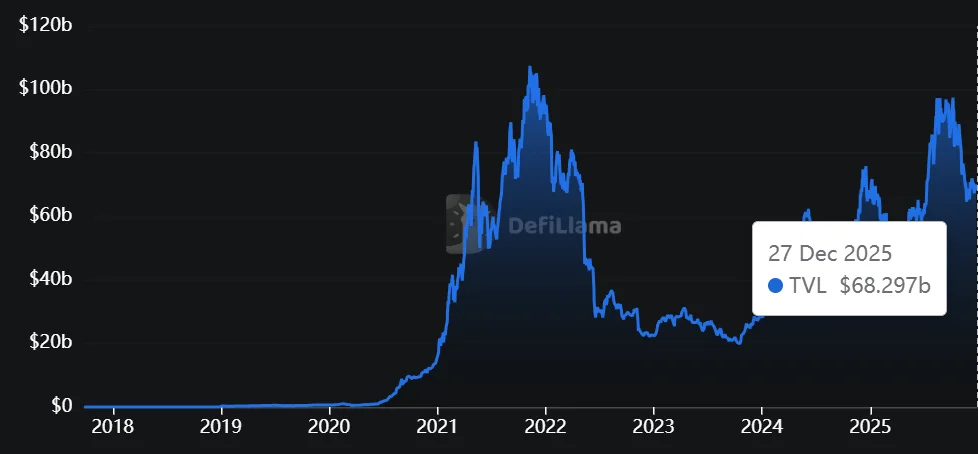

Despite the optimistic outlook, risks remain. Ethereum’s TVL currently stands near $68B, still below its previous peak. Analyst Benjamin Cowen has warned that Ether could struggle to reach new price highs in the near term, citing broader Bitcoin market conditions.

At the time of writing, ETH is trading near $2,900, down roughly 3% over the past month.

Looking Toward 2026

Beyond capital inflows, Chalom also points to on-chain AI agents and prediction markets as potential growth drivers. Meanwhile, Ethereum’s roadmap continues with the upcoming Glamsterdam upgrade, aimed at improving Layer-1 scalability and network efficiency.

The broader message is clear: if tokenization and institutional adoption scale as expected, Ethereum’s role as the backbone of on-chain finance could expand significantly over the next two years.

Ethan Moore

Ethan Moore