Crypto ETF Market Pauses After Months of Volatility

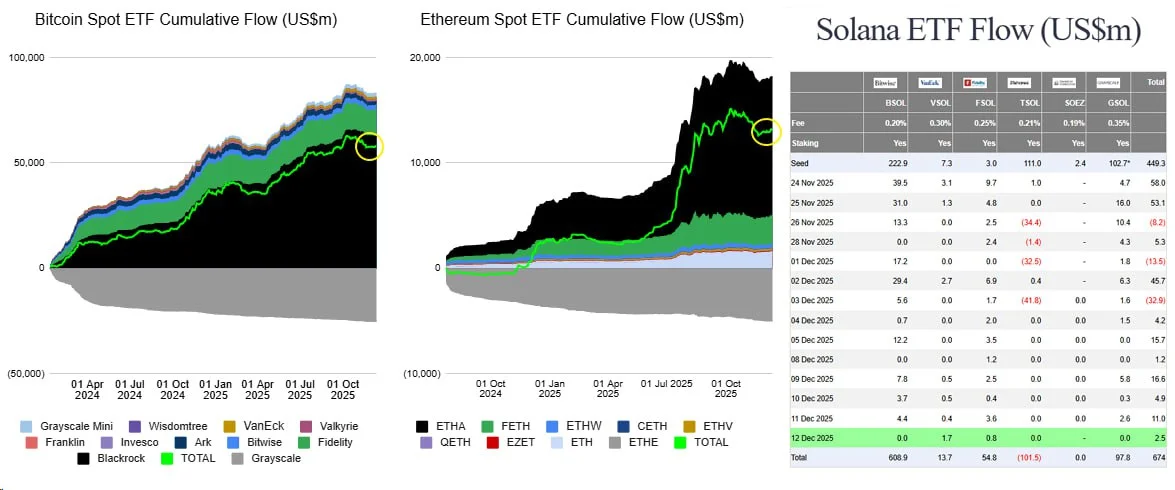

Crypto ETF flows remain subdued, with minor inflows into Ethereum ETFs, flat activity in Bitcoin ETFs, and steady demand for Solana ETFs, according to Farside data.

The crypto ETF market is showing signs of a clear slowdown, with capital flows across major products remaining largely subdued in recent sessions.

According to data from Farside Investors, spot Bitcoin ETFs have seen almost no meaningful change in net flows, while Ethereum ETFs continue to attract only modest daily inflows.

Bitcoin ETF Flows Stabilise

After months of pronounced volatility and large directional moves, Bitcoin ETF activity has entered a consolidation phase. Recent data shows that net inflows and outflows have remained close to neutral, signalling a pause in investor positioning rather than renewed conviction.

This stability contrasts sharply with earlier periods marked by record daily redemptions and aggressive accumulation, suggesting that institutional demand is currently in wait-and-see mode.

Ethereum ETFs See Limited but Positive Demand

Spot Ethereum ETFs have recorded small but consistent inflows, indicating selective demand rather than broad-based accumulation. While volumes remain muted, the absence of sustained outflows suggests investors are maintaining exposure despite weaker overall market momentum.

Analysts note that Ethereum flows have tended to be more stable than Bitcoin’s during recent sessions, reflecting different investor profiles and positioning strategies.

Solana ETFs Show Structural Resilience

Flows into Solana ETFs stand out by comparison. Since the launch of the first spot Solana ETF in November, only three individual days of net outflows have been recorded.

During most trading sessions, Solana ETFs continued to attract inflows — even at times when Bitcoin ETFs experienced significant redemptions. This divergence highlights growing investor interest in alternative layer-1 assets beyond Bitcoin and Ethereum.

ETF Market Enters a Quiet Phase

Overall, the data points to a cooling phase in the crypto ETF market. Capital is neither exiting aggressively nor rotating decisively into risk, suggesting that investors are waiting for clearer macro or market catalysts.

With Bitcoin ETF flows largely unchanged, Ethereum seeing incremental inflows, and Solana maintaining relative strength, the current environment reflects consolidation rather than trend reversal.

Market participants will be watching whether this period of calm precedes renewed inflows or signals a longer phase of reduced ETF-driven momentum.

Ethan Moore

Ethan Moore