New Bitcoin Whales Drive Historic Capital Inflows in 2025

Bitcoin whale accumulation has reached record levels in 2025, driven by ETFs, corporates, and institutional investors, according to CryptoQuant data.

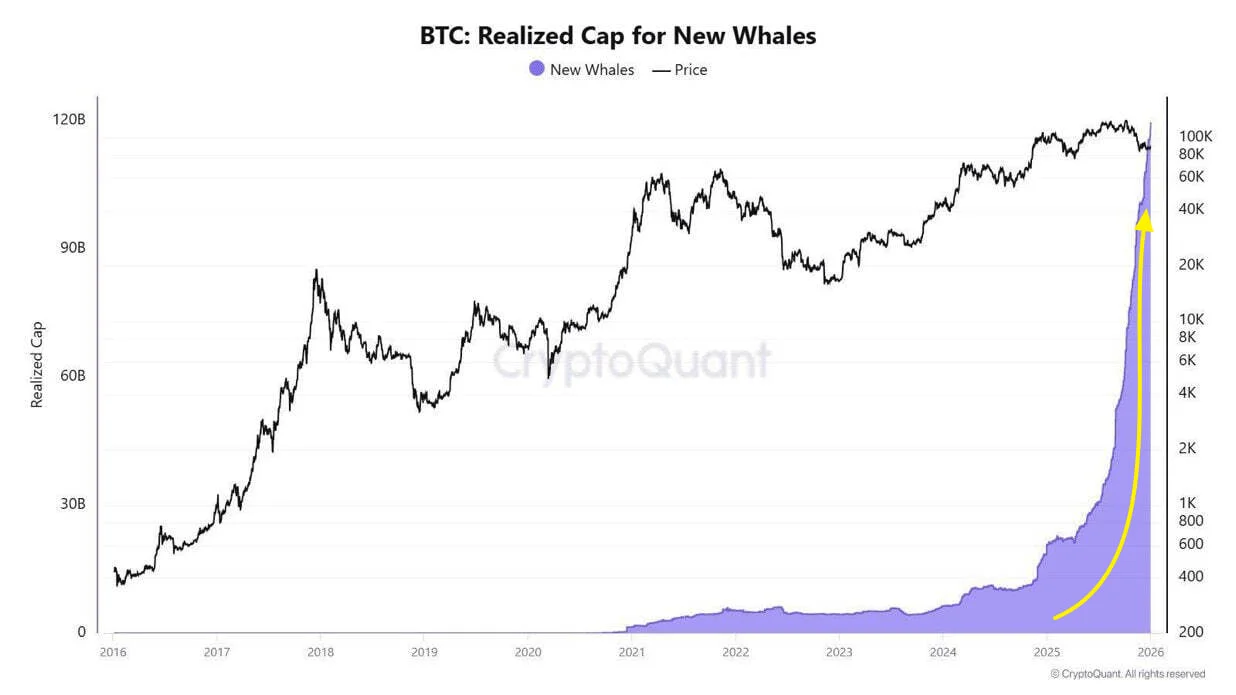

Bitcoin whale accumulation has reached an unprecedented level in macro terms. On-chain data from CryptoQuant shows that the realised capitalisation of new Bitcoin whales has surged to an all-time high, signalling the strongest large-holder accumulation phase on record.

The metric tracks capital inflows from wallets classified as “new whales” — entities that have recently accumulated large BTC balances. In 2025, this cohort expanded rapidly, reflecting sustained demand from spot Bitcoin ETFs, corporate treasuries, and a growing set of institutional and sovereign participants.

Record Capital Inflows From New Whales

According to CryptoQuant, the realised cap attributed to new whales has accelerated sharply since late 2024, far outpacing previous accumulation phases observed in earlier market cycles. The pace and scale of inflows suggest structurally different demand compared with retail-led bull markets.

Institutional Demand Reshapes the Market

Unlike past cycles, accumulation in 2025 has been dominated by institutional flows. Spot Bitcoin ETFs absorbed consistent inflows throughout the year, while several publicly listed companies continued to add BTC to their balance sheets. In parallel, reports indicate that certain sovereign-linked entities have also entered the market.

This shift has meaningful implications for supply dynamics. Coins accumulated by large, long-term holders historically tend to remain illiquid, tightening available supply during periods of sustained demand.

Macro Signal, Not a Short-Term Trade

From a macro perspective, the data points to a structural accumulation phase rather than short-term speculative positioning. Previous periods marked by similar whale behaviour were associated with extended price expansion, although on-chain metrics should not be viewed as predictive in isolation.

The scale of current accumulation, however, stands out. New whales are absorbing Bitcoin at a pace not previously recorded — a signal that long-horizon capital continues to view BTC as a strategic asset.

Ethan Moore

Ethan Moore