Bear Market Signals Emerge for Bitcoin, CryptoQuant Says

CryptoQuant says a Bitcoin bear market has begun as on-chain demand weakens, with downside risk toward $70,000 and potentially $56,000 over time.

From an editorial perspective, the significance lies in how sharply on-chain demand has cooled. According to CryptoQuant, Bitcoin has already entered a bear market phase as demand growth slips below its long-term trend.

In a report released Friday, the firm said three major demand waves since 2023 — driven by the U.S. spot ETF launch, the U.S. presidential election outcome, and the rise of bitcoin treasury companies — have now largely played out. Since early October 2025, incremental demand has fallen below trend, removing a key layer of price support.

Demand Weakens Across Spot and Derivatives Markets

CryptoQuant noted that U.S. spot Bitcoin ETFs turned into net sellers during the fourth quarter of 2025, with holdings declining by roughly 24,000 BTC. This marks a sharp reversal from the same period a year earlier, when ETF inflows were a major driver of demand.

Addresses holding between 100 and 1,000 BTC — a group that includes ETFs and bitcoin treasury firms — are also expanding below trend. CryptoQuant said this mirrors demand deterioration observed toward the end of 2021, ahead of the 2022 bear market.

Derivatives data reinforces the shift. Funding rates in perpetual futures, measured on a 365-day moving average, have fallen to their lowest level since December 2023. Historically, sustained declines in funding rates reflect reduced willingness to maintain long exposure — a pattern more consistent with bear markets than bull phases.

Bitcoin has also slipped below its 365-day moving average, a long-term technical level that has often separated bull and bear regimes in past cycles.

Key Price Levels and Cycle Interpretation

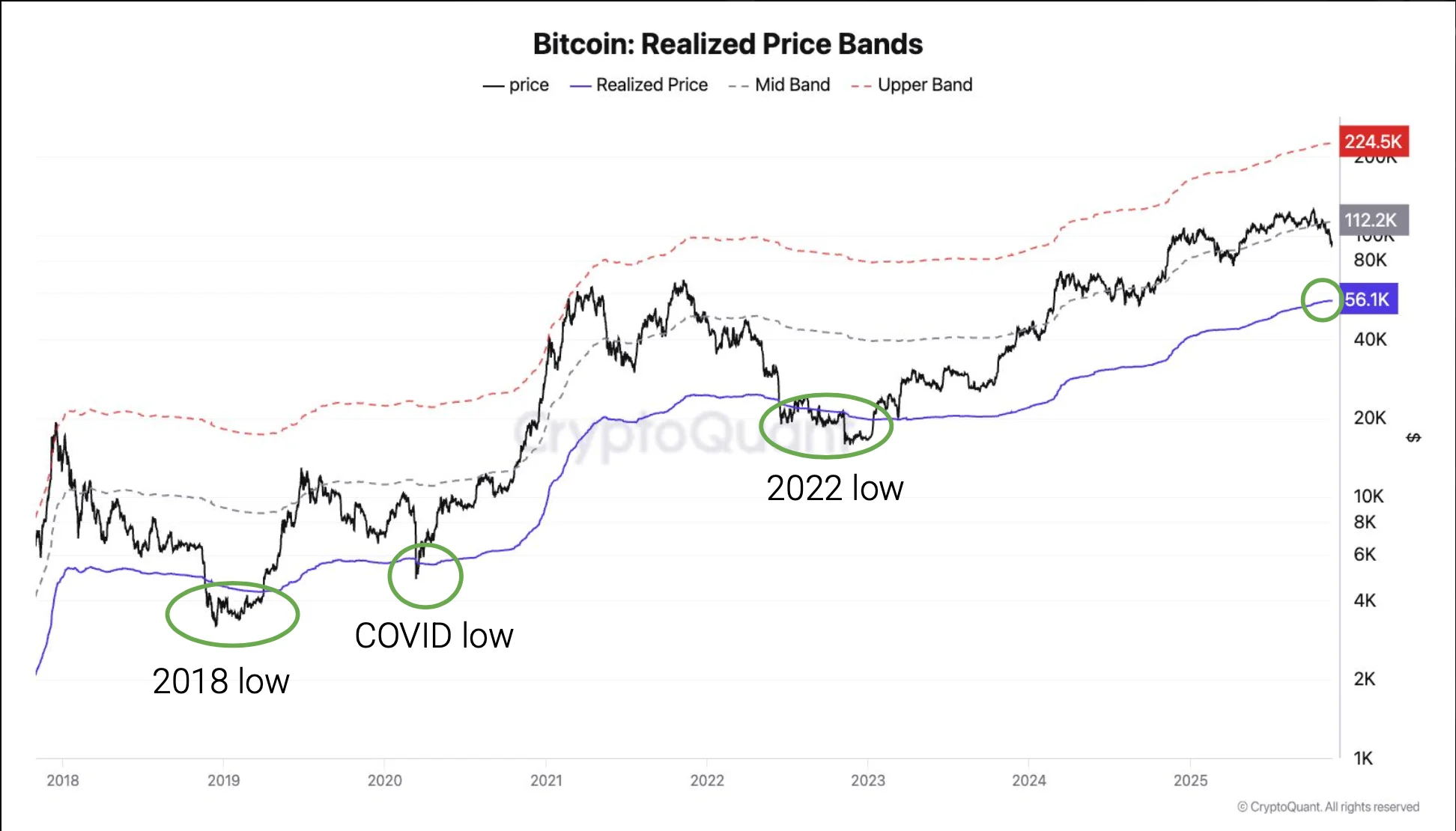

Based on current conditions, CryptoQuant sees initial downside risk toward the $70,000 level, with a deeper move toward the realized price near $56,000 possible if momentum fails to recover. Historically, bitcoin bear market lows have aligned closely with the realized price, implying a drawdown of roughly 55% from the most recent all-time high — potentially the shallowest bear market on record.

CryptoQuant head of research Julio Moreno said a move toward $70,000 could unfold within three to six months, while a decline toward $56,000 would represent a longer-term scenario, potentially extending into the second half of 2026.

The firm added that the current downturn reinforces its view that bitcoin’s four-year cycle is driven primarily by demand expansions and contractions, rather than by the halving itself. When demand growth peaks and rolls over, bear markets tend to follow regardless of supply-side dynamics.

Bitcoin was trading around $87,800 at the time of publication, up roughly 3% over the past 24 hours.

CryptoQuant’s assessment contrasts with several more bullish outlooks from major financial institutions, some of which continue to project six-figure price scenarios over the next year, while still identifying the $70,000 area as a key technical and psychological support level.

Olivia Carter

Olivia Carter