Emerging Market Stocks May Be Entering a New Catch-Up Phase

Emerging market equities have significantly lagged developed markets for years, but new relative signals suggest a potential trend shift that investors are starting to notice.

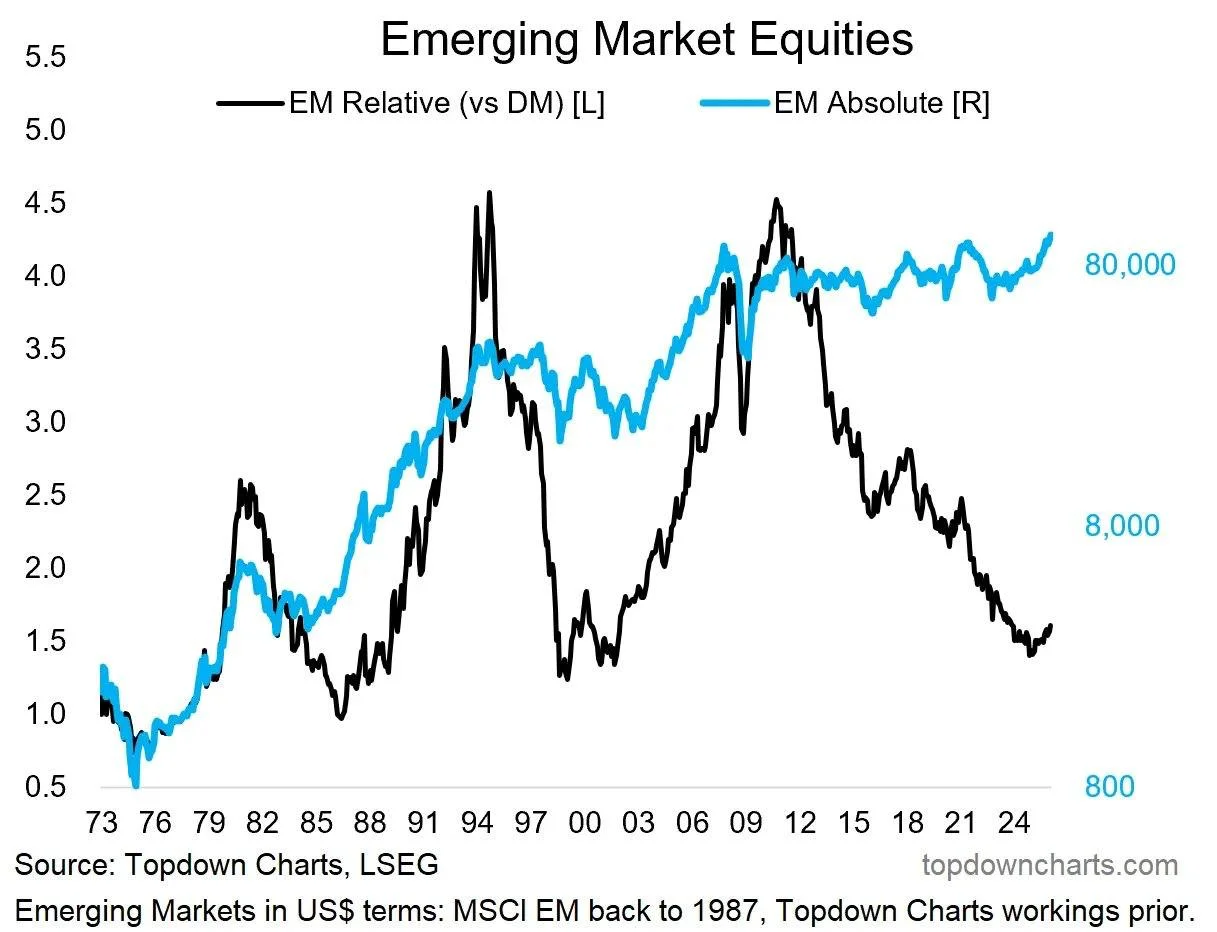

Emerging market equities may be approaching a structural inflection point. After more than a decade of underperformance versus developed markets, relative performance indicators are beginning to stabilise — and in some cases, turn higher.

From an editorial perspective, the significance lies not in short-term price action, but in the length of the cycle itself. Emerging markets have spent years consolidating while developed markets — led by the United States — absorbed the bulk of global equity inflows.

A long period of relative underperformance

In relative terms, emerging market equities have lagged developed peers since the early 2010s. The gap widened meaningfully during periods of U.S. dollar strength, tighter global liquidity and repeated global risk-off episodes.

This has resulted in one of the longest stretches of relative underperformance on record. Historically, such extended divergences have often preceded multi-year rebalancing phases (as historical cycles often show).

Signs of consolidation fatigue

What stands out in the current setup is the behaviour of relative performance rather than absolute price levels. While emerging markets in dollar terms have broadly moved sideways, the relative trend versus developed markets appears to be exiting a prolonged consolidation range.

This does not yet confirm a sustained outperformance cycle. However, it does suggest that downside relative momentum has weakened materially — a necessary condition before leadership can rotate.

What could drive a catch-up phase?

- Valuation differentials: Emerging market equities continue to trade at a meaningful discount to developed markets on multiple metrics.

- Dollar sensitivity: Any stabilisation or softening in the U.S. dollar historically supports EM assets.

- Growth dispersion: Several emerging economies are now growing faster than developed peers, with improving balance-of-payments dynamics.

- Portfolio rebalancing: After years of concentration in U.S. equities, global investors are increasingly sensitive to diversification risks.

Risks remain elevated

Despite improving signals, emerging markets remain exposed to structural risks. Geopolitical fragmentation, uneven policy frameworks, and sensitivity to global liquidity conditions continue to limit visibility.

Moreover, leadership within emerging markets is likely to be selective rather than broad-based — favouring countries with stronger fiscal discipline, reform momentum and external balances.

Emerging markets are not yet in a confirmed leadership cycle. But after years of consolidation and relative decline, the balance of evidence suggests the asset class is moving from neglect toward reconsideration.

For investors, this may mark the early stages of a longer re-rating process — one that tends to unfold gradually, then all at once.

Olivia Carter

Olivia Carter