Central Banks Now Hold More Gold Than U.S. Treasuries

Central banks now hold more gold than U.S. Treasuries, a structural shift in reserve allocation that helps explain gold’s sustained price strength.

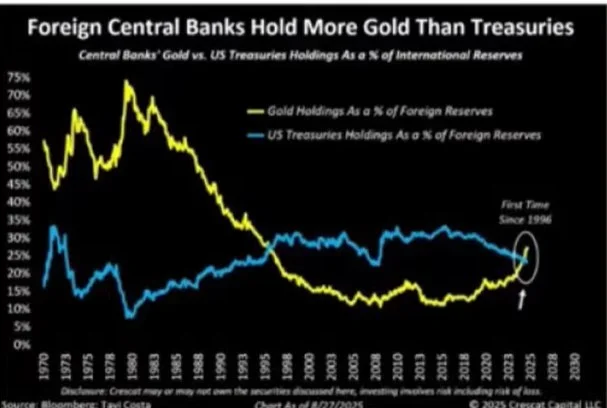

Central banks now hold more gold than U.S. Treasuries as a share of their international reserves, marking a historic turning point in global reserve allocation and offering a clear explanation for gold’s persistent price strength.

The shift reflects a long-term change in how monetary authorities manage risk, diversify reserves, and respond to geopolitical uncertainty.

A structural change, not a short-term trade

The data show that gold’s share in central bank reserves has risen steadily, while holdings of U.S. Treasuries have declined in relative terms. This is the first time since the mid-1990s that gold has overtaken Treasuries in this comparison.

Unlike speculative flows, central bank reserve decisions tend to be slow, conservative, and strategically driven. When these institutions shift allocation, it typically reflects long-term considerations rather than cyclical market timing.

Why central banks are favouring gold

Several factors are driving the renewed preference for gold:

- Rising geopolitical and sanction-related risks

- The desire to reduce dependence on any single sovereign issuer

- Gold’s role as a neutral, non-liability reserve asset

- Concerns around long-term fiscal sustainability and debt issuance

Gold offers reserve managers an asset with no counterparty risk, no default risk, and global liquidity — attributes that have become increasingly valuable in a fragmented financial landscape.

What this means for gold prices

The continued accumulation of gold by central banks provides a structural demand base that helps explain why gold prices remain resilient even during periods of higher real yields or temporary risk-on sentiment.

From a market perspective, this flow acts as a stabilising force. It limits downside pressure and reinforces the prevailing long-term uptrend.

Technical backdrop

From a technical standpoint, gold continues to trade near historical highs, supported by strong momentum and persistent demand on pullbacks.

As long as central bank buying remains intact, betting aggressively against gold becomes increasingly difficult from a risk-reward perspective.

Bottom line

The message from reserve managers is clear: gold is no longer just a hedge — it is a core strategic asset.

When the most conservative and patient participants in the financial system continue to increase exposure, the broader market tends to take notice.

Daniel Brooks

Daniel Brooks