BlackRock: Stablecoins Are Now a Core Part of the Global Financial System

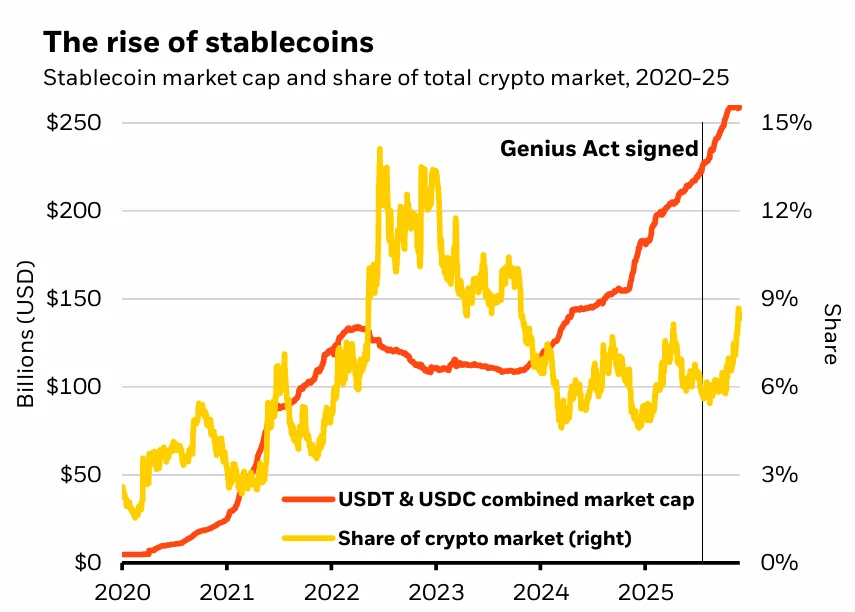

BlackRock’s 2026 Global Outlook highlights the rapid expansion of stablecoins, noting that their combined market value has surged to $250 billion and that they are becoming a foundational layer of the modern financial system.

From an editorial perspective, BlackRock’s treatment of stablecoins marks a shift: they are no longer a crypto side topic but a structural pillar of global finance.

Stablecoins have transitioned from a niche crypto instrument into one of the fastest-growing forms of digital money, according to BlackRock’s 2026 Global Outlook. The firm highlights that the combined market capitalization of the largest stablecoins — led by USDT and USDC — now exceeds $250 billion, reflecting accelerating adoption across exchanges, payment rails and institutional infrastructure.

Stablecoins become a core liquidity layer

BlackRock notes that stablecoins increasingly function as a global liquidity layer, facilitating cross-border transfers, digital settlement and instant dollar mobility. Their usage has expanded well beyond trading: fintech platforms, remittance providers, on-chain lenders and even corporates are integrating stablecoin rails to speed up cash movement.

The report points out that the rapid growth of tokenized cash is part of a broader trend toward “digitally native finance,” where money, assets and settlement infrastructure coexist on interoperable networks.

Regulatory momentum accelerates

Stablecoins have also gained traction due to improving regulatory clarity. BlackRock highlights that frameworks in the U.S., Europe and parts of Asia are converging around fully backed, high-quality reserve models. This shift is drawing in both institutional investors and traditional financial institutions, which now view stablecoins as a legitimate tool for payments and liquidity management.

Part of a larger transformation

According to the Outlook, stablecoins sit at the intersection of multiple long-term forces: the tokenization of financial markets, advancements in blockchain settlement, and the rise of AI-driven transaction systems. Their expansion is expected to continue as more real-world assets and treasury products move on-chain.

A critical component of the future financial system

BlackRock concludes that stablecoins are becoming “an essential bridge” between traditional finance and digital markets. Their adoption reflects a functional need — faster settlement, global reach and programmable transactions — rather than speculative demand.

“The future of money movement is increasingly digital,” the report states, “and stablecoins are at the centre of that evolution.”

BlackRock’s full 2026 Global Outlook, including methodology and complete data tables, is available at the link below.

Ethan Moore

Ethan Moore