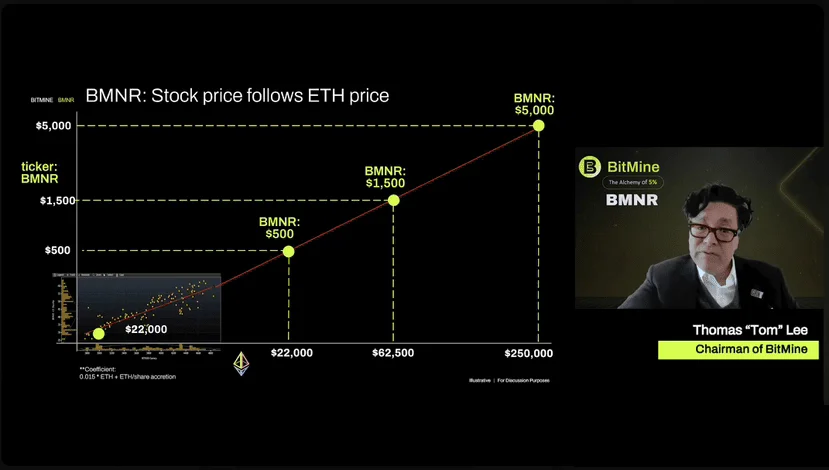

Ethereum Could Reach $250,000, Says BitMine Chairman Tom Lee

BitMine chairman Tom Lee says Ethereum could rise to $250,000, potentially pushing its market capitalisation to $30 trillion as institutional accumulation accelerates.

BitMine chairman Tom Lee has laid out an aggressive long-term outlook for Ethereum, arguing that the second-largest cryptocurrency could ultimately rise to $250,000 per coin as institutional adoption and balance-sheet accumulation accelerate.

During a presentation to shareholders, Lee highlighted a series of potential valuation milestones for Ethereum, including $22,000, $62,500 and $250,000. The scenario assumes a continued expansion of Ethereum’s role as a settlement layer for digital assets, tokenised finance and on-chain capital markets.

At the upper end of this range, Ethereum’s implied market capitalisation would approach $30 trillion. That would place it above the combined value of several of today’s largest technology companies and at more than six times the current market capitalisation of Nvidia.

Lee also addressed BitMine shareholders directly, urging support for continued Ethereum purchases on the company’s balance sheet. According to his remarks, BitMine already ranks among the largest corporate holders of ETH, positioning the firm as a high-beta proxy on Ethereum’s long-term price trajectory.

In his framework, Ethereum’s valuation expansion is closely tied to its monetary and network characteristics: staking-driven supply constraints, growing fee generation, and its role as the base layer for decentralised finance and institutional tokenisation.

While Lee acknowledged that such price levels are not a short-term forecast, he argued that historical adoption cycles in transformative technologies tend to look “unreasonable” before they become structural. And the market noticed.

Note: These projections represent a long-term scenario and do not constitute investment advice. Cryptocurrency markets remain highly volatile.

Ethan Moore

Ethan Moore