New XRP ETF TOXR Is Ready to Trade After Cboe Approval

Cboe BZX Exchange has approved the 21Shares XRP ETF for listing, clearing the final regulatory hurdle before launch and adding momentum to fast-growing institutional inflows into XRP products.

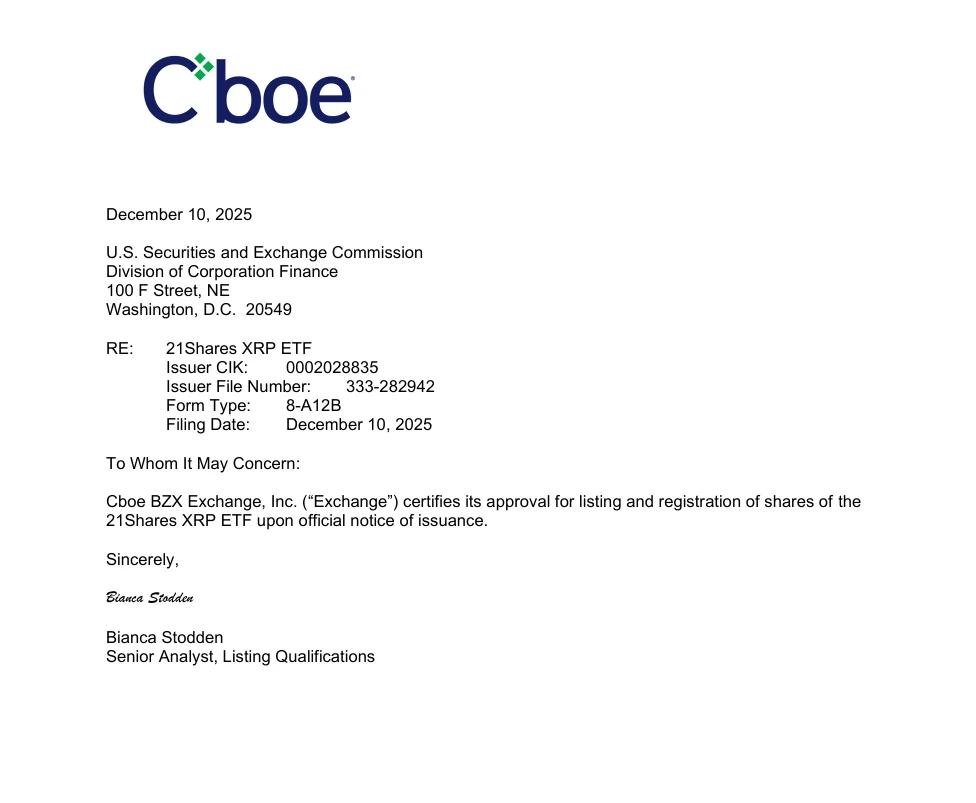

Cboe BZX Exchange has approved the listing of the 21Shares XRP ETF, according to a new filing submitted to the U.S. Securities and Exchange Commission (SEC). With this approval, the spot XRP product is now cleared for immediate launch, pending only the official notice of issuance.

The exchange confirmed it has signed off on both the listing and registration of the fund, marking another major step forward for regulated XRP investment products in the United States.

ETF to Track CME CF XRP-Dollar Benchmark

According to the fund’s prospectus, the 21Shares XRP ETF will track the CME CF XRP-Dollar Reference Rate – New York Variant, providing investors with direct exposure to XRP, currently the fourth-largest cryptocurrency by market capitalization.

The ETF will trade on Cboe BZX under the ticker TOXR and impose an annual sponsor fee of 0.30%, calculated daily and paid weekly in XRP. The document notes the fee range remains competitive at 0.25%–0.40%.

The fund’s design focuses on transparency and accurate valuation by closely tracking the CME CF benchmark widely used in institutional markets.

Institutional-Grade Custody

Multiple custodians will secure the ETF’s underlying XRP holdings, including Coinbase Custody Trust Company, Anchorage Digital Bank and BitGo Trust. This multi-custodian structure aims to deliver institutional-grade security and reduce single-point risk.

Institutional Demand Surges Across XRP ETFs

The 21Shares XRP ETF joins a growing lineup of U.S. spot XRP products offered by issuers such as Canary Capital, Bitwise, Franklin Templeton and Grayscale. The rollout of these ETFs has dramatically reshaped XRP’s investment landscape.

Collectively, U.S. XRP ETFs have already recorded more than $666 million in net inflows shortly after launch, while total assets under management exceeded $1.2 billion by early December 2025. Analysts attribute these flows to rising institutional confidence and improving regulatory clarity in the U.S.

The approval of the 21Shares product is expected to add further momentum, reinforcing XRP’s position in the regulated digital asset ecosystem.

Regulated Expansion of the XRP Market

The introduction of multiple spot ETFs signals deepening institutional appetite for XRP. The exchange-traded structure provides investors a transparent, compliant and accessible path to exposure — a shift that market participants say strengthens XRP’s status within the broader digital asset market.

Cboe’s final approval effectively opens the door for a new wave of capital allocation into XRP, establishing yet another highly visible entry point for both retail and institutional investors.

Ethan Moore

Ethan Moore