Overbought Signal Appears Across US Stocks After Strong Rally

The NYSE Bullish Percent Index has reached overbought territory, historically followed by short-term market corrections. Investors should prepare for volatility.

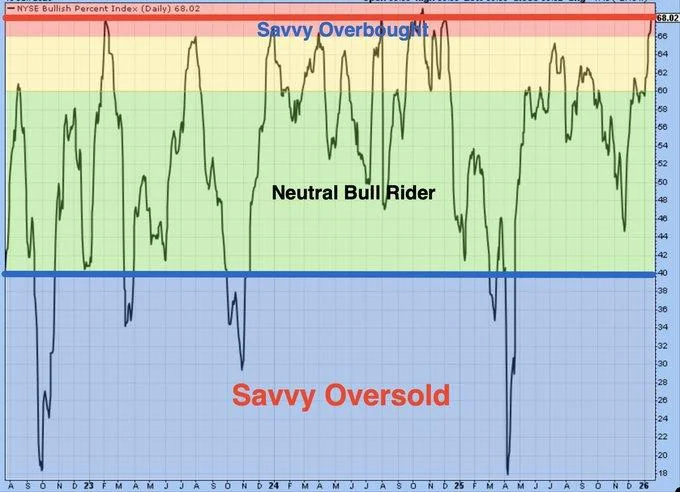

The broad US stock market is showing clear signs of short-term exhaustion. A widely followed market breadth indicator — the NYSE Bullish Percent Index — reached the 70 level this week, triggering an overbought signal under the SAVVY framework.

The importance of this signal is not about calling a market top, but about recognising where short-term risks begin to build. Historically, readings at or above this level have often been followed by pauses or pullbacks within days, as buying momentum temporarily cools.

What the NYSE Bullish Percent Index Is Signaling

The NYSE Bullish Percent Index tracks the share of stocks on the New York Stock Exchange that are currently on point-and-figure buy signals. In practical terms, it shows how broadly bullish the market really is.

When the index approaches the 70 area, optimism tends to become widespread. That’s typically when markets grow more vulnerable — not because fundamentals suddenly weaken, but because positioning becomes crowded.

SAVVY Overbought: A Familiar Pattern

The latest reading places the indicator firmly in the SAVVY Overbought zone. As historical cycles show, similar conditions have frequently preceded short-term corrections rather than full trend reversals.

This does not invalidate the broader bullish trend. Instead, it suggests the market may need time to digest recent gains.

What This Means for Investors

For long-term investors, overbought signals are not automatic sell signals. They do, however, highlight the importance of risk management — especially for short-term or leveraged positions.

- Strong breadth rallies often pause before resuming

- Volatility tends to rise after extended momentum runs

- Pullbacks can create healthier entry points

Once again, investors are recalibrating expectations. The broader trend remains constructive, but markets rarely move in straight lines.

The US market looks stretched. Breadth indicators suggest optimism is elevated, and history argues for caution in the near term. Having a clear plan for potential volatility matters most when sentiment feels comfortable.

Corrections are not failures of bull markets. They are part of them.

Olivia Carter

Olivia Carter