Crypto Trading Volume Hits All-Time High in 2025

Total crypto trading volume across centralized and decentralized exchanges reached a record high in 2025, surpassing the previous market peak.

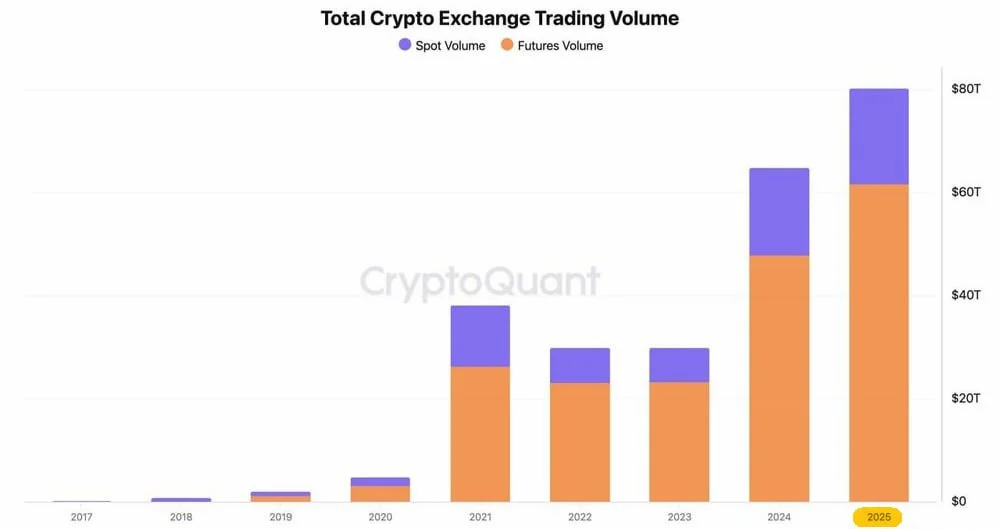

Total trading activity in the cryptocurrency market reached a new all-time high in 2025, surpassing the previous cycle peak set in 2021.

According to aggregated exchange data, combined spot and futures trading volumes across centralized (CEX) and decentralized (DEX) platforms climbed to record levels this year, confirming a sharp expansion in market liquidity.

Volumes exceed prior cycle peak

The latest data show that overall crypto trading volumes not only recovered from the 2022–2023 downturn but moved decisively above the highs recorded during the last bull market.

After peaking in 2021, activity contracted sharply as risk appetite faded and leverage was unwound. That phase now appears to be firmly behind the market.

By 2024, volumes began accelerating again. In 2025, total trading activity surged to a new historical record, marking a clear regime shift in participation and liquidity.

Derivatives dominate market activity

A key feature of the current cycle is the dominant role of derivatives. Futures trading accounts for the majority of total volume, significantly outweighing spot market activity.

This structure points to a more institutional and professionally traded market, where hedging, leverage and short-term positioning play a larger role than in earlier crypto cycles.

While deeper liquidity can support higher valuations, it also tends to amplify volatility during periods of stress.

What record volumes signal

Historically, sustained increases in trading volume reflect stronger engagement from a broad range of participants, including funds, market makers and sophisticated traders. At the same time, volume growth driven primarily by derivatives often coincides with faster price moves, sharper corrections and tighter funding conditions when sentiment shifts.

In practical terms, the crypto market has become larger, more liquid and more interconnected with global risk assets. For investors, the volume breakout reinforces that the market has entered a high-liquidity phase. Price trends may persist longer, but drawdowns can also unfold more abruptly.

As previous cycles have shown, elevated activity is a double-edged sword — supporting momentum on the way up while increasing fragility during periods of deleveraging. How the market manages leverage and volatility from these levels will be critical for the sustainability of the current cycle.

Chart source: CryptoQuant

Ethan Moore

Ethan Moore