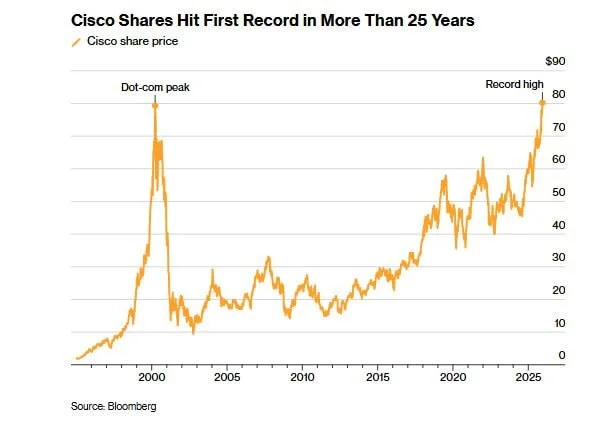

Cisco Shares Recover Dot-Com Losses After a Quarter-Century Wait

Cisco shares hit a new record close for the first time since the dot-com era, lifted by AI optimism and a broad U.S. market rally.

Cisco Systems has closed at a record high for the first time in more than 25 years, finally surpassing the peak levels seen during the dot-com boom. The stock finished the December 10 session at $80.25 (+0.9%), edging above its previous record close of $80.06 set in March 2000.

The intraday high from that era — $82 — remains unmatched, according to Bloomberg. Shares were down 0.6% in pre-market trading on December 11.

Market Rally Meets Historic Milestone

The move came during a broad advance across U.S. equities after the Federal Reserve delivered its third rate cut of 2025, lowering the federal funds rate to 3.5–3.75%. The S&P 500 gained 0.7% on the session, while the Nasdaq 100 added 0.4%.

In the late 1990s, Cisco was one of Nasdaq’s “Four Horsemen” alongside Microsoft, Intel and Dell — among the most heavily traded and closely watched stocks of the era. In the two years leading into its 2000 peak, Cisco surged nearly 600%, briefly reaching a market capitalization above $500 billion.

The collapse of the dot-com bubble erased roughly 90% of that value. By the end of 2002, Cisco’s market cap had fallen to around $60 billion. Shares have since gained more than 800%, though the company’s current valuation remains about 40% below its historic peak.

AI Demand Recharges Investor Confidence

Recent gains have been driven by stronger revenue guidance and optimism that AI-related infrastructure spending will support growth in the coming years. Investors are increasingly positioning Cisco as a beneficiary of rising enterprise demand for networking and data-center connectivity.

“When you lose investor confidence after a painful collapse, it can take years to regain it,” said Declan Mallarkey, managing director at SLC Management. “Cisco’s recovery is a reminder that healing from a bubble can take decades — Japan showed the same pattern in the 1980s.”

Mallarkey added that Cisco has gradually shifted from a hyper-growth innovator to a more utility-like technology provider — a profile that long-term investors may now prefer.

Chart: Cisco Shares Break a 25-Year Record

For markets watching the parallels between today’s AI-driven rally and the late-1990s tech surge, Cisco’s milestone serves as a powerful historical marker — and a reminder that recoveries, no matter how inevitable they seem, can take a generation.

Michael Reed

Michael Reed