Strong Start to 2026 Fuels Optimism Across Global Stock Markets

Global stock markets begin the year with strong gains as Asia and Europe rally, European indices move into overbought territory, and U.S. equity futures extend higher.

“As the first week goes, so goes the year” — one of the many January sayings on Wall Street. Early market action suggests investors are starting the year with a clear risk-on bias.

Equity markets across Asia, Europe and the United States have opened the year with notable gains, marking one of the strongest starts in more than a decade.

Asia leads the way

Technology-oriented Asian equity markets delivered their best start to a new year since 2012. Gains were driven by renewed interest in growth stocks, optimism around artificial intelligence investment and expectations of more accommodative global monetary conditions later in the year.

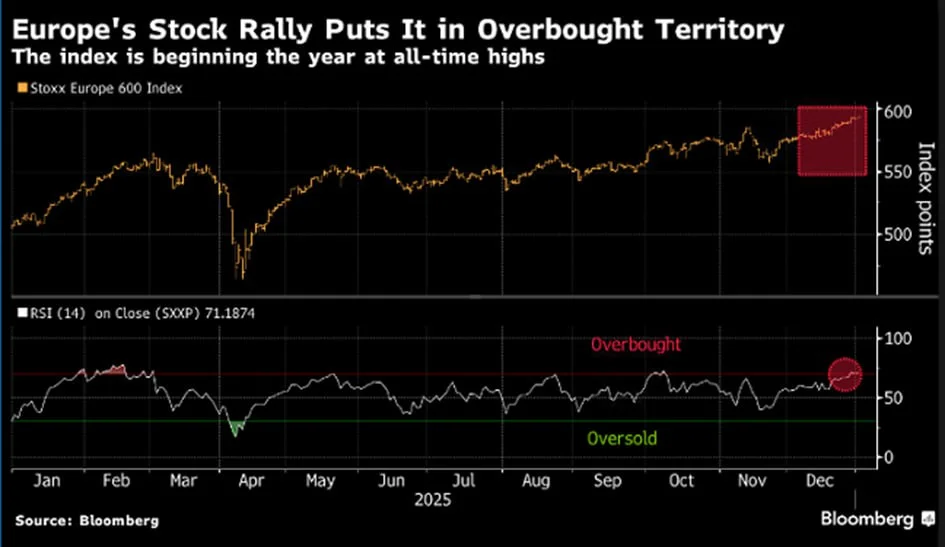

Europe approaches overbought levels

European markets — at least those already open — are also gaining momentum. The broad European equity index has moved into overbought territory based on momentum indicators, reflecting the strength of the rally and growing investor confidence.

The UK market added to the bullish tone, with the FTSE 100 surpassing the 10,000-point mark for the first time in its history, underlining the scale of the early-year move.

U.S. futures extend gains

U.S. equity futures are also trading firmly higher, led by the Nasdaq. Technology stocks gained more than 1% in early futures trading, extending the global tech-led rally seen across Asian markets.

Strong performance in futures suggests investors are positioning for continued upside as the year begins, supported by expectations of easing financial conditions, resilient corporate earnings and sustained investment in growth sectors.

Market outlook

While early January strength does not guarantee full-year performance, the synchronized rally across regions points to improving risk sentiment. Investors will now watch closely to see whether this momentum can be sustained as macroeconomic data, central bank signals and earnings season begin to shape expectations for the months ahead.

Daniel Brooks

Daniel Brooks