US Stock Futures Consolidate as Investors Await Jobless Claims

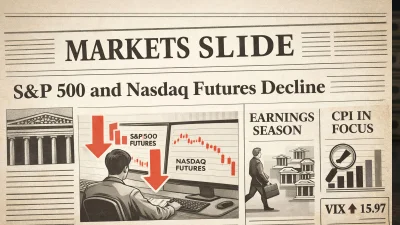

US stock futures are consolidating near record levels as investors await weekly jobless claims, trade data, and comments from Fed officials.

US equity futures are trading in a consolidation phase, with contracts tied to the S&P 500 and Nasdaq hovering near recent highs as investors await a fresh batch of macroeconomic data and signals from Federal Reserve officials.

Previous session

During the prior trading day, Wall Street closed with mixed performance. The S&P 500 briefly pushed to a new all-time high before reversing lower, ending the session near the 6,920 level. The Nasdaq Composite managed to hold above a short-term ascending trendline but surrendered most of its intraday gains, finishing around 25,650.

Market setup today

In early trading, S&P 500 futures remain above the 6,900 mark, consolidating just below record territory. A local support zone is seen near 6,850. Nasdaq futures have slipped back below a short-term descending trendline but continue to move within a broader medium-term upward channel, with support near 25,500.

What is driving the market

Investors are closely watching today’s release of weekly initial jobless claims, which may offer further insight into the health of the US labor market. In addition, data on the US trade balance, exports, and imports for October are scheduled for release.

Markets are also bracing for remarks from a member of the :contentReference[oaicite:0]{index=0}, as investors look for clues on the future path of monetary policy. Recent labor indicators have been mixed: JOLTS job openings and the ADP private payrolls report both came in slightly below expectations, while the services PMI from the :contentReference[oaicite:1]{index=1} showed continued expansion in December, marking its strongest growth pace since 2024.

Sector performance

Cyclical sectors underperformed in the previous session, with industrials, materials, aerospace and defence, and financials leading the declines. Growth-oriented sectors showed mixed results: biotech and cloud-related stocks posted gains, while solar and semiconductor names lagged. Defensive sectors were mostly lower, with utilities under pressure, although healthcare ended the day modestly higher.

Cross-asset signals

In other markets, oil prices continue to move within an ascending channel, approaching a local resistance area near 56. US Treasury yields remain range-bound around 4.15%. Volatility indicators are showing early signs of tension, with the VIX edging higher after consolidating near the 15 level. Gold prices are undergoing a mild pullback within a broader uptrend, retreating from resistance near 4,500.

Overall, markets appear to be in a wait-and-see mode, balancing resilient growth signals against softer labor data and ongoing uncertainty over the timing of future Fed policy adjustments.

Investor focus: policy risk and macro signals

Investors continue to reassess the broader market backdrop, with sentiment increasingly shaped by signs of deeper White House involvement in corporate decision-making.

US President Donald Trump criticised major defence contractors, urging them to suspend dividend payments and share buybacks until capital expenditure and domestic manufacturing investment accelerate. Shortly after, Trump stated that the administration plans to raise the US defence budget for 2027 from $901bn to $1.5tn — a move that introduces both fiscal stimulus expectations and policy uncertainty.

Later today, markets will digest weekly initial jobless claims data. Consensus expectations point to 212,000 claims, up from 199,000 last week. Recent ADP employment figures and JOLTS data already signalled cooling momentum in the labour market, and a further rise in claims would likely reinforce expectations of future monetary policy easing.

On the geopolitical front, Trump said that Venezuela would use proceeds from oil sales to the US to purchase American goods. The statement adds another layer of uncertainty to energy markets and may support elevated volatility across commodities.

Market balance

Equity futures are showing modest downside pressure, though overall risk conditions remain balanced. Volatility is moderate, and the near-term outlook can be characterised as neutral. For now, the S&P 500 is expected to trade within a range between 6,880 and 6,960, as investors weigh macro data against policy-driven headlines.

Daniel Brooks

Daniel Brooks