Central Banks Step Up Strategic Gold Accumulation Amid Macro Uncertainty

Central banks bought 53t of gold in October, led by Poland and Brazil, keeping 2025 demand strong despite higher prices and slowing momentum.

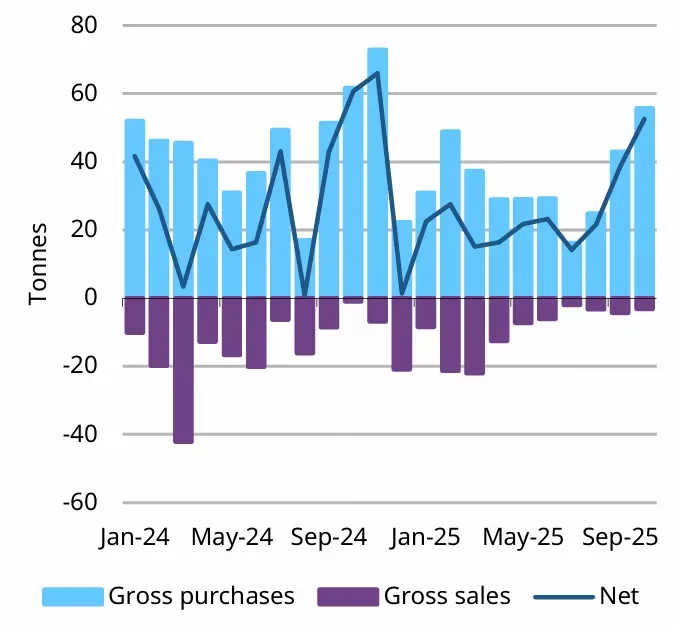

From an editorial perspective, the significance lies in the persistence of official-sector gold demand at a time when macroeconomic uncertainty remains elevated. Central banks added a net 53 tonnes of gold in October — a 36% month-on-month jump and the largest monthly increase recorded so far in 2025.

Central bank buying has consistently exceeded expectations throughout the year, and October was no exception. According to data from the IMF, respective central banks, and the World Gold Council, reported purchases climbed sharply, driven by a familiar group of emerging-market institutions. The National Bank of Poland, which had paused accumulation since May, re-emerged as a major buyer during the month.

October Sees Strongest Monthly Demand YTD

The net total of 53 tonnes purchased in October underscores the resilience of official-sector appetite for gold, even as prices hover near multi-year highs. Buying remained notably concentrated, with Poland and Brazil accounting for the majority of additions.

Chart 1: Central bank gold buying has picked up pace in recent months

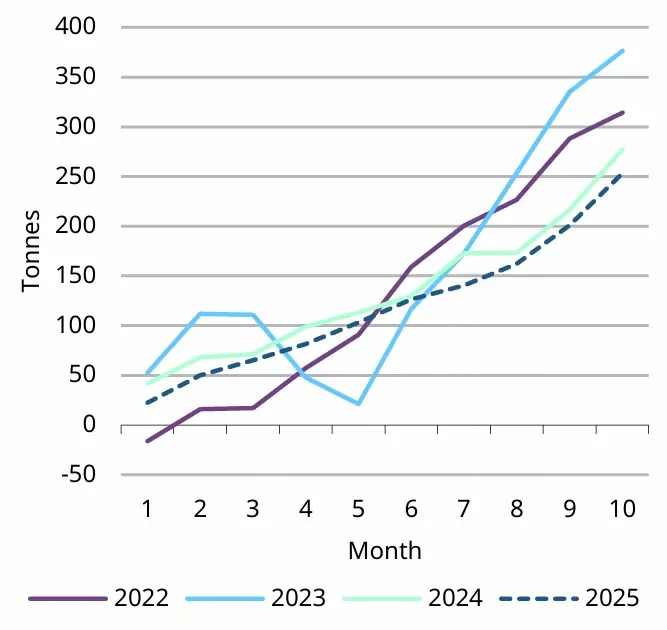

Year-to-date purchases reached 254 tonnes through October — still firmly positive, albeit at a slower pace than the previous three years. As historical cycles often show, elevated prices tend to moderate buying, but the sustained activity from emerging-market central banks suggests that these motivations are strategic rather than opportunistic.

Chart 2: Y-t-d reported buying trails the previous three years

Poland and Brazil Lead October Buying

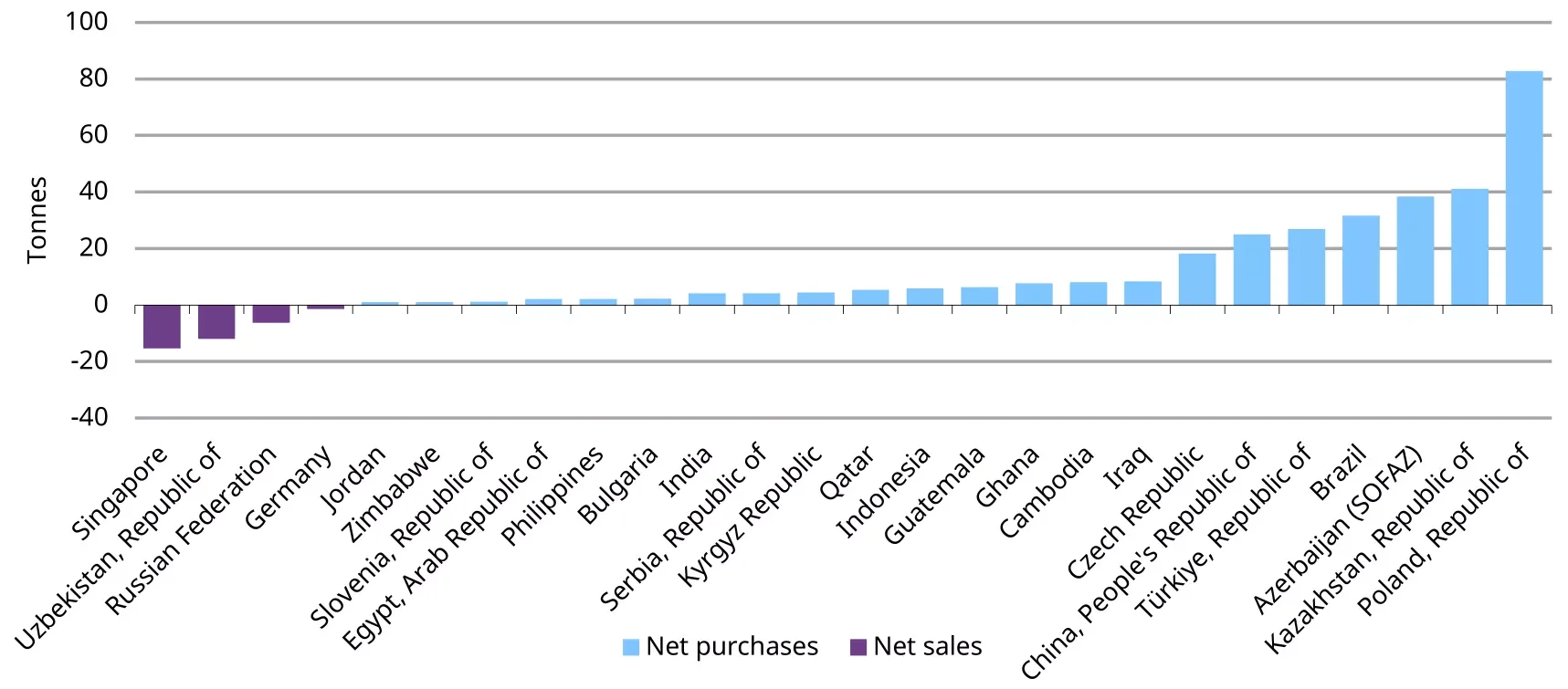

The National Bank of Poland purchased 16 tonnes, lifting reserves to 531 tonnes — now accounting for 26% of total assets at October prices. This follows the bank’s recent move to raise its target allocation to 30%, reflecting a structural shift in its reserve strategy.

Brazil also remained active, adding another 16 tonnes after a 15-tonne purchase in September. Gold now represents around 6% of its total reserves.

Additional buyers in October included:

- Central Bank of Uzbekistan — 9t

- Bank Indonesia — 4t

- Central Bank of Turkey — 3t

- Czech National Bank — 2t

- National Bank of the Kyrgyz Republic — 2t

- Bank of Ghana — >1t

- People’s Bank of China — >1t

- National Bank of Kazakhstan — >1t

- Central Bank of the Philippines — >1t

The Central Bank of Russia was the only reported seller, reducing its holdings by 3 tonnes to 2,327 tonnes.

Poland Extends Its Lead in YTD Purchases

Poland remains the largest buyer in 2025 with 83 tonnes added through October — twice the volume accumulated by Kazakhstan (41t), the next largest buyer. The breadth of the buyer list continues to highlight the structural nature of this trend.

Chart 3: The National Bank of Poland extends y-t-d buying in October

More Central Banks Signal Long-Term Accumulation

Beyond October’s immediate activity, several central banks are laying out longer-term gold strategies. Serbia plans to nearly double its holdings to 100 tonnes by 2030, according to President Aleksandar Vučić — a move that underscores gold’s role as a stabilizing asset within reserve portfolios.

At the LBMA conference in Kyoto, officials from Madagascar and South Korea also expressed intentions to grow their reserves, although without specifying timelines.

These developments reinforce findings from the World Gold Council’s 2025 survey, in which 95% of central bankers expected global gold reserves to increase over the next 12 months — a clear signal of the metal’s rising strategic importance amid persistent geopolitical and economic uncertainty.

Olivia Carter

Olivia Carter