After Maduro Bet Windfall, U.S. Congress Targets Insider Trading on Prediction Markets

A massive Polymarket payout tied to Venezuela’s political turmoil has triggered a new U.S. bill aimed at banning federal officials from trading on prediction markets using nonpublic information.

U.S. lawmakers are moving to restrict government officials from trading on prediction markets after a series of highly profitable bets linked to Venezuela’s political crisis raised fresh concerns about insider trading.

From an editorial perspective, the significance lies in how quickly financial prediction markets have become entangled with real-world geopolitics — and how lightly regulated they remain.

Rep. Ritchie Torres, a New York Democrat, plans to introduce legislation this week titled the Public Integrity in Financial Prediction Markets Act of 2026. The bill would prohibit federal elected officials, political appointees, and Executive Branch employees from trading on prediction markets when they possess nonpublic information, or could reasonably obtain such information through their official duties.

Venezuela Bet Triggers Scrutiny

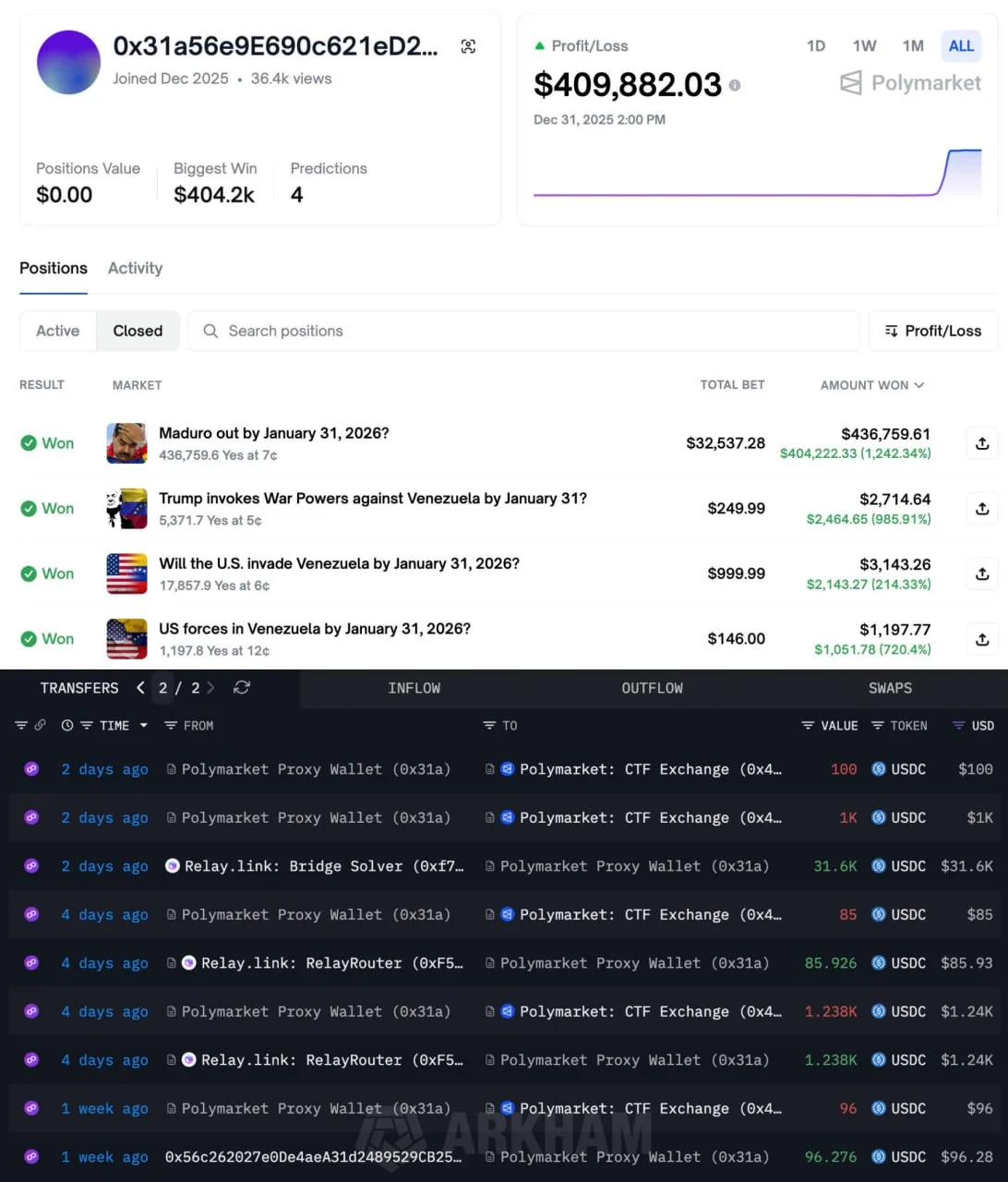

The legislative push follows a striking episode on Polymarket, a crypto-based prediction market platform. In late December, a newly created wallet wagered roughly $30,000 that Venezuelan President Nicolás Maduro would be out of office by January 31, 2026.

Within days, after Maduro’s reported capture, the position paid out more than $436,000, generating a return exceeding 1,200%.

On-chain data and platform records indicate that at least three wallets placed large bets tied exclusively to Venezuela-related political outcomes just hours before the event. According to blockchain analysts, these wallets were created and funded only days earlier and showed no history of unrelated trading activity.

- Wallet 0x31a5: Invested ~$34,000 → Earned ~$409,900

- Wallet 0xa72D: Invested ~$5,800 → Earned ~$75,000

- SBet365: Invested ~$25,000 → Earned ~$145,600

In total, the three wallets generated approximately $630,000 in profits.

Regulatory Gap Between Platforms

Polymarket currently does not maintain explicit prohibitions against insider trading. Its CEO, Shayne Coplan, has previously argued that insider participation can serve a public function by incentivising information discovery.

“What’s cool about Polymarket is that it creates a financial incentive for people to go and divulge the information to the market.”

By contrast, rival platform Kalshi enforces strict rules barring insider trading. The company prohibits government officials and decision-makers from trading on markets tied to events they influence or oversee.

“Kalshi explicitly prohibits insider trading of any form, including government employees trading on prediction markets related to government activity,” a company spokesperson said.

What the Proposed Bill Would Change

If enacted, the Public Integrity in Financial Prediction Markets Act would formally extend insider-trading restrictions into the rapidly growing prediction market space — an area that currently operates in a regulatory grey zone.

While the bill does not target prediction markets themselves, it seeks to draw a clear boundary between public office and speculative financial activity, particularly when geopolitical events and national security issues are involved.

As prediction markets continue to intersect with politics, intelligence, and policy outcomes, Washington’s response may signal whether these platforms will remain lightly regulated — or face rules closer to traditional financial markets.

Olivia Carter

Olivia Carter