ETH Whales Accumulate, BTC Traders Show FOMO

Whales have been aggressively accumulating ETH since mid-November, while Bitcoin shows a fresh FOMO spike, raising the risk of a near-term pullback.

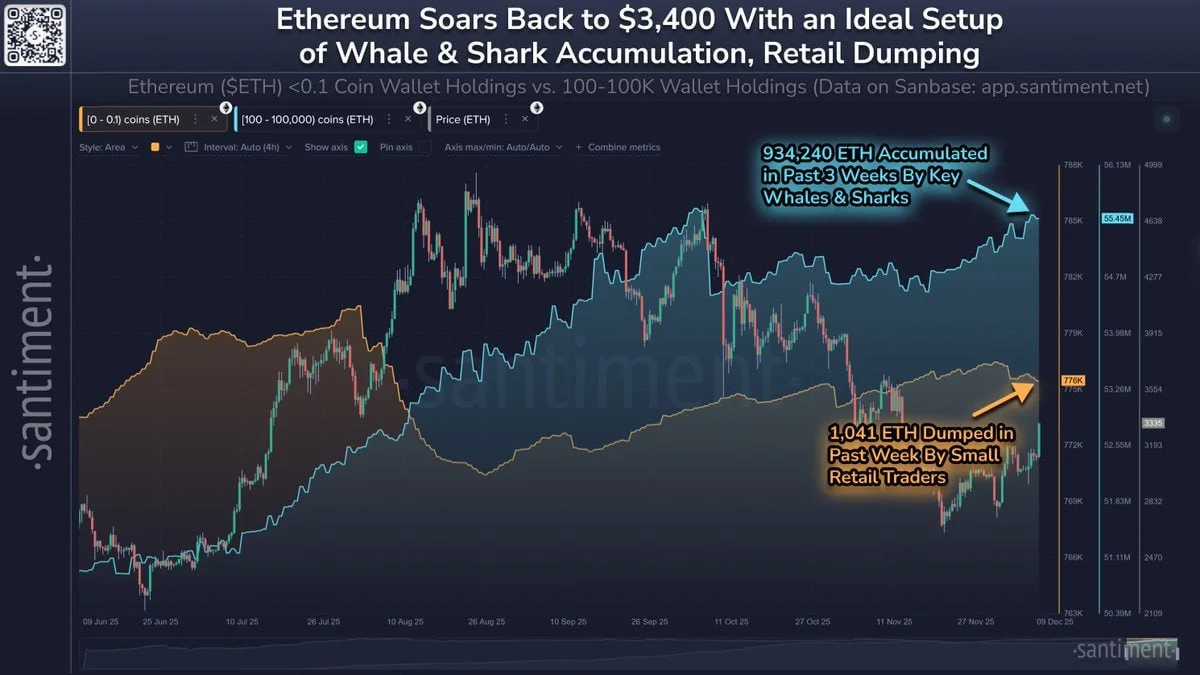

Whales have been steadily accumulating Ethereum (ETH) since mid-November, according to on-chain data from Santiment. The wallets holding between 100 and 100,000 ETH added roughly 934,000 ETH over the past three weeks — even as the price corrected.

The divergence between large holders and retail traders continues to widen. Santiment notes that small wallets (<0.1 ETH) collectively dumped more than 1,000 ETH during the same period, a behaviour typical of short-term capitulation.

Despite the selling from smaller traders, ETH rebounded back toward the $3,400 level, supported by sustained demand from major “whale” and “shark” cohorts. Analysts point out that such patterns often precede medium-term rallies, as large holders accumulate into weakness.

Bitcoin: FOMO Returns Quickly After the Bounce

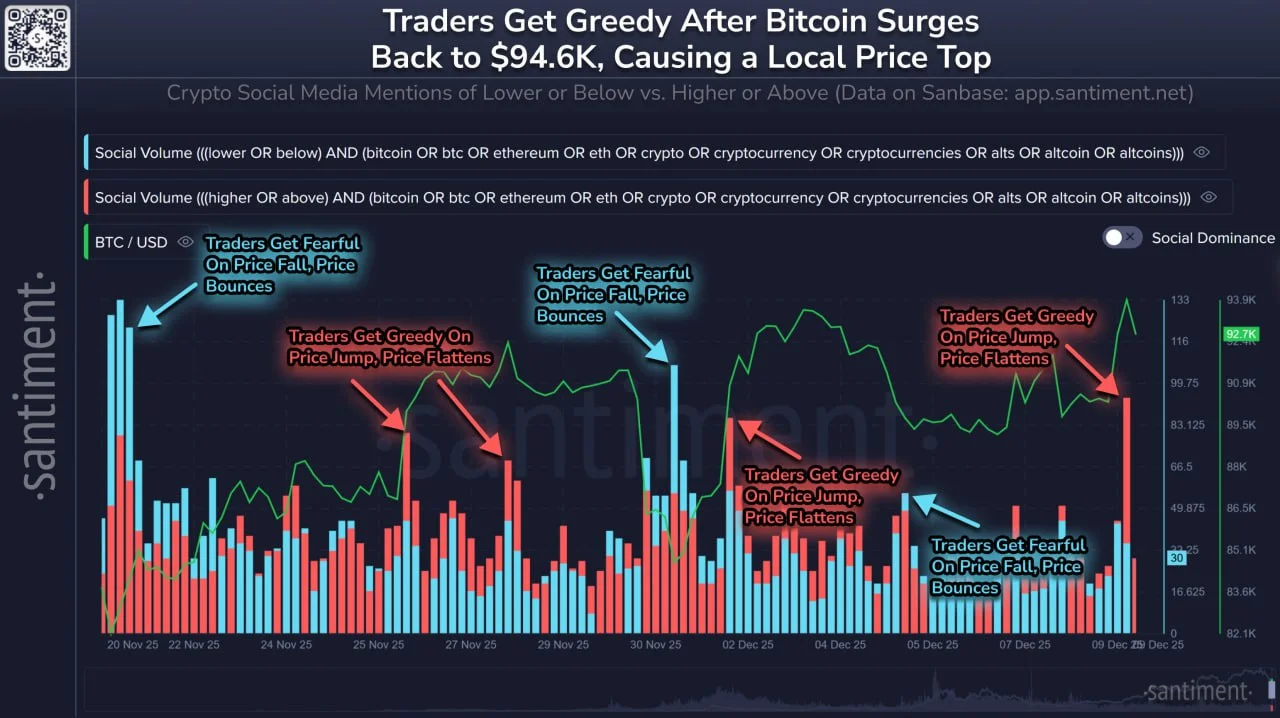

Meanwhile, traders in Bitcoin (BTC) are again showing signs of FOMO. According to Santiment’s sentiment data, social mentions of “higher prices” spiked sharply after BTC bounced back toward $95,000.

Historically, Santiment highlights that greed-driven sentiment clusters often align with local tops: when traders become overly optimistic after a rapid rebound, price action tends to flatten or retrace shortly after.

“We’re seeing the same pattern again — fear during dips, greed on every jump,” Santiment noted. The latest surge in optimistic mentions increases the probability of a short-term pullback if the market fails to sustain new highs.

For now, crypto markets show a clear divergence: Ethereum is quietly absorbed by large holders, while Bitcoin sentiment is overheating despite price consolidation.

Ethan Moore

Ethan Moore