Long-Term Bitcoin Holders Turn Net Buyers for First Time Since July

Bitcoin spot ETFs recorded their first net inflows in a week, while on-chain data shows long-term holders turning net buyers for the first time since July.

Bitcoin market dynamics showed early signs of a potential shift as spot ETF flows turned positive and long-term holders stopped distributing coins, according to fresh institutional and on-chain data.

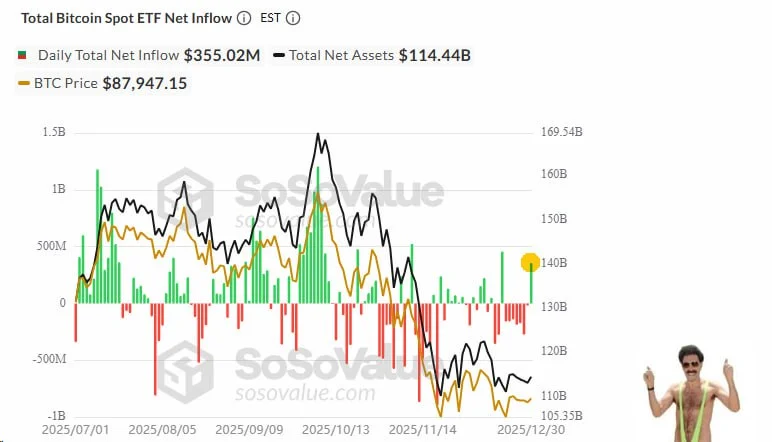

ETF flows turn positive

On December 30, spot Bitcoin ETFs recorded their first net inflow in a week, according to data from SoSoValue. Daily net inflows totaled approximately $355 million, lifting total net assets held by U.S. spot Bitcoin ETFs to around $114.4 billion.

The return of positive flows follows a period of persistent outflows during late December, suggesting a pause in institutional de-risking as Bitcoin prices stabilised near recent highs.

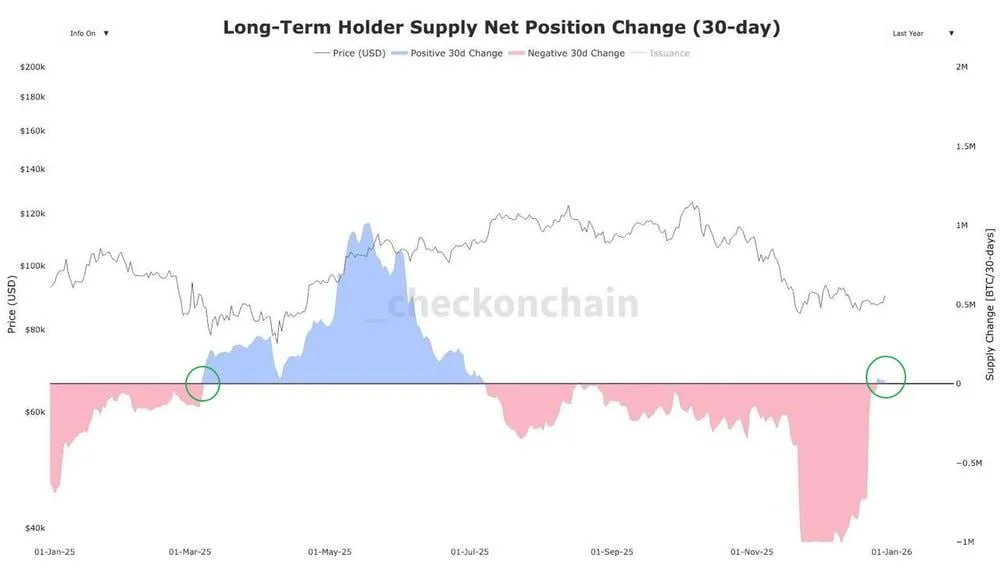

Long-term holders shift to net buying

At the same time, on-chain analytics firm Checkonchain reported a notable development in Bitcoin supply behaviour. For the first time since July, long-term holders (LTHs) have stopped selling Bitcoin and moved back into net accumulation.

The data shows the 30-day net supply change turning positive, historically a signal that distribution pressure from conviction holders is easing.

Why it matters

The combination of renewed ETF inflows and a shift in long-term holder behaviour points to a potential tightening in Bitcoin’s liquid supply. In previous cycles, similar conditions have often coincided with periods of improved price stability or renewed upside momentum—though not as a guarantee.

With Bitcoin trading near $88,000, market participants are closely watching whether institutional demand and on-chain accumulation can offset near-term macro uncertainty and year-end positioning effects.

For now, both data sets suggest that selling pressure is moderating at current levels, setting the stage for a more balanced supply-demand environment as the market moves into the new year.

Ethan Moore

Ethan Moore