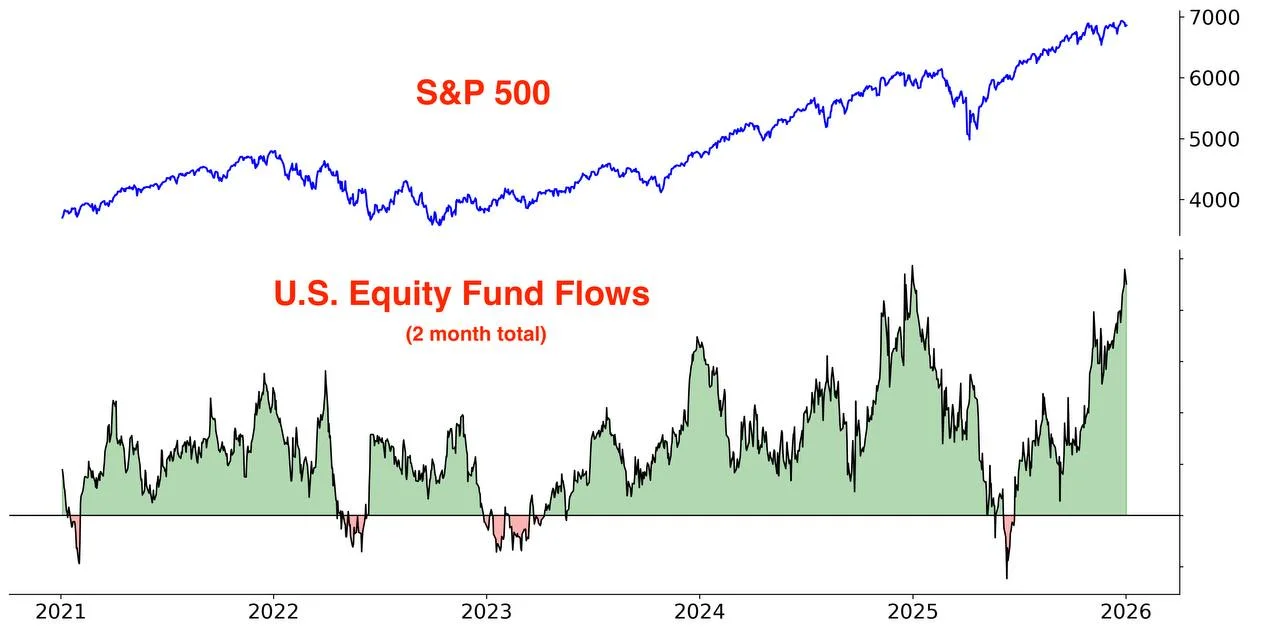

Equity Inflows Reach a Dangerous Extreme

Inflows into U.S. equity funds have returned to levels last seen near a major S&P 500 peak, adding a potential cautionary signal to an already crowded market.

Market enthusiasm is once again approaching familiar territory. Capital inflows into index funds focused on U.S. equities have climbed back to levels last observed exactly one year ago — a moment that coincided with a local peak in the S&P 500.

While fund flows alone rarely serve as a precise market-timing tool, the current surge highlights increasingly crowded positioning as U.S. equities trade near record highs.

What the data shows

Over the past two months, cumulative inflows into U.S. equity funds have reached a historical extreme, matching the peak recorded a year earlier. At that time, investor optimism was similarly elevated — and the S&P 500 soon entered a corrective phase.

The renewed acceleration in flows suggests strong risk appetite, particularly among passive investors allocating capital through broad market index products.

How to interpret the signal

On its own, elevated fund inflows do not constitute a reliable or standalone signal of an imminent market correction. Strong flows can persist for extended periods during trending markets, especially when macro conditions remain supportive.

However, as a secondary indicator, extreme inflows often reflect late-cycle behavior — a stage where marginal buyers are increasingly price-insensitive.

In this context, the current data strengthens the case for caution rather than outright bearishness.

Flows don’t call tops — but they often show when positioning becomes crowded.

From a technical perspective, the S&P 500 continues to trade near its historical highs, maintaining its broader uptrend. At the same time, sentiment and positioning indicators are flashing increasingly stretched readings.

This combination — strong price momentum alongside extreme inflows — tends to precede periods of consolidation, higher volatility, or shallow pullbacks rather than abrupt trend reversals.

What investors should watch next

- Earnings season guidance, particularly from large-cap leaders

- Inflation data and real yield dynamics

- Volatility behavior and options market positioning

- Any slowdown or reversal in equity fund inflows

In short, the data does not argue for panic — but it does argue for discipline. As history shows, markets are most vulnerable not when fear dominates, but when optimism becomes unanimous.

Daniel Brooks

Daniel Brooks