Ethereum Supply on Exchanges Collapses to Pre-ICO Levels

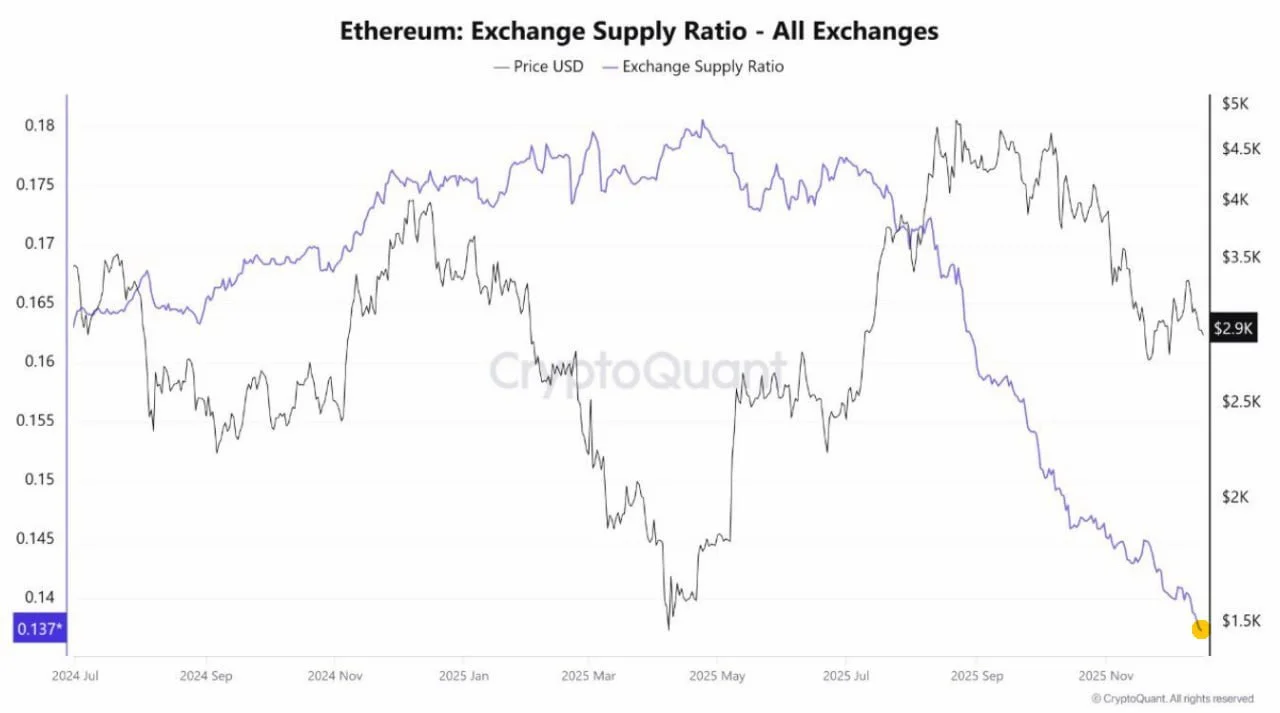

Ethereum’s exchange supply has dropped to its lowest level since 2016, according to CryptoQuant data, highlighting a sharp contraction in liquid ETH available for trading.

Ethereum’s available supply on centralized exchanges has fallen to its lowest level since 2016, according to new on-chain data from CryptoQuant — a milestone that underscores a significant tightening in liquid ETH across the market.

The Exchange Supply Ratio, which measures the proportion of total ETH held on exchanges relative to circulating supply, has now dropped to around 0.137. This level has not been seen since Ethereum’s early years, when network adoption and market structure were still in their infancy.

Historically, sustained declines in exchange supply reflect a shift toward long-term holding behaviour, reduced immediate sell pressure, and growing confidence among holders.

What the Exchange Supply Ratio Signals

From a market structure perspective, declining exchange balances typically indicate that investors are moving ETH into self-custody, staking contracts, or long-term storage rather than keeping assets readily available for sale.

In previous cycles, similar supply contractions preceded periods of heightened volatility — often to the upside — as lower liquid supply amplified price reactions to demand shocks (as historical cycles often show).

Price Action vs On-Chain Dynamics

Notably, the drop in exchange supply has occurred even as Ethereum’s price experienced elevated volatility throughout 2024 and 2025. This divergence suggests that a growing share of ETH holders remain structurally committed, despite macro uncertainty and shifting risk sentiment across digital assets.

From an editorial perspective, the significance lies less in short-term price movements and more in the underlying liquidity profile of Ethereum. With less ETH sitting on exchanges, market depth becomes thinner — increasing the potential impact of large inflows, ETF-related demand, or network-driven catalysts.

Long-Term Implications

While exchange supply alone does not determine price direction, it remains a key on-chain indicator for assessing sell-side pressure. At current levels, Ethereum’s liquid supply profile resembles conditions last seen nearly a decade ago — when the asset was still emerging into global markets.

Whether this supply tightening translates into sustained upside will ultimately depend on broader macro conditions, institutional participation, and network-level developments. Still, the on-chain signal itself is clear: Ethereum is becoming increasingly scarce on exchanges.

Ethan Moore

Ethan Moore