Korea’s Crypto Traders Double Down on Ethereum via BitMine

South Korean investors bought $1.4B of BitMine shares in 2025, backing Tom Lee’s long-term Ethereum super-cycle thesis despite sharp drawdowns.

Shares of BitMine, a crypto-focused company backed by Fundstrat’s Tom Lee and entrepreneur Peter Thiel, have surged in popularity among South Korean investors, cementing the firm’s status as one of the most aggressively accumulated overseas crypto plays of 2025.

Korean investors pile into BitMine

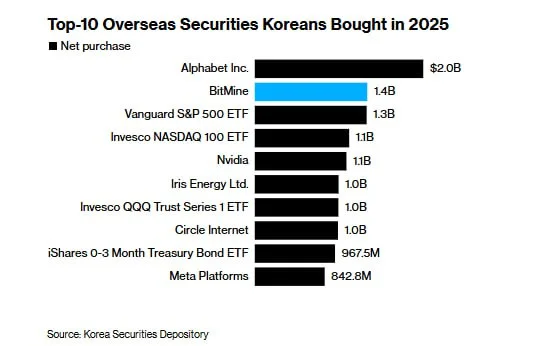

According to data from the Korea Securities Depository, South Korean investors purchased approximately $1.4 billion worth of BitMine shares in 2025, making it the second-most bought overseas security among Korean retail investors. The company ranked just behind Alphabet and ahead of several major US ETFs and large-cap technology names.

The buying spree stands out given BitMine’s extreme volatility. Despite suffering drawdowns of up to 80% at various points, demand from Korean investors has remained resilient, reflecting a high-risk, high-conviction approach that has become characteristic of the country’s crypto trading culture.

All-in on Ethereum

BitMine’s strategy is straightforward but bold: the company is accumulating Ethereum (ETH) at virtually any price level. As of late 2025, BitMine reportedly controls more than 4% of Ethereum’s total circulating supply, making it one of the largest single corporate holders of ETH globally.

This concentration has drawn both admiration and criticism, with supporters viewing the strategy as a leveraged proxy for long-term Ethereum adoption, while skeptics warn about liquidity risks and exposure to prolonged drawdowns.

Tom Lee’s “life bet” on a super-cycle

Tom Lee, managing partner at Fundstrat, has described Ethereum as entering a multi-decade “super-cycle” that could last 10 to 15 years. He has publicly framed BitMine’s Ethereum accumulation as a “bet of a lifetime”, driven by expectations of sustained institutional adoption, tokenization of real-world assets, and Ethereum’s central role in decentralized finance and settlement infrastructure.

From a market perspective, BitMine has increasingly been treated as a high-beta Ethereum proxy, particularly attractive to investors seeking amplified exposure without holding the underlying asset directly.

Why South Korea matters

South Korean retail investors are widely regarded as among the most speculative and momentum-driven participants in global crypto markets. Their outsized participation in BitMine underscores both the enduring appeal of long-term Ethereum narratives and the willingness of Korean traders to absorb volatility in pursuit of asymmetric returns.

From an editorial perspective, the significance lies not only in the scale of the inflows, but in what they represent: a renewed conviction that Ethereum’s long-term story remains intact, even after deep and painful corrections.

Ethan Moore

Ethan Moore