Bitcoin Selling Pressure Intensifies Even as Bulls Eye Higher Levels

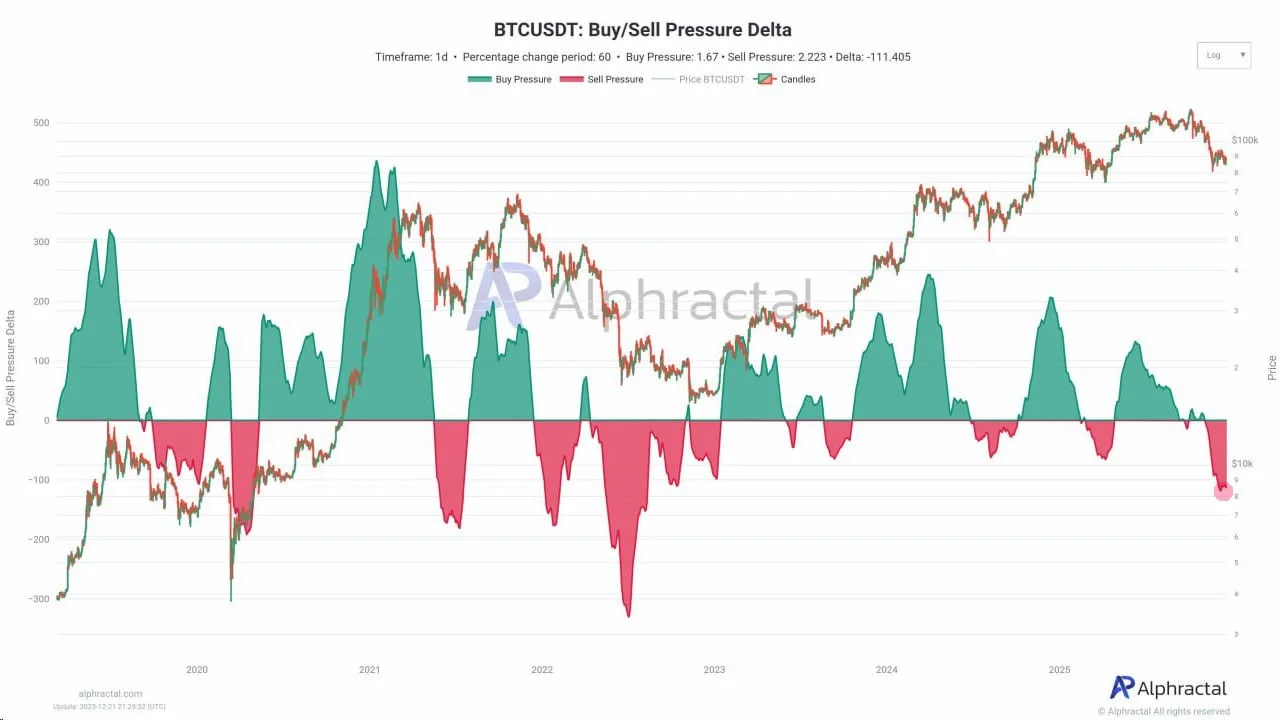

Bitcoin is experiencing its strongest seller pressure in three years, while on-chain data, analyst forecasts, and a record options expiry send mixed signals to the market.

Bitcoin is currently facing its strongest selling pressure in more than three years, according to market data from Alphractal. The shift marks a notable change in market dynamics after a prolonged period of steady capital inflows.

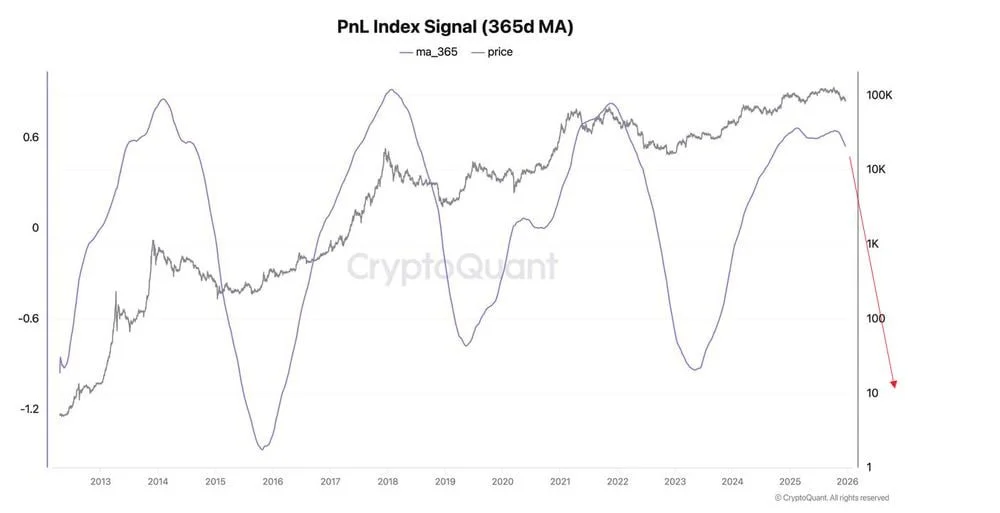

CryptoQuant data shows that capital inflows into Bitcoin are weakening for the first time after roughly 2.5 years of sustained growth. Historically, similar slowdowns have coincided with transitions into consolidation or corrective phases.

On-Chain Signals Point to Rising Stress

The deterioration in inflow momentum coincides with elevated sell-side pressure visible across multiple on-chain indicators. Measures tracking profit-and-loss dynamics suggest the market is shifting away from accumulation behaviour and toward distribution.

Earlier, analysts at CryptoQuant stated that Bitcoin has entered a bearish market phase, citing declining demand metrics and fading momentum across spot flows.

Options Market Shows Concentrated Interest

Despite the pressure in spot and on-chain markets, derivatives positioning presents a more nuanced picture. December 26 marks the largest options expiration in Bitcoin and Ethereum history, with total notional value exceeding $27 billion — including $23.6 billion in Bitcoin and $3.8 billion in Ethereum.

The primary zone of interest in Bitcoin options is clustered around the $96,000 strike. A put-call ratio near 0.38 indicates positioning remains skewed toward bullish bets, even as short-term selling pressure intensifies.

Diverging Forecasts Add to Market Uncertainty

Market forecasts remain sharply divided. Fundstrat has warned of a serious correction in the cryptocurrency market in early 2026, reflecting concerns around liquidity conditions and valuation sensitivity.

At the same time, long-term bullish views persist. Arthur Hayes has reiterated his expectation that Bitcoin could reach $200,000 by March 2026. Fundstrat founder Tom Lee has also consistently expressed a structurally bullish outlook, despite near-term risks highlighted by his team.

Corporate Activity and Positioning

Adding to the mixed signals, Strategy did not purchase Bitcoin during the past week, a pause that some market participants interpret as caution amid heightened volatility and shifting market conditions.

Taken together, current data points to a market at an inflection point — where short-term stress is building, liquidity is tightening, and positioning remains heavily contested ahead of a critical derivatives expiry.

Ethan Moore

Ethan Moore