Ruble-Linked Stablecoin A7A5 Outpaces USDT and USDC in Growth

The ruble-linked stablecoin A7A5 has surpassed $100 billion in transaction volume in under a year, outpacing USDT and USDC in growth pace, according to industry data.

The ruble-linked stablecoin A7A5 has surpassed $100 billion in cumulative transaction volume less than a year after its launch, marking one of the fastest growth trajectories ever observed in the stablecoin market.

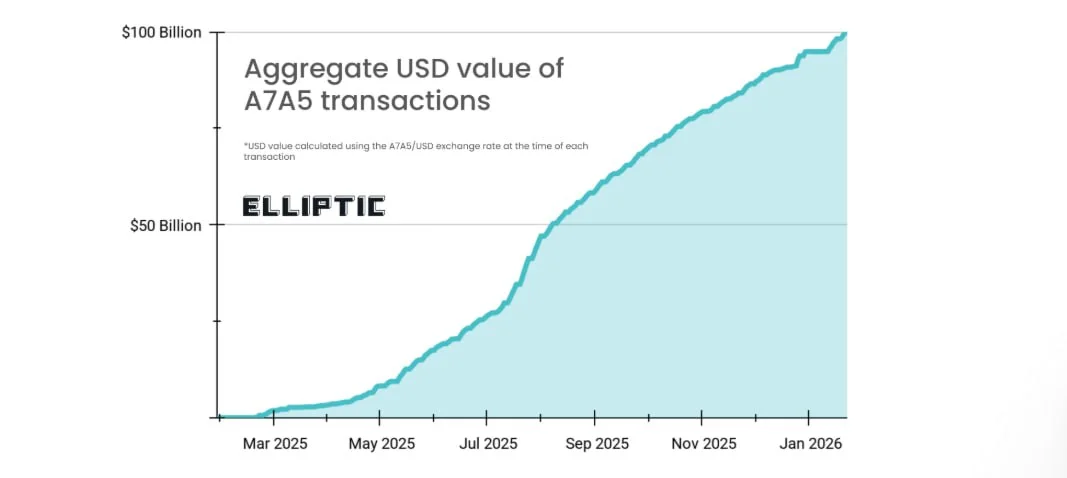

According to blockchain analytics firm Elliptic, the aggregate U.S. dollar value of A7A5 transactions crossed the $100 billion threshold by January 2026, highlighting the token’s rapid adoption in cross-border payment flows.

Fastest-growing stablecoin by volume

Earlier reporting by CoinDesk noted that A7A5 has outpaced both USDT and USDC in growth rate over the past 12 months, making it the fastest-growing stablecoin globally by transaction activity.

For comparison, market leader USDT added approximately $49 billion in circulating supply over the same period, while USDC expanded by around $31 billion, according to data from Artemis.

What is driving A7A5’s growth

A7A5 was launched by A7 LLC and is linked to the Russian ruble. The token is issued via a Kyrgyz-based entity and circulates primarily on the Tron and Ethereum blockchains.

Its rapid adoption has been closely tied to cross-border payment demand from Russian users facing banking restrictions, as well as broader shifts in regional payment infrastructure.

Despite extensive international sanctions, the ruble has strengthened more than 40% against the U.S. dollar this year, supported by capital controls and actions by the central bank. This macro backdrop has contributed to growing demand for ruble-linked settlement instruments.

Role in cross-border payments and DeFi

A7A5 is widely used to facilitate cross-border transfers while avoiding direct reliance on dollar-denominated stablecoins. In practice, it also serves as a bridge into USDT liquidity via decentralized finance protocols, allowing users to access global crypto liquidity without holding dollar stablecoins directly.

This positioning has made A7A5 particularly attractive in environments where access to traditional banking rails is constrained.

Regulatory and risk considerations

Elliptic notes that A7A5 is linked to sanctioned entities, which raises compliance and regulatory concerns for counterparties and platforms interacting with the token.

As a result, its rapid growth highlights not only innovation in payment rails but also the increasing fragmentation of the global stablecoin ecosystem along geopolitical and regulatory lines.

Why this matters

The rise of A7A5 underscores how stablecoins are evolving beyond dollar-centric models, increasingly reflecting regional currencies and localized use cases.

While transaction volume alone does not equate to systemic importance, A7A5’s growth trajectory signals a meaningful shift in how digital assets are being used for cross-border settlement under constrained financial conditions.

Ethan Moore

Ethan Moore