Why Most Investors Miss Multi-Baggers — and This Chart Shows Why

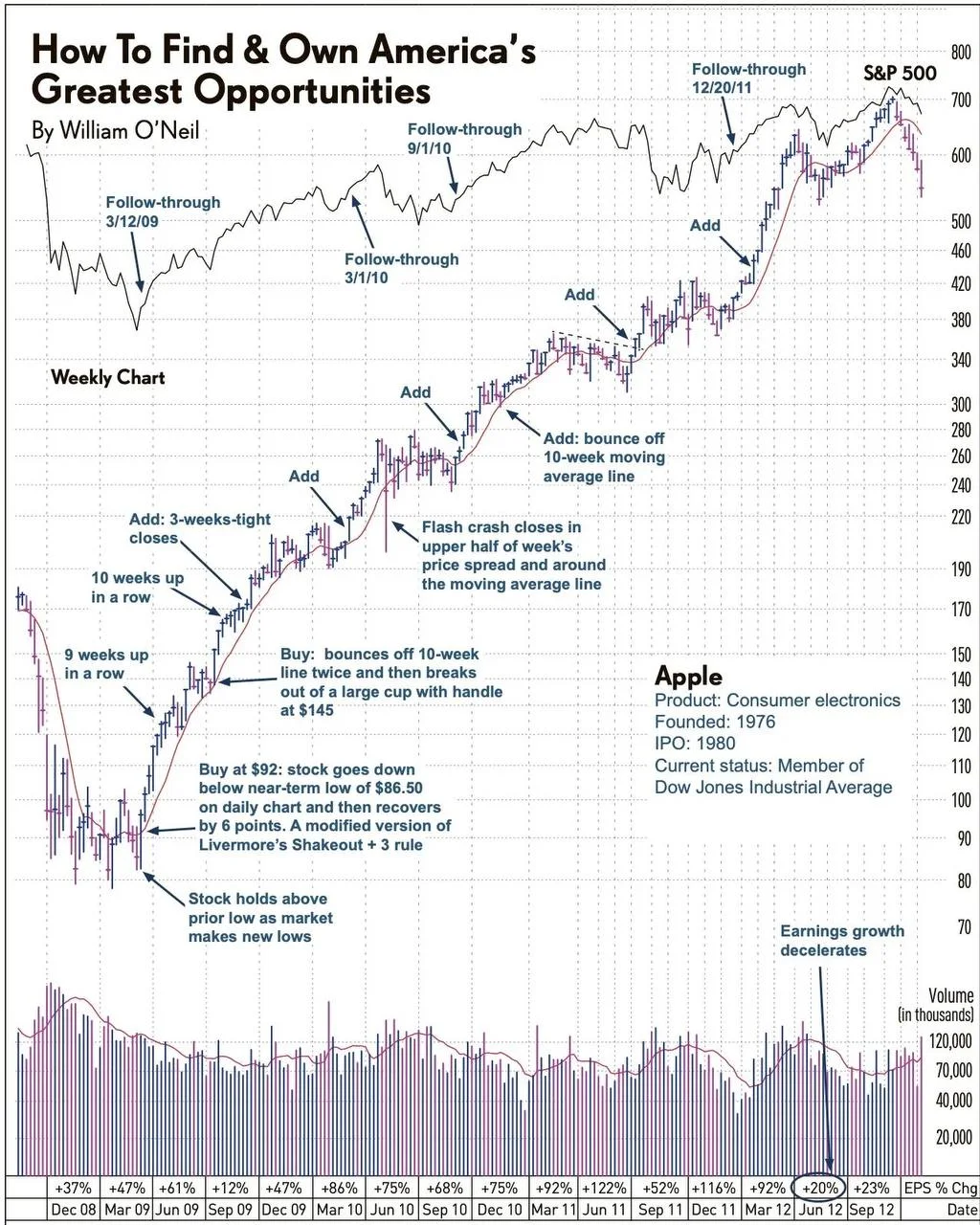

A single weekly Apple chart reveals how multi-bagger returns are built through trend-following, position management, and disciplined accumulation — not prediction.

Most investors believe multi-bagger returns come from a single brilliant decision. In reality, they are the result of a process that looks slow, uncomfortable, and often unconvincing in real time. The market rarely rewards excitement. It rewards consistency.

Apple’s early bull-market structure illustrates this better than almost any textbook example. Long before enthusiasm took hold, the stock was already advancing through a disciplined pattern of accumulation, shallow pullbacks, and steady institutional demand.

Markets Turn Before Belief Arrives

The broader market had already shifted into a new bullish regime. Yet sentiment remained fragile. Follow-through days tend to emerge amid doubt, negative headlines, and residual fear — not euphoria. Historically, these are precisely the conditions under which long-term leaders begin to separate from the pack.

Apple’s Advance Was Anything but Dramatic

Rather than a single explosive move, Apple advanced through a sequence of methodical, often unexciting steps:

- Repeated pullbacks toward the 10-week moving average

- Tight weekly closes signalling institutional support

- Controlled additions to position size

- A notable absence of panic-driven sell-offs

This is not speculative trading. It is systematic exposure building — quietly executed while most participants hesitate.

The Best Entries Rarely Look Attractive

Several annotations on the chart highlight psychologically uncomfortable moments:

- Rebounds from the 10-week moving average

- Shakeouts that remove weak holders before recovery

- Relative strength as the broader market retests lows

These are not visually “perfect” setups. They are effective ones. The market consistently rewards discipline over aesthetics.

Growth Compounds Through Process, Not Precision

At the bottom of the chart, sequential performance figures tell the real story: +37%, +61%, +86%, +122%. These gains were not achieved by calling a bottom, but by holding, adding, and letting time work.

Multi-bagger outcomes are rarely the result of a single brilliant decision. They are the product of sustained alignment with a dominant trend.

The Exit Signal Comes Last — Not First

Only near the end of the cycle does a critical warning appear: earnings growth begins to decelerate. This is typically where late entrants arrive — just as professionals start to reduce exposure.

The irony is consistent across cycles. Most investors feel safest when risk is highest.

Big money is not made through prediction. It is made through trend adherence, position management, and the ability to act rationally while emotions dominate the crowd.

Chart Reference

Olivia Carter

Olivia Carter