Coinbase: Bitcoin’s “old cycle” playbook is breaking as institutions take the wheel

Coinbase Institutional says Bitcoin’s historical cycle signals are becoming less reliable as ETFs, corporate treasuries, and institutional strategies play a larger role in market dynamics.

Bitcoin’s market cycles may be entering a new regime. In its Crypto Market Outlook 2026, Coinbase Institutional argues that traditional frameworks used to explain BTC’s performance are becoming less relevant, as the market’s demand drivers and participant mix have changed materially.

Why Coinbase says the “old” Bitcoin cycle model matters less

Coinbase points to a confluence of factors that have reshaped Bitcoin’s market structure — from who is buying, to how positions are expressed, to how risk is managed. Historically, analysts leaned heavily on early-adopter cycles, retail sentiment, and miner-driven selling as dominant forces. Coinbase says those forces no longer explain the market as cleanly as they once did.

ETF flows and institutional adoption are now central

One of the biggest shifts highlighted in the report is the growing role of institutional participation — including asset managers, hedge funds, and other professional allocators — alongside wider access through regulated vehicles such as spot Bitcoin ETFs. Coinbase notes that these “larger players” can influence sentiment and price action in ways that may dwarf legacy drivers like miner selling.

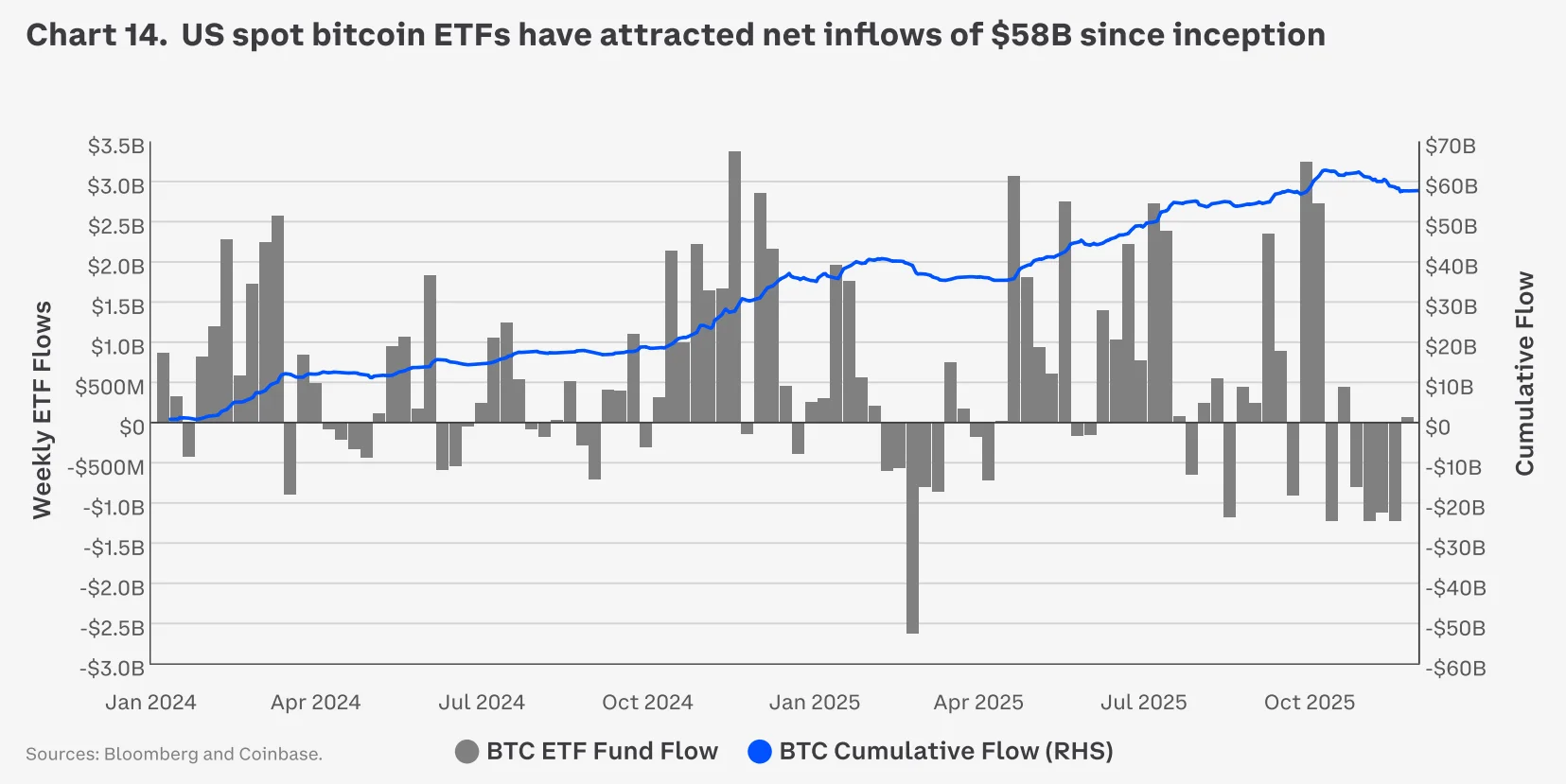

The report also highlights the scale of ETF participation, referencing cumulative net inflows of $58 billion into U.S. spot Bitcoin ETFs since inception.

Corporate treasuries add a different kind of demand

Coinbase also flags the growing presence of publicly traded companies and “digital asset treasuries” adding bitcoin to balance sheets, creating a buyer class that tends to operate with longer horizons than typical retail flow. In practice, that can shift the market toward more sustained positioning rather than purely short-term speculation.

What this could mean for investors in 2026

- Signals may shift: classic “cycle” indicators could become less predictive as the buyer base changes.

- Volatility may evolve: professional portfolio construction (hedging, diversification, risk limits) can dampen or reshape price swings — though it won’t eliminate them.

- More macro sensitivity: as institutional ownership rises, BTC may trade more like a macro-linked asset in certain regimes (risk-on/risk-off), depending on positioning.

Quick snapshot

| Theme | Coinbase’s core point |

|---|---|

| Market structure | Bitcoin is increasingly shaped by institutional participation rather than legacy retail/miner-only dynamics. |

| ETFs | Regulated access channels deepen the buyer pool and alter flow behavior. |

| Time horizon | Institutional commitments can be larger and more sustained versus short-term speculative churn. |

Source: Coinbase Institutional, Crypto Market Outlook 2026.

Ethan Moore

Ethan Moore