BofA Finds S&P 500 Richer Than 2000 on Nine Key Measures

New BofA data shows the S&P 500 is now more expensive than during the 2000 dot-com bubble on nine of twenty key valuation metrics tracked by the bank.

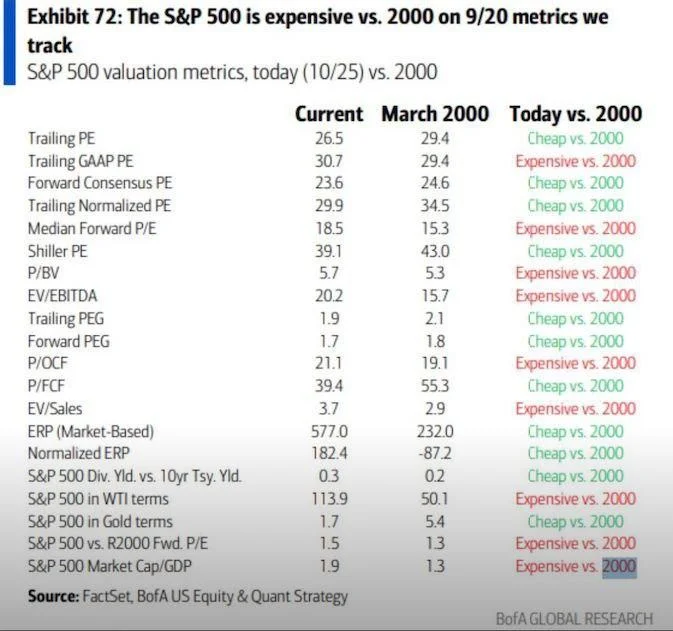

New valuation data from Bank of America shows that the S&P 500 now screens as more expensive than it did at the peak of the dot-com bubble on nine of the twenty major metrics the bank tracks. The comparison uses figures as of October 25, 2025, versus March 2000 — the height of the tech mania.

The dot-com bubble, which formed in the late 1990s, was marked by investor euphoria toward internet stocks, many of which lacked revenue, profits, or viable business models. Despite that period being remembered as one of the most overvalued eras in U.S. market history, several valuation measures now indicate an even richer market.

Key valuation takeaways

Among the metrics where the S&P 500 is more expensive today:

- Trailing GAAP P/E — 30.7 today vs. 29.4 in 2000

- Median forward P/E — 18.5 vs. 15.3

- P/BV — 5.7 vs. 5.3

- EV/EBITDA — 20.2 vs. 15.7

- P/OCF — 21.1 vs. 19.1

- P/FCF — 39.4 vs. 55.3 (still marked “expensive” due to today’s lower cash generation)

- EV/Sales — 3.7 vs. 2.9

- S&P 500 vs. Russell 2000 forward P/E — 1.6 vs. 1.3

- S&P 500 Market Cap/GDP — 1.9 vs. 1.3

At the same time, several widely watched indicators show the index is still cheaper than during the 2000 bubble — most notably on forward consensus P/E and equity risk premium (ERP), largely due to today’s higher interest rates and stronger earnings base.

What analysts say

The S&P 500 may look less extreme on earnings-based metrics, but on market-cap and cash-flow measures it is undeniably stretched compared with the 2000 peak.

Analysts note that investors must interpret the comparison carefully. The makeup of the index today is different, with mega-cap technology companies generating substantial cash flow — unlike the speculative, unprofitable dot-com firms of the early 2000s. Still, the historical parity on many metrics highlights how sensitive markets may be to shifts in policy, liquidity, or earnings expectations.

Why it matters for investors

- Valuation extremes can increase the risk of sharp corrections.

- Today’s market is more concentrated in a handful of mega-caps.

- Higher interest rates put additional pressure on valuation multiples.

With the S&P 500 sitting near record territory, the comparison to one of the most infamous bubbles in history underscores the importance of monitoring both earnings durability and broader macro conditions.

Daniel Brooks

Daniel Brooks