BofA Survey Signals Extreme Optimism as Cash Levels Hit Record Lows

BofA’s January Global Fund Manager Survey shows record-low cash levels, extreme bullish sentiment, and reduced hedging — conditions that have historically preceded market corrections.

Global investor optimism has reached extreme levels, according to the January Bank of America Global Fund Manager Survey, as portfolio cash levels dropped to a new historical low and risk exposure surged across asset classes.

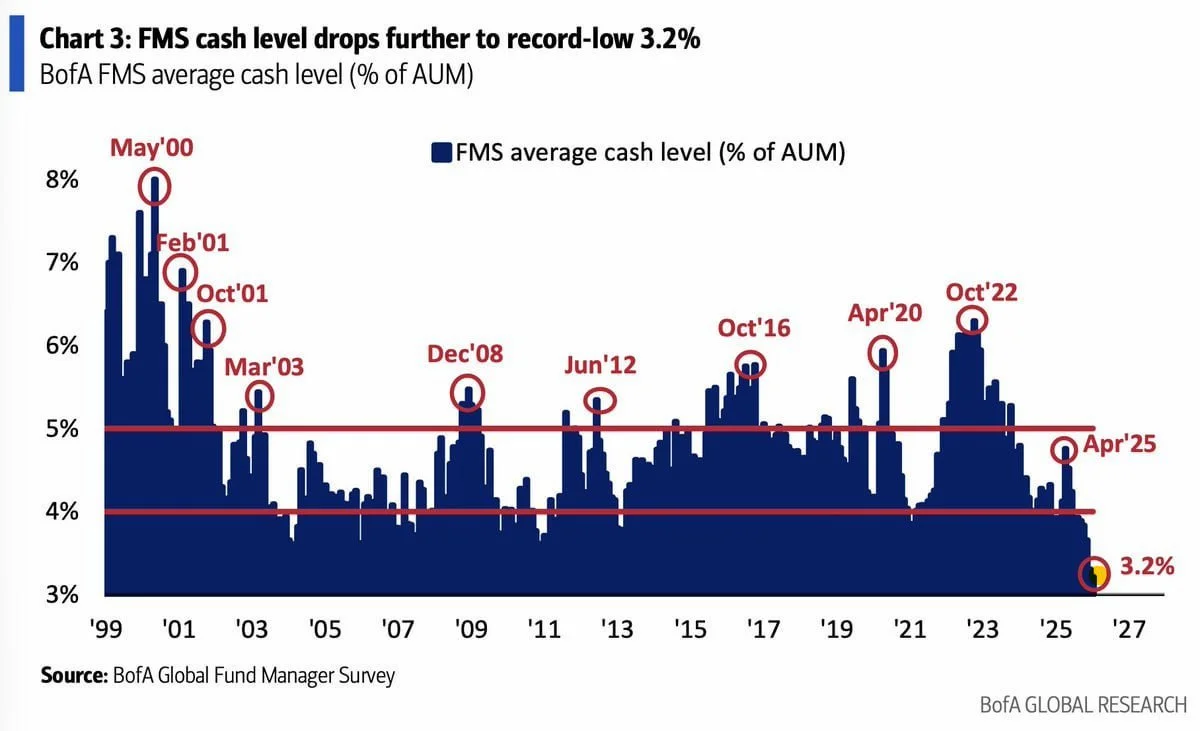

Cash levels hit record lows

The average cash allocation among global fund managers fell to 3.2% of assets under management, the lowest level on record. This indicates that managers are almost fully invested, leaving limited dry powder in portfolios.

Historically, such low cash levels have been observed during periods of elevated market confidence, often preceding phases of increased volatility or corrective price action.

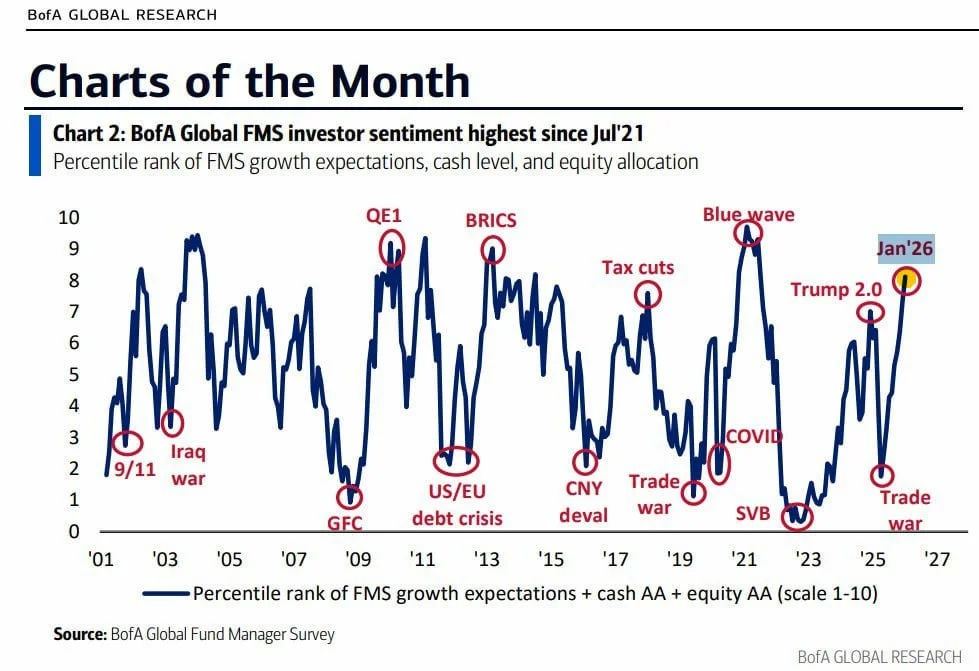

Bull & Bear indicator signals extreme optimism

The BofA Bull & Bear Indicator climbed to 9.4, a level associated with extreme bullish sentiment. The indicator aggregates positioning, flows, and sentiment metrics and is designed to flag crowded positioning in risk assets.

Readings near the upper end of the scale have historically coincided with late-cycle phases of market rallies.

Equity and commodity allocations surge

Global equity allocation among fund managers rose to its highest level since February 2022, reflecting strong conviction in continued upside for risk assets.

At the same time, allocation to commodities also climbed to the highest level since February 2022, underscoring renewed interest in inflation-sensitive and real assets amid geopolitical and supply-side uncertainties.

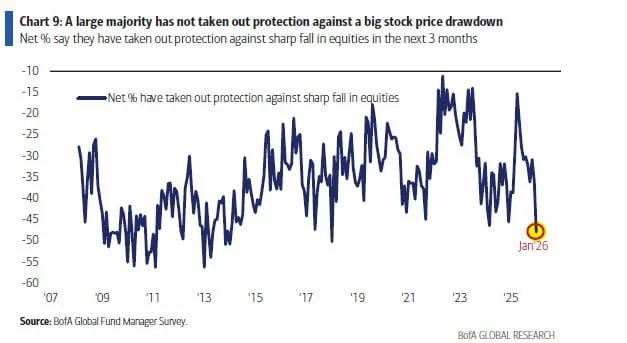

Hedging activity drops to multi-year lows

The survey shows that the share of global fund managers who have not implemented protection against a sharp equity drawdown reached its highest level since 2018.

This suggests widespread confidence that downside risks remain limited in the near term.

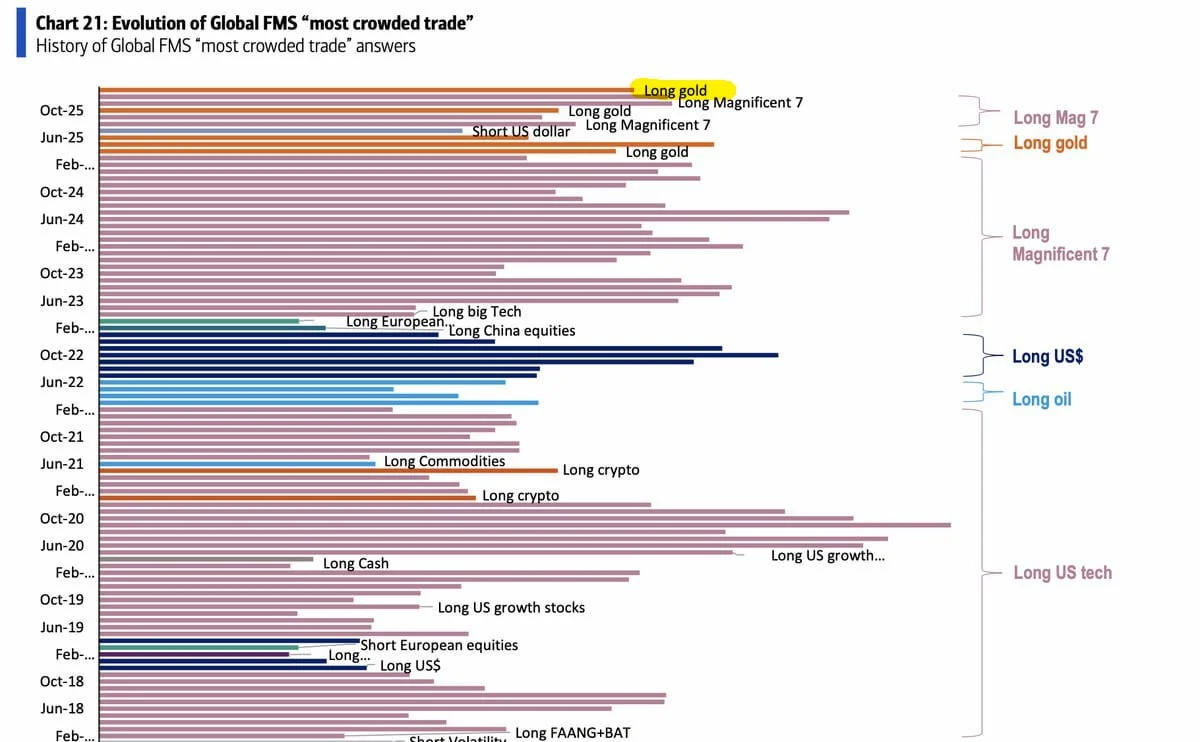

Crowded trades: gold regains top position

“Long gold” once again became the most crowded trade globally, overtaking the previous month’s consensus position in large-cap U.S. technology stocks.

The shift reflects a combination of strong price momentum in precious metals and growing geopolitical uncertainty.

Geopolitics emerges as top perceived risk

For the first time in several months, geopolitics was identified as the single largest risk to markets by survey participants. The second-largest risk cited was the potential formation of an artificial intelligence–related bubble.

This ranking highlights a growing disconnect between elevated risk appetite and rising awareness of macro and geopolitical tail risks.

Why this matters

Bank of America notes that the combination of record-low cash levels and an extremely elevated Bull & Bear Indicator represents a textbook signal of excessive optimism.

Historically, similar conditions have often preceded market corrections rather than sustained upside, as positioning becomes crowded and marginal buyers disappear.

Extreme optimism does not mark market tops precisely, but it significantly increases the probability of near-term volatility and drawdowns.

While sentiment alone is not a timing tool, the January survey suggests that markets are entering a phase where risk-reward dynamics may become increasingly asymmetric.

Daniel Brooks

Daniel Brooks