Ray Dalio Says Investors Should Hold More Gold Right Now

Ray Dalio says today resembles the early 1970s and advises investors to allocate up to 15% of their portfolios to gold as the metal hits a record high above $4,000.

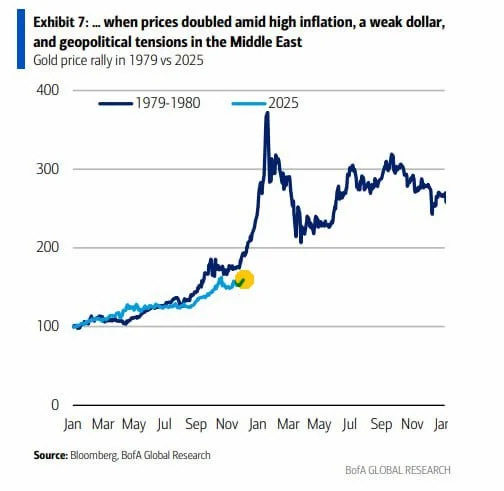

Gold surged above $4,000 an ounce on Tuesday, and Bridgewater Associates founder Ray Dalio says the current environment mirrors the early 1970s — a period when inflation, debt and government spending undermined confidence in traditional assets.

Speaking at the Greenwich Economic Forum, Dalio argued that investors should hold as much as 15% of their portfolios in gold, calling the metal one of the few reliable hedges when equities and bonds come under pressure.

“Gold is a very excellent diversifier in the portfolio,” he said, noting that a strategic allocation model would naturally lead investors toward a higher weighting in precious metals. Gold futures last traded at $4,005.80 per ounce, up more than 50% this year amid rising geopolitical strains and concerns over widening fiscal deficits.

“Very much like the early ’70s”

Dalio drew a direct parallel between today’s macro backdrop and the early 1970s, when soaring government spending, inflation and growing debt burdens weakened trust in fiat currencies and debt markets.

“It's very much like the early ’70s... where do you put your money in? When there’s such a supply of debt, it's not an effective storehold of wealth.”

He warned that when investors rely on debt instruments in periods of heavy monetary expansion, the store-of-value function breaks down. According to Dalio, gold’s unique advantage is that it carries no counterparty risk.

“Gold is the only asset that somebody can hold and you don’t have to depend on somebody else to pay you money for.”

Growing support from other market veterans

Dalio’s recommendation contrasts with conventional financial-planning models, such as the traditional 60/40 stock-bond split, where gold typically makes up only a low single-digit portion of a portfolio. But he is not alone in adopting a more aggressive stance.

DoubleLine Capital CEO Jeffrey Gundlach recently suggested that investors could justify a gold allocation as high as 25%, citing persistent inflationary pressures and expectations of a weaker U.S. dollar.

The surge in demand reflects growing unease over monetary policy, fiscal imbalances and geopolitical uncertainty — conditions that historically strengthened interest in hard assets.

Daniel Brooks

Daniel Brooks