Public Companies Now Hold Over 1 Million BTC

Public companies have accumulated more than 1.06 million BTC, led by MicroStrategy, signaling a powerful shift in corporate treasury strategy and long-term institutional confidence.

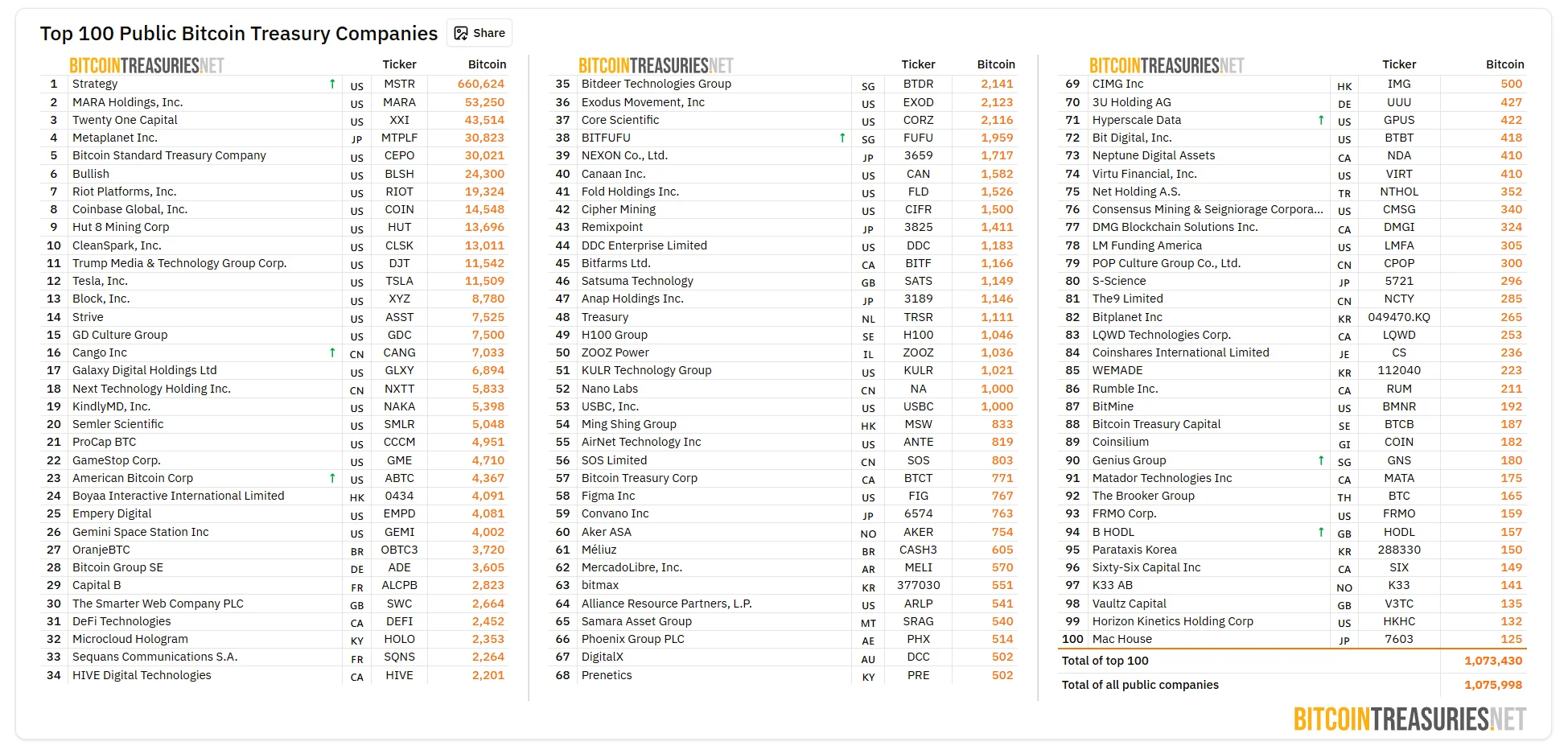

Publicly traded companies now collectively hold more than 1,060,000 Bitcoin on their balance sheets, marking one of the strongest signals yet that corporate adoption of digital assets continues to deepen — even through market volatility. The latest BitcoinTreasuries dataset shows an accelerating accumulation trend across U.S., Asian, and European firms.

MicroStrategy Remains the Undisputed Leader

At the top of the list is MicroStrategy (MSTR), holding an extraordinary 660,624 BTC — a position that has grown consistently through both bull and bear cycles. The company remains far ahead of the second-largest holder, MARA Holdings, which reports 53,250 BTC.

Ethan Moore writes: “This gap is not just wide — it’s structural. MicroStrategy has effectively positioned itself as a Bitcoin-native corporation, while others still treat BTC as a balance-sheet enhancer rather than a core asset.”

Corporate Accumulation Broadens Globally

While U.S. companies dominate the rankings, several international players stand out:

- Metaplanet (Japan) — 30,823 BTC

- Cango Inc. (China) — 7,033 BTC

- Boyaa Interactive (Hong Kong) — 4,091 BTC

- OranjeBTC (Brazil) — 3,720 BTC

The presence of companies across Asia, North America, South America and Europe illustrates a clear pattern: Bitcoin is no longer treated as a niche reserve asset but increasingly as a global corporate treasury instrument.

Crypto-Native Firms Join the Top Ranks

Unsurprisingly, crypto-focused companies remain prominent among the largest holders:

- Riot Platforms — 19,324 BTC

- CleanSpark — 13,101 BTC

- Bitdeer Technologies — 2,141 BTC

- Bitfarms — 1,166 BTC

These firms operate mining and infrastructure models that naturally accumulate Bitcoin, but their willingness to hold it rather than sell immediately reinforces a marketwide belief in Bitcoin’s long-term value.

Growing Institutional Confidence

The total of over 1.06 million BTC held by public companies represents nearly 5% of Bitcoin’s maximum supply. That level of concentration among institutions was unimaginable just a few years ago.

Corporate holdings act as a form of supply lock-up, reducing circulating liquidity and creating upward pressure during demand spikes. Even with periods of price weakness, public firms appear to be increasing their exposure rather than scaling back.

As Bitcoin approaches new regulatory frameworks, spot ETF flows continue, and macro uncertainty persists, public companies may become one of the strongest stabilising forces in the market.

Public companies are now one of Bitcoin’s largest and most consistent buyer groups — a structural shift that could define the next decade of digital asset markets.

Ethan Moore

Ethan Moore