Brazil’s Largest Private Bank Recommends Holding 1–3% in Bitcoin

Brazil’s largest private bank, Itaú Unibanco, has reiterated its recommendation that investors allocate between 1% and 3% of their portfolios to Bitcoin.

Itaú Unibanco, Brazil’s largest private bank, has reiterated its recommendation that investors allocate between 1% and 3% of their portfolios to Bitcoin, even after the cryptocurrency posted losses this year.

In a new research note, the bank argues that Bitcoin has matured into a meaningful diversification tool and a form of currency hedge, particularly for portfolios exposed to macroeconomic uncertainty and geopolitical risk.

Bitcoin as a Diversification Asset

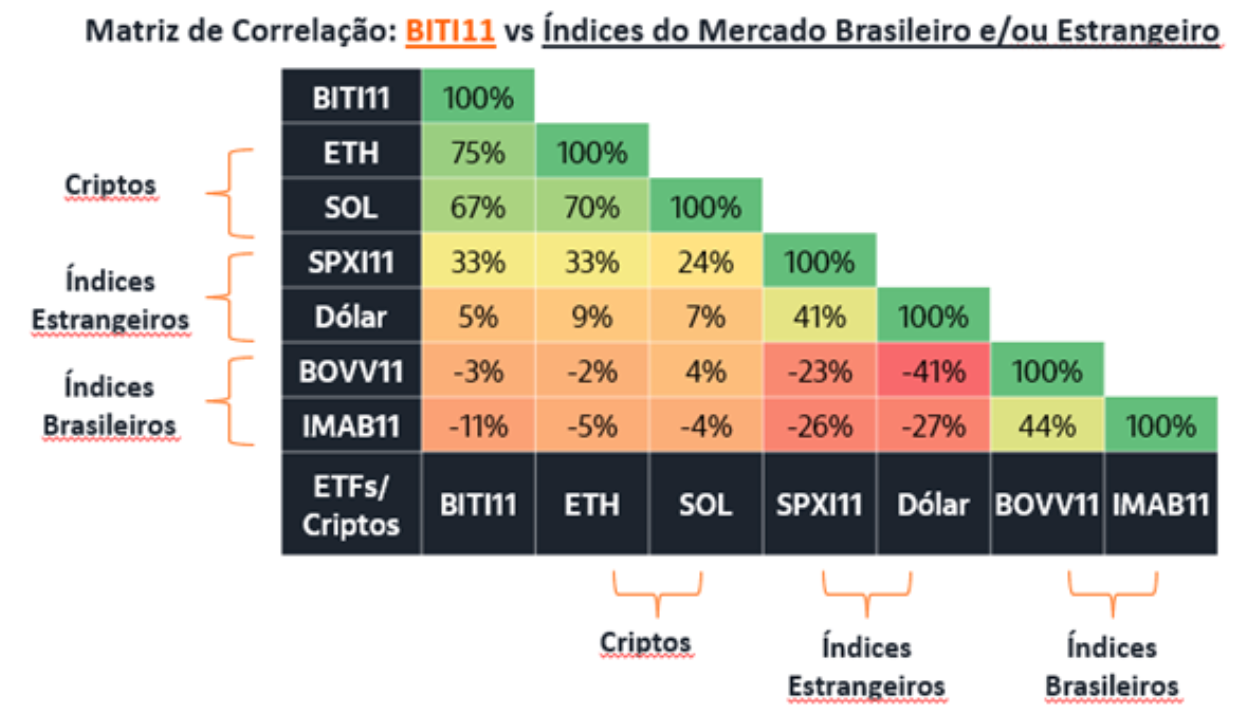

The report, authored by Itaú analyst Renato Eid, stresses that Bitcoin behaves differently from traditional assets such as equities, fixed income, or domestic market instruments. Its decentralised and global structure, the bank notes, creates diversification benefits that are difficult to replicate elsewhere.

From an editorial perspective, the significance lies in Bitcoin’s low correlation with local assets — especially in stress scenarios (as historical cycles often show).

According to Itaú’s analysis, Bitcoin ETFs such as BITI11 show relatively low correlation with Brazilian equity and fixed-income indices, reinforcing its role as a portfolio stabiliser rather than a direct substitute for risk assets.

Currency Effects Amplified Losses in Brazil

The bank also highlights that Bitcoin’s weak performance in 2025 should be viewed in context. While the asset is down roughly 3.5% year-to-date in U.S. dollar terms, losses for Brazilian investors reached 16.2% due to the appreciation of the real against the dollar, according to TradingView data.

Bitcoin began the year near $93,500, traded as low as the $80,000 region, and reached new all-time highs above $125,000 before pulling back. Currency movements, Itaú notes, played a decisive role in shaping local returns.

Bitcoin as a Hedge in Periods of Stress

Eid points to late 2024 as a reminder of Bitcoin’s hedging potential. In December, when the U.S. dollar approached R$6.30, Bitcoin positions regained strength, offsetting broader portfolio stress.

As a result, Itaú argues that the greater risk for long-term investors may be staying out of the market altogether, rather than tolerating short-term volatility.

Access via ETFs and Digital Platforms

Investors can gain exposure to Bitcoin through Itaú’s Íon platform or via the BITI11 ETF, which trades on Brazil’s B3 exchange. Both options allow participation in Bitcoin’s performance without direct custody or operational complexity.

The report also notes that B3 is preparing for a new phase of large-scale tokenisation from 2026, a development that could further integrate digital assets into Brazil’s capital markets.

Long-Term Discipline Over Short-Term Forecasts

Itaú cautions against short-term market timing, emphasising that forecasting price moves in high-volatility assets is rarely effective. Instead, the bank recommends a disciplined, long-term approach with periodic rebalancing.

Bitcoin should act as a complement — not the core — of a balanced portfolio.

With its hybrid characteristics combining elevated risk and global store-of-value potential, Bitcoin can enhance diversification when used in moderation. Itaú concludes that a 1% to 3% allocation suits most investor profiles and provides exposure to global opportunities while offering partial protection against currency shocks.

Ethan Moore

Ethan Moore