Coinbase Outlook 2026: Why Ethereum and Solana Are Diverging

Coinbase Institutional says Ethereum and Solana are attracting capital in fundamentally different ways, reflecting a growing structural divide inside the crypto market.

Ethereum and Solana may share the same market cycle, but they are being driven by very different forces. In its Crypto Market Outlook 2026, Coinbase Institutional highlights a widening structural gap between the two ecosystems — one shaped by institutional balance-sheet demand, the other by consumer-led activity.

Ethereum: balance-sheet driven demand

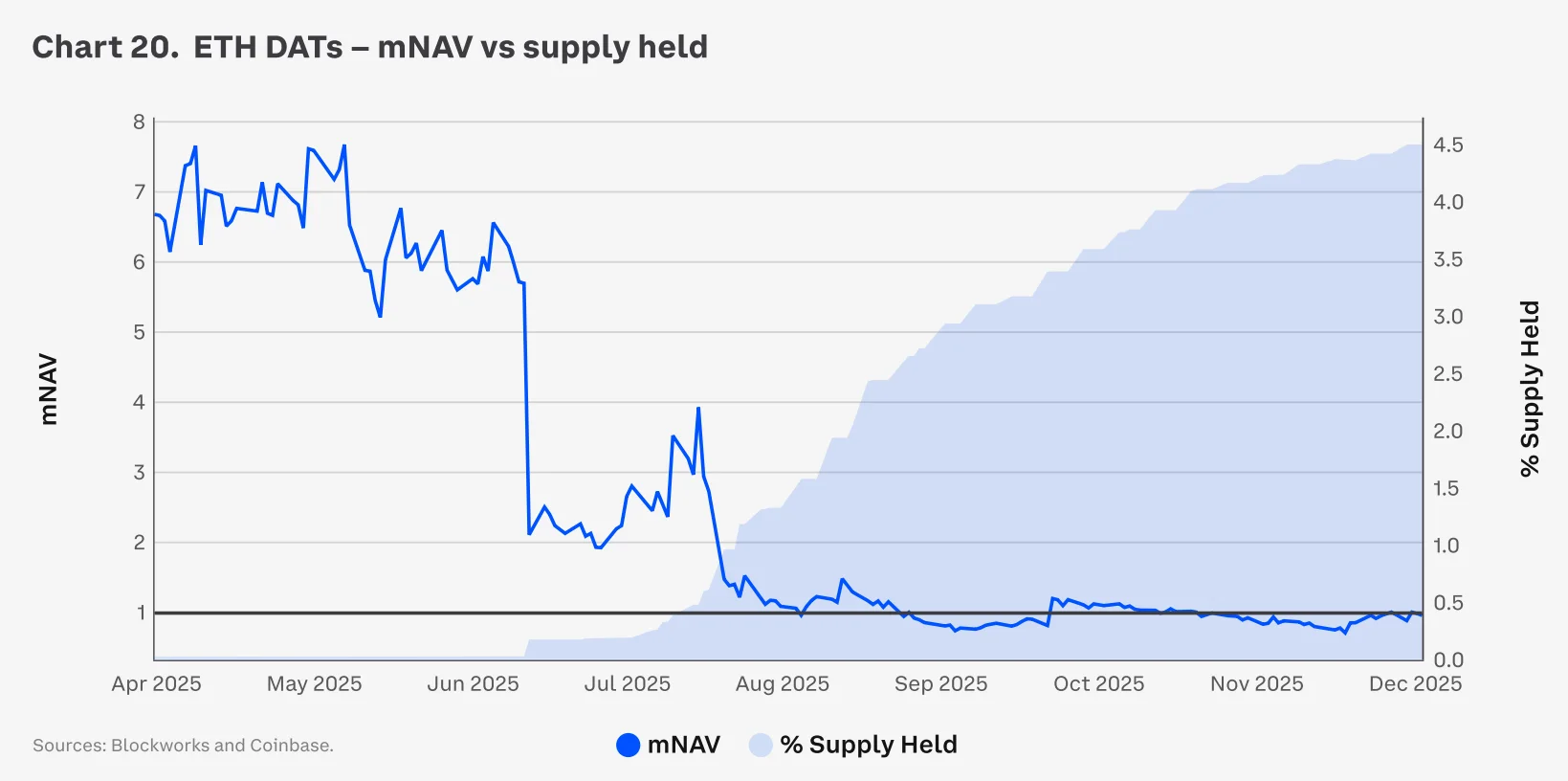

According to Coinbase, one of the most important demand drivers for Ethereum in 2025 was the rise of Digital Asset Treasuries (DATs). These entities accumulated ETH aggressively, ultimately holding more than 4% of circulating supply by year-end.

This balance-sheet-style demand created a persistent bid for ETH, even as broader market liquidity tightened. However, as price momentum cooled, market valuations adjusted. Coinbase notes that DAT market premiums compressed sharply, signalling a shift from speculative enthusiasm toward more disciplined capital allocation.

A maturing ETH market structure

The compression in ETH DAT mNAV (market cap divided by the value of crypto assets held) reflects a broader trend: Ethereum’s market structure is becoming more institutional and valuation-aware.

Rather than chasing momentum, capital flowing into ETH increasingly resembles traditional asset allocation — slower, more deliberate, and tied to longer-term strategic exposure.

Solana: consumer apps still dominate

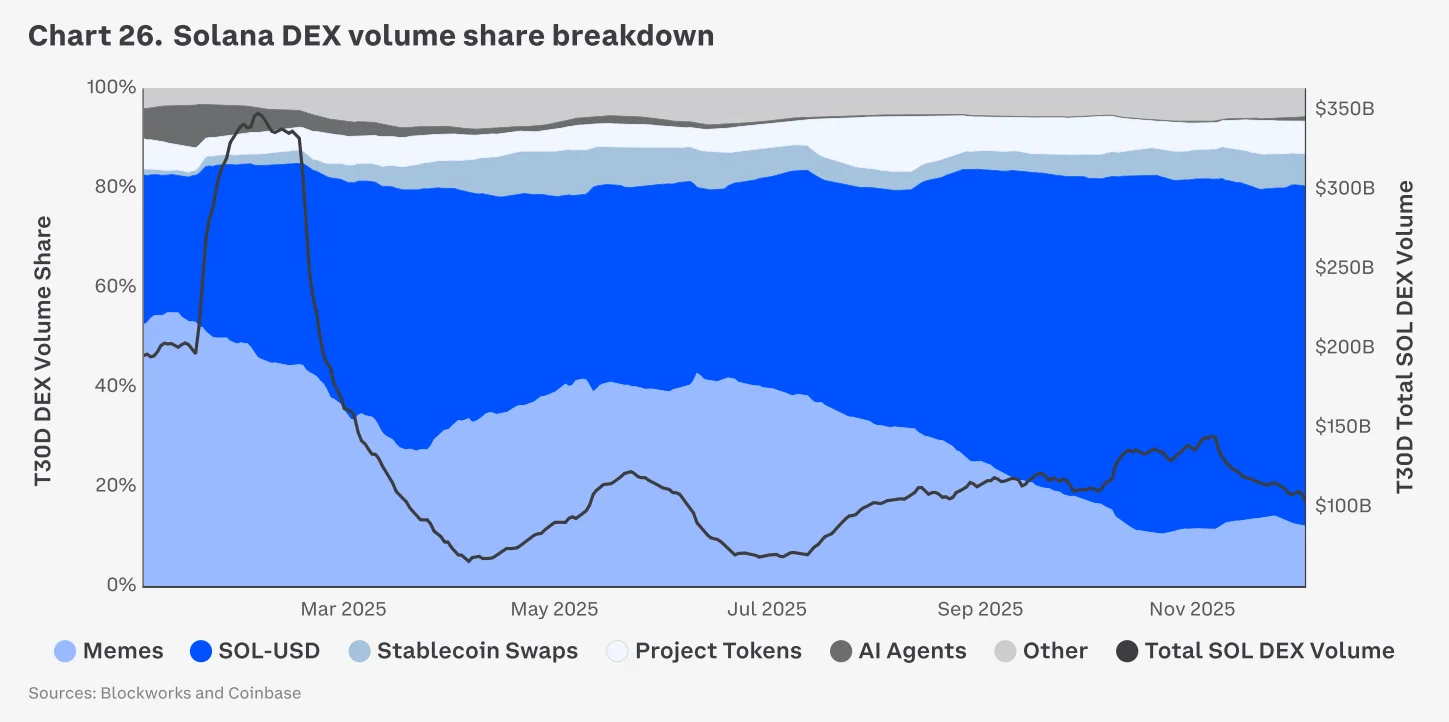

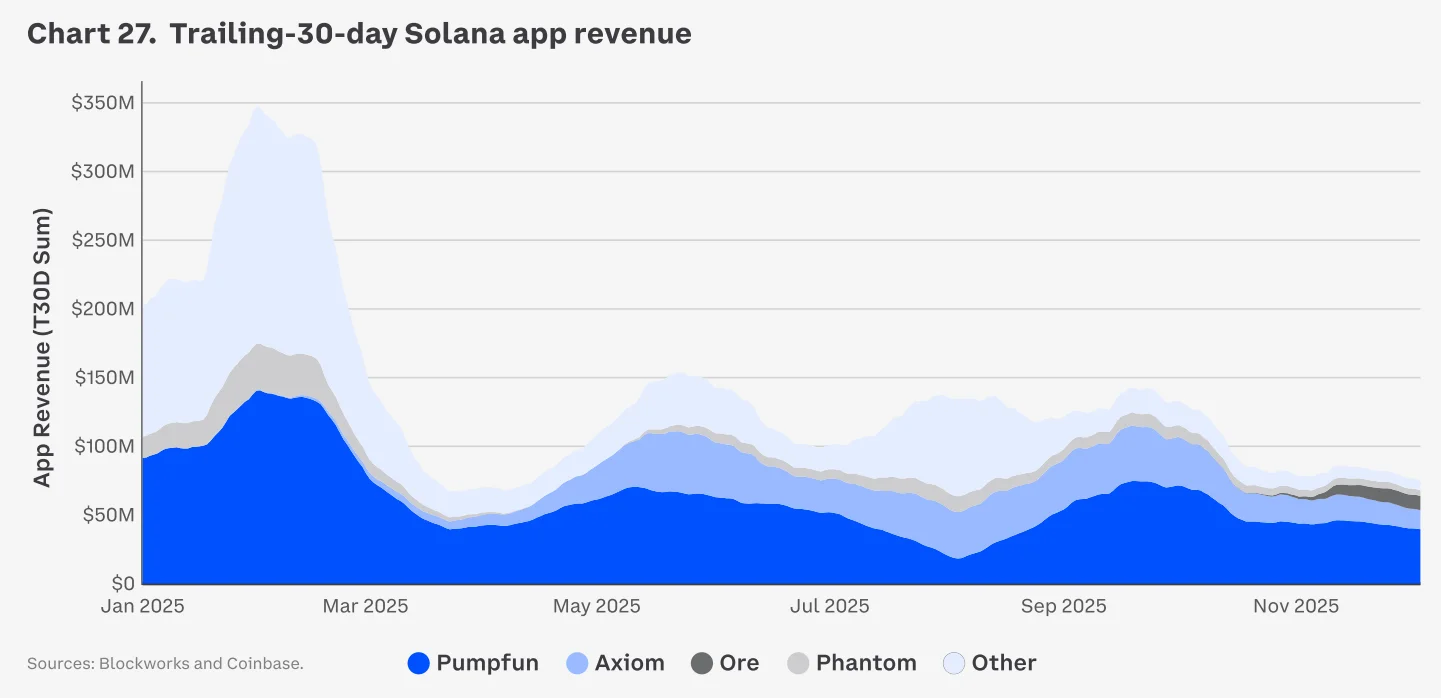

Solana, by contrast, remains heavily driven by consumer-facing applications. Coinbase points out that app-level revenue on Solana surged during the early-2025 memecoin cycle, with platforms such as PumpFun and Phantom generating hundreds of millions of dollars in monthly revenue at the peak.

As speculative activity faded, aggregate app revenue fell sharply, highlighting Solana’s continued sensitivity to narrative-driven demand.

ETFs change the equation — but not the model

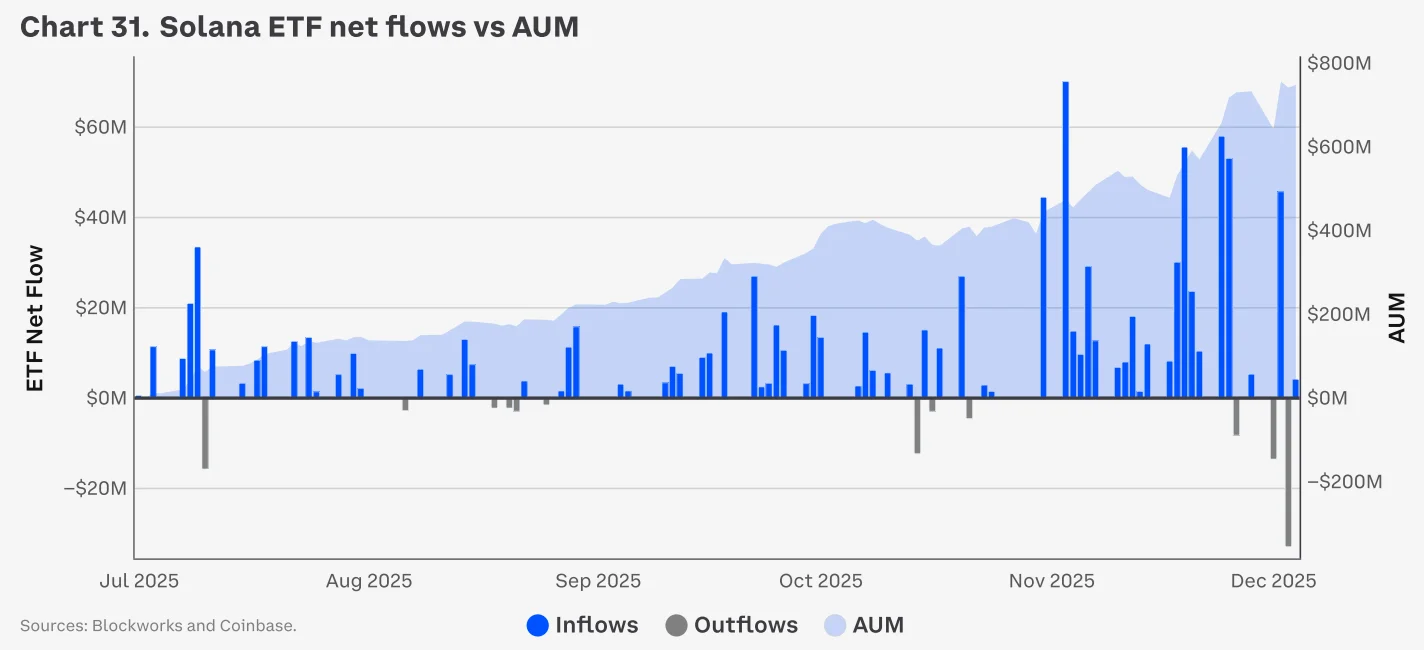

Coinbase also highlights the launch of spot U.S. Solana ETFs in the second half of 2025, which opened a new conduit for capital inflows. Assets under management and cumulative net flows rose into year-end as lower-fee vehicles entered the market.

However, despite ETF participation, Coinbase cautions that Solana’s revenue base remains concentrated. A large share of economic activity still depends on a narrow set of consumer applications, leaving the ecosystem exposed to rapid shifts in sentiment.

What this divergence means for 2026

- Ethereum: increasingly institutional, balance-sheet oriented, and valuation-sensitive.

- Solana: fast-moving, consumer-driven, and more exposed to narrative cycles.

- Market takeaway: capital flows may respond very differently to macro shocks across the two ecosystems.

Key takeaways

| Network | Primary demand driver | Structural risk |

|---|---|---|

| Ethereum | Institutional treasuries and long-term allocation | Slower upside, tighter valuation discipline |

| Solana | Consumer apps and speculative cycles | Revenue concentration and sentiment sensitivity |

Source: Coinbase Institutional, Crypto Market Outlook 2026.

Ethan Moore

Ethan Moore