How Geopolitics Reshaped Gold’s Role in the Global System

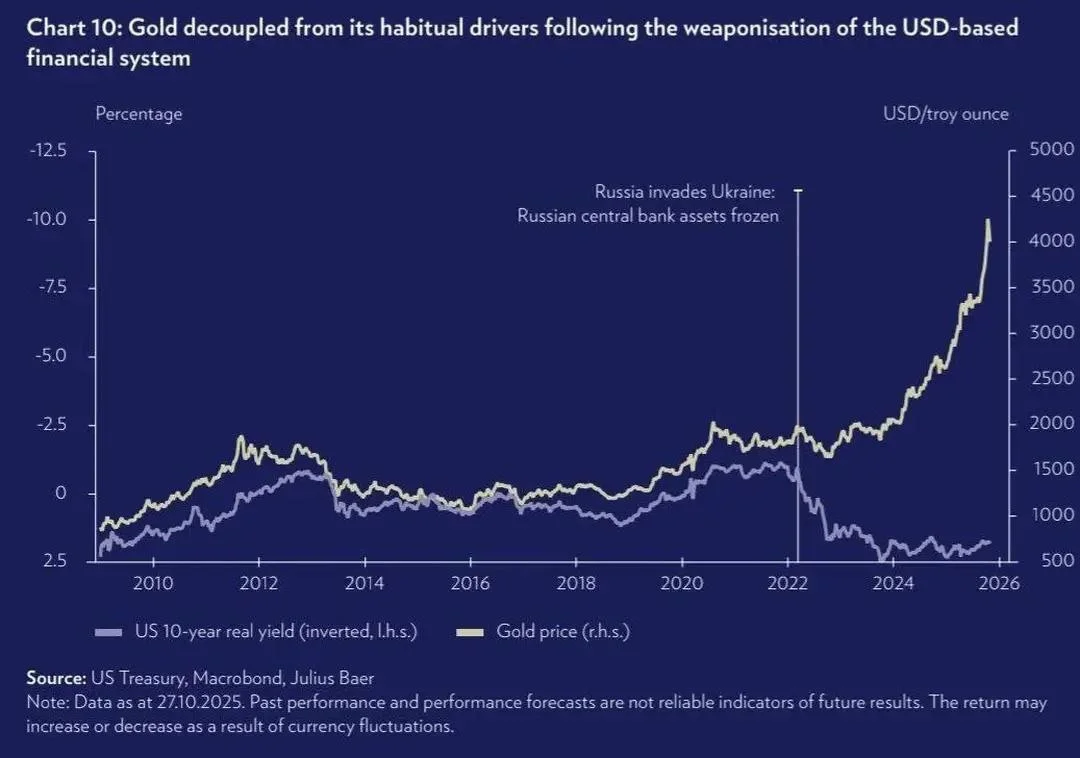

Gold’s parabolic rally began shortly after the Ukraine war, marking a structural break as the metal decoupled from real yields amid rising geopolitical fragmentation.

Gold’s parabolic rally began almost immediately after the start of the Ukraine conflict, raising a fundamental question for investors: was it merely a coincidence, or a signal of a deeper structural shift in the global financial system?

Historically, gold prices have shown a strong inverse relationship with U.S. real yields. Higher real rates typically pressured gold, while falling yields supported it. However, since 2022, this relationship has visibly weakened — and in some periods, effectively broken.

A structural break after 2022

The timing is difficult to ignore. The acceleration in gold prices followed Russia’s invasion of Ukraine and the subsequent freezing of Russian central bank reserves — a move that effectively demonstrated the weaponisation of the USD-based financial system.

Shortly thereafter, The Economist argued that the Ukraine conflict was not merely a regional war, but the opening chapter in a broader struggle over a new global order. Markets appear to have drawn similar conclusions.

Gold as a geopolitical hedge

Since 2022, central banks — particularly in emerging markets — have sharply increased gold purchases. Unlike reserve currencies, gold carries no counterparty risk, cannot be sanctioned, and sits outside the Western financial infrastructure.

This shift helps explain why gold continued to rally even as real yields moved higher — a scenario that would have historically capped or reversed gains.

More than a safe haven

The metal is no longer reacting solely to inflation expectations or interest-rate dynamics. Instead, it increasingly reflects concerns about financial fragmentation, reserve diversification and long-term trust in the global monetary architecture (as historical cycles often show).

If this decoupling persists, gold may remain structurally bid — not as a short-term hedge, but as a strategic asset in a multipolar world.

Olivia Carter

Olivia Carter