Prediction Markets Are Gaining Scale — Coinbase Sees Structural Shift

Coinbase Institutional says crypto-based prediction markets are rapidly scaling, moving beyond niche speculation toward a more mature, institutional-ready market structure.

Prediction markets are no longer just a fringe crypto experiment. In its Crypto Market Outlook 2026, Coinbase Institutional argues that the rapid growth of on-chain prediction platforms marks the early stages of a structurally important new market within the digital asset ecosystem.

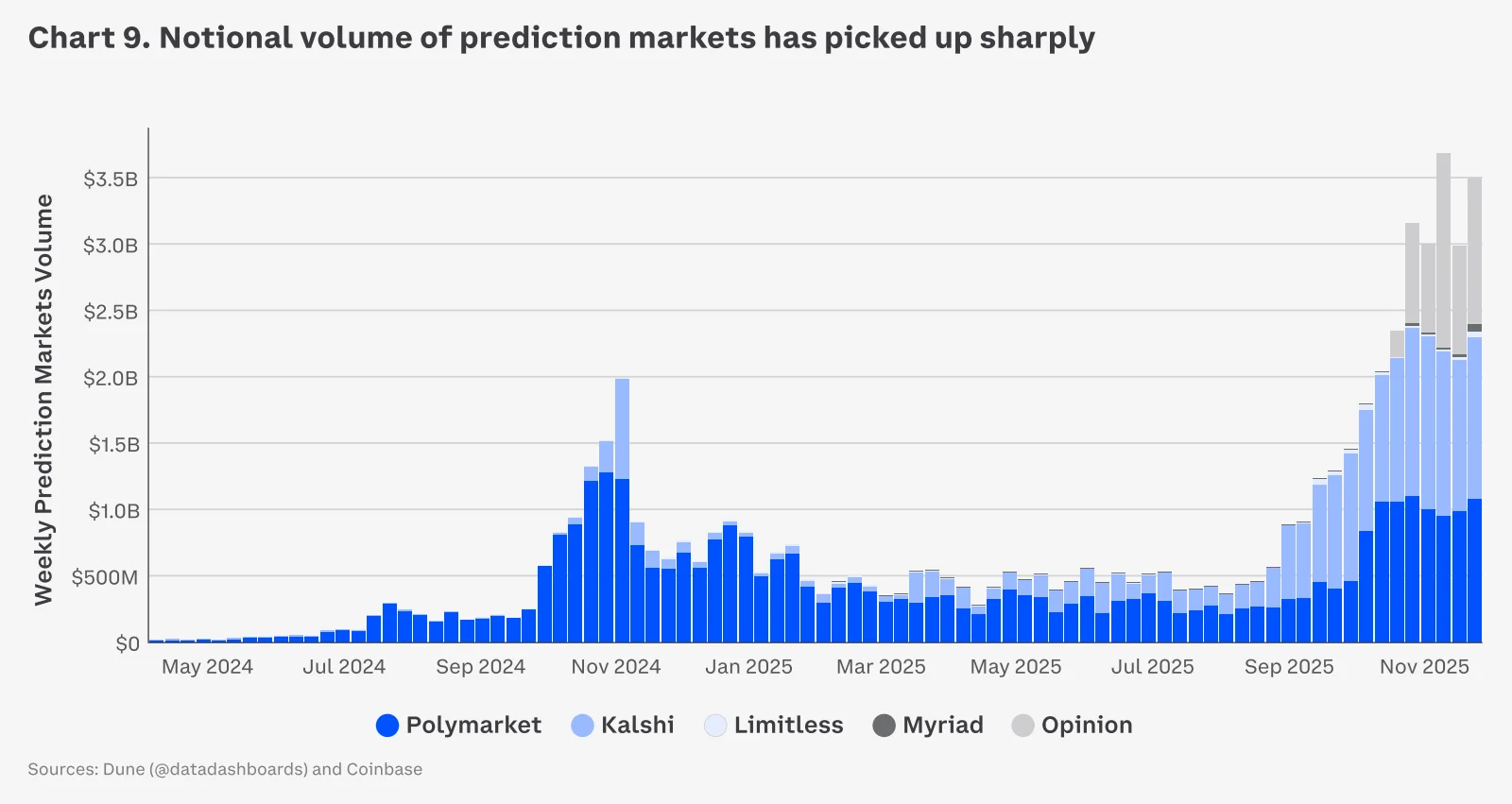

Volumes are rising — and fast

Coinbase points to a sharp increase in notional trading volumes across major prediction market platforms over the past year. What was once a low-liquidity niche has begun to attract sustained user activity, signalling broader interest in markets that allow participants to price probabilities on real-world events.

These platforms now span a wide range of outcomes — from elections and macroeconomic data to financial markets and technology developments — expanding their relevance well beyond crypto-native audiences.

From fragmented apps to market infrastructure

As activity grows, Coinbase warns that fragmentation could become a limiting factor. Multiple isolated platforms risk recreating the inefficiencies seen during earlier DeFi cycles, when liquidity and users were spread thin across competing protocols.

The report suggests that prediction market aggregators could emerge as a critical layer, consolidating liquidity and providing users with a unified interface across protocols via smart contracts and APIs.

Why prediction markets are different

Unlike traditional financial derivatives, prediction markets focus on information rather than price exposure alone. By allowing participants to express views on future outcomes, these markets can act as real-time indicators of collective expectations.

Coinbase notes that this information-discovery function may become increasingly valuable in a world where data is abundant but reliable signals are scarce.

Regulation and maturity ahead

With greater scale comes regulatory attention. Coinbase expects that as prediction markets mature, they will face clearer governance frameworks and oversight, helping them transition from speculative tools into more robust market infrastructure.

Such a shift could improve transparency, reduce manipulation, and encourage participation from more sophisticated users.

What to watch heading into 2026

- Liquidity concentration: Whether aggregators succeed in unifying fragmented markets.

- Use-case expansion: Growth beyond crypto-native events into macro and policy outcomes.

- Institutional interest: Early signs of professional participation as frameworks mature.

Key takeaways

| Theme | Coinbase’s view |

|---|---|

| Market stage | Prediction markets are transitioning from niche to scalable platforms. |

| Structural risk | Fragmentation could limit growth without aggregation. |

| Long-term role | Information discovery may become a core value proposition. |

Source: Coinbase Institutional, Crypto Market Outlook 2026.

Ethan Moore

Ethan Moore